India's Car Market to Grow by 1-2% in FY26, With SUVs Leading the Charge

Source: shutterstock

India's passenger vehicle (PV) market is anticipated to see a modest increase of 1% to 2% in FY26, according to key insights shared by major automakers at a recent industry meeting. A key driver of this growth will be the continued rise of sport utility vehicles (SUVs), which are projected to see a more substantial growth rate of around 8%. This reflects the growing consumer demand for larger, feature-packed vehicles that combine style, comfort, and versatility.

Automakers such as Maruti Suzuki and Hyundai predict a conservative growth outlook of 1% to 1.5% for the overall PV industry in the upcoming fiscal year, citing macroeconomic uncertainty and other challenges. However, Tata Motors remains slightly more optimistic, forecasting an increase of 2% to 4%. Mahindra & Mahindra, while also projecting a 1% to 2% overall growth in PV sales, is more bullish on its utility vehicle (UV) segment, which is expected to mirror the broader SUV trend with a growth rate of 8%.

The cautious expectations stem from various challenges, including high base effects, fluctuating consumer sentiment, and ongoing macroeconomic pressures. However, despite these uncertainties, the SUV segment continues to outperform other vehicle categories, with consumers gravitating toward premium offerings with advanced features and robust road presence.

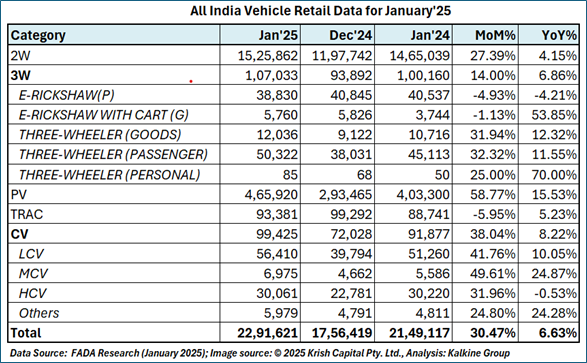

As the year 2025 progresses, the auto retail sector enters February with a mix of cautious optimism. After a promising start to the year, the Federation of Automobile Dealers Association (FADA) survey indicates that nearly half of the dealers (46%) foresee growth in the upcoming month. However, 43% expect sales to remain steady, and 11% anticipate a slight dip. This mixed sentiment reflects the complex landscape the industry faces.

Several factors, including shorter working days, weak rural liquidity, and inflationary pressures, continue to create uncertainty around the potential for robust growth. Tight lending policies, rising vehicle costs, and subdued demand in certain industrial sectors also pose challenges to overall industry performance. Yet, optimism remains, with improved inventory management, attractive financing options from select lenders, and pent-up demand in certain vehicle segments, particularly commercial vehicles, contributing to a sense of guarded confidence.

The auto retail sector is benefiting from a favorable combination of factors. The ongoing marriage season, fresh product launches, and targeted promotional activities are helping sustain customer interest and footfalls at dealerships. Additionally, the government's supportive policies, along with the post-budget lift in consumer sentiment, suggest that the industry may witness a stable or slightly improved sales trajectory in February.

While challenges persist—such as inflationary pressures, tight credit, and some subdued demand from rural markets—there is a strong sense of cautious optimism. Dealers are hopeful that the sector can overcome these near-term obstacles, setting the stage for modest but steady growth in the coming months.

Major Players

Looking ahead, India's auto retail industry remains on track for a measured recovery, with a resilient outlook supported by the ongoing shift toward SUVs and strategic moves by automakers. As the sector navigates through challenges, it stands poised for modest gains if headwinds ease, signaling a positive trajectory for 2025 and beyond.

Technical Analysis

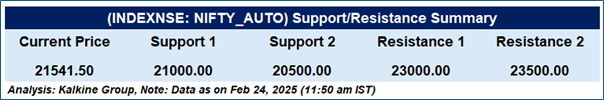

The Nifty Auto Index has been in a persistent downtrend since mid-2024, forming lower highs and lower lows. Both the 21-day and 50-day Exponential Moving Averages (EMA) are sloping downward, with the price currently trading below them, reinforcing a bearish outlook. The Relative Strength Index (RSI) is at 34.56, nearing the oversold region, which suggests weakening momentum but also hints at a potential short-term reversal or consolidation. Key support levels to watch are around 21,000, which acts as a psychological level, and 20,500, a previous low where buyers might step in. On the upside, immediate resistance lies near 22,500, aligning with the 21-day EMA, while a stronger resistance zone exists between 23,000 and 23,500, where the price has previously faced rejection. If the index fails to hold above 21,000, further downside pressure could emerge, while a break above 23,500 with strong volume might indicate a trend reversal. Until then, the overall sentiment remains bearish, with caution advised for long positions unless clear reversal signals appear.

Conclusion

The Indian passenger vehicle market is expected to see modest growth in FY26, driven largely by the rise of SUVs. Despite macroeconomic challenges and fluctuating consumer sentiment, the SUV segment remains strong. Automakers have a cautious outlook, with some predicting slight increases in sales, while others are more optimistic, particularly in the utility vehicle sector.

The auto retail sector enters 2025 with mixed sentiment, balancing optimism with ongoing challenges like tight credit and rising vehicle costs. However, factors such as new product launches and government policies support steady growth in the short term. Overall, the market shows resilience and potential for steady gains, positioning itself for growth beyond 2025.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.