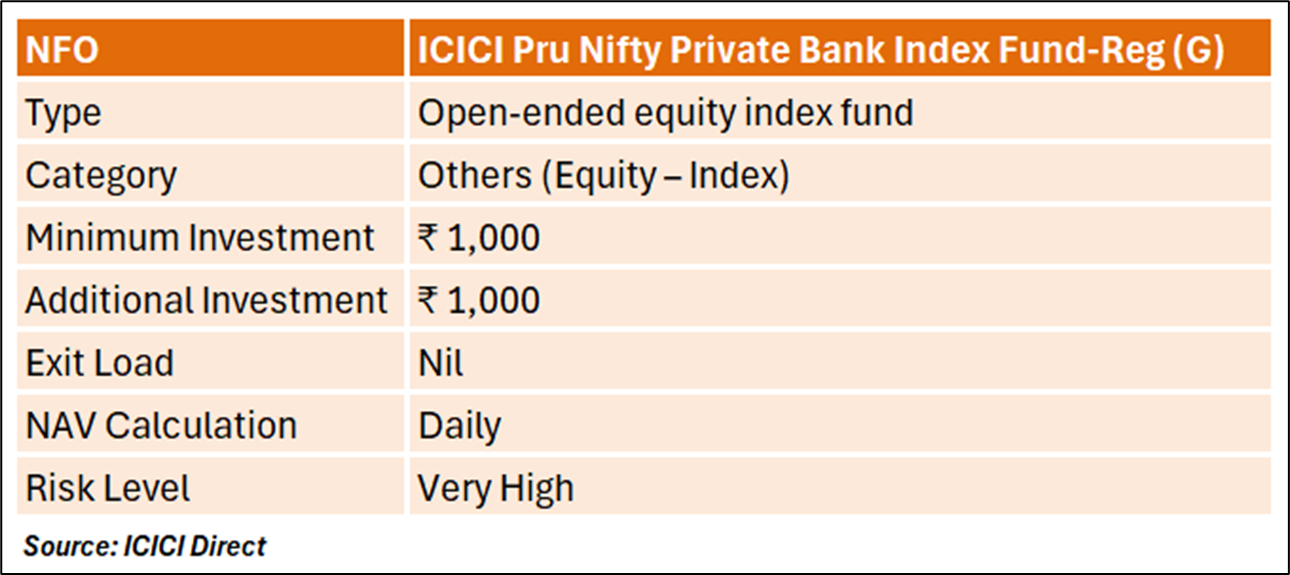

ICICI Prudential Mutual Fund has introduced a new open-ended index scheme—ICICI Prudential Nifty Private Bank Index Fund (Regular – Growth). The New Fund Offer (NFO) opened on July 1, 2025, and will close on July 14, 2025. The fund aims to mirror the performance of the Nifty Private Bank Index, which represents India’s top private sector banks. It follows a passive investment strategy, allocating funds in the same constituents and weightages as the index, subject to tracking error. The scheme is managed by Nishit Patel.

Sector Context: India’s Private Banks:

India’s private banking sector has shown resilience and consistent growth, driven by digital adoption, retail lending expansion, and improved asset quality. The Nifty Private Bank Index includes top players such as HDFC Bank, ICICI Bank, Kotak Mahindra Bank, and Axis Bank all of which have reported steady credit growth and improved profitability over recent quarters.

As per recent earnings, HDFC Bank and ICICI Bank each reported double-digit loan book growth, backed by robust demand in the retail and SME segments. The sector continues to benefit from structural reforms, improving credit cycle trends, and rising consumption.

Accessing the Fund:

The NFO can be subscribed via ICICI Prudential Mutual Fund’s website, registered mutual fund distributors, or leading investment platforms.

While the fund offers exposure to a high-growth sector, it is important to note that index funds carry market and sector-specific risks. Performance will mirror the movements of the underlying index, without active management.

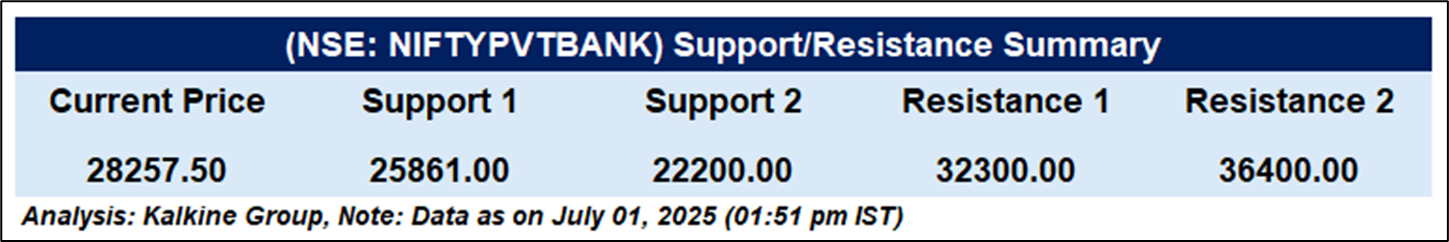

Technical Analysis

The Nifty Private Bank Index is currently trading at 28,257.50, maintaining strength above its 51-day EMA at 27,422.51, signaling a sustained bullish bias. The RSI is at 60.02, indicating healthy strength in the trend while staying below overbought levels. The index remains in a constructive uptrend, consolidating near recent highs, which points to healthy digestion of gains rather than trend exhaustion. The technical setup continues to favour buyers, supported by strength in private sector banks and improving sectoral sentiment.

Conclusion

The ICICI Prudential Nifty Private Bank Index Fund offers investors a low-cost route to participate in India’s resilient private banking growth story. With favorable technical and strong sector fundamentals, the fund provides passive exposure to a well-performing index, though investors should consider market-linked risks before investing.