The Property Share Investment Trust was registered with SEBI on August 5, 2024, as a small and medium real estate investment trust (SM REIT). PropShare is supported by prominent private equity and venture capital firms, including Westbridge Capital, Lightspeed India, BEENEXT, and Pravega Ventures.

The Property Share Investment Trust is currently filing for an SM REIT IPO, aiming to raise ₹352.91 crore from the primary market. The REIT IPO is for PropShare Platina, the first scheme launched under PSIT. In June of this year, SEBI introduced small and medium REITs as a new asset class within the broader REIT framework, covering assets valued between ₹50 crore and ₹500 crore.

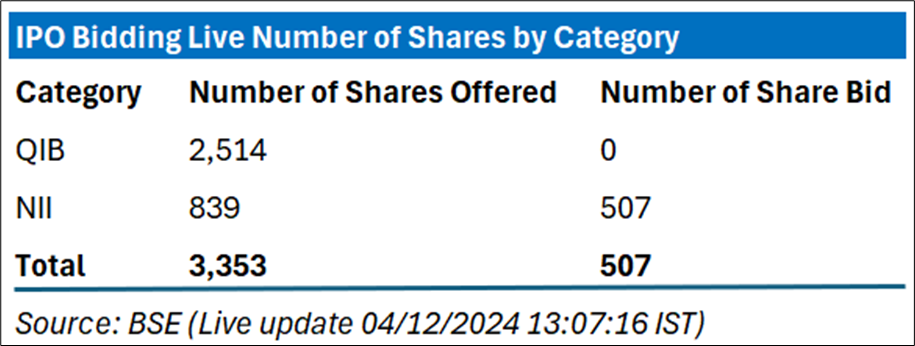

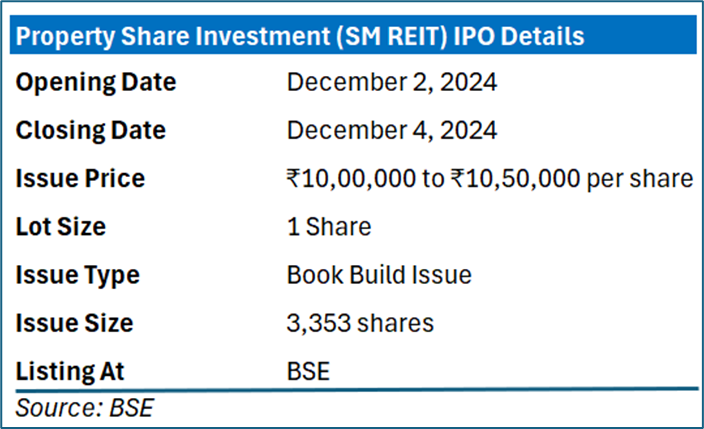

IPO Details

This book-built issue consists entirely of new Platina units, with no offer-for-sale (OFS) component. The price band for the units has been set between ₹10 lakh and ₹10.5 lakh each. Retail investors can apply for a minimum of one unit. The IPO opened on December 2 and will close on December 4. Allotment of shares will be finalized on December 5, with the listing scheduled for December 10. The PropShare REIT IPO units will be listed on BSE.

About of Property Share Platina Scheme

- The PropShare Platina scheme includes 246,935 square feet of office space within Prestige Tech Platina, a LEED Gold-certified building located on Bengaluru’s Outer Ring Road (ORR). The property is expected to be leased to a US-based tech company under a 9-year lease agreement, which includes a 4.6-year weighted average lock-in period and a 15% rent escalation every three years.

- Investors in the PropShare Platina scheme are projected to receive a distribution yield of 9% for FY26.

- The PropShare Investment Manager has announced that management fees will be waived for FY25 and FY26 for the first scheme. In FY27, a nominal management fee of 0.25% will be charged, increasing to 0.3% in FY28.

Property Share REIT IPO Objectives

- The company intends to use the net proceeds from the issuance for the acquisition of Project Platina by Platina SPVs, which includes commercial office spaces and the reimbursement of statutory charges (such as stamp duty and registration fees), will be funded through loans to Platina SPVs and investments in their equity and debt instruments.