Macrotech’s Momentum Continues After Record FY25 Performance

Source: shutterstock

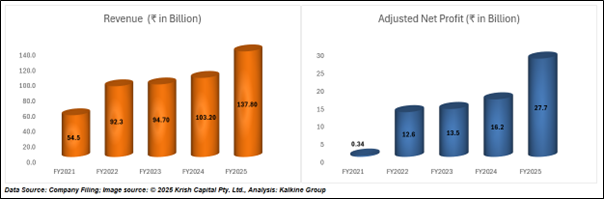

Macrotech Developers, operating under the Lodha brand, delivered exceptional performance in FY25, solidifying its leadership in India's real estate market. The company saw a 71% increase in adjusted net profit, reaching ₹27.7 billion compared to ₹16.2 billion in FY24 driven by strong housing demand and strategic growth initiatives. Total revenue surged by 34%, reaching ₹137.8 billion compared by ₹103.2 billion in FY24, bolstered by record pre-sales and effective debt management.

Record-Breaking Pre-Sales and Revenue Growth

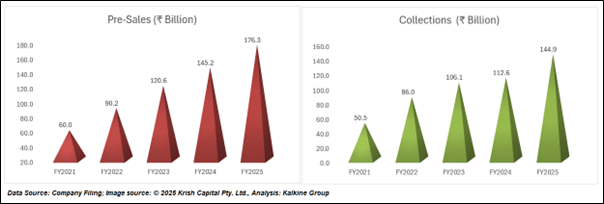

Macrotech reported a 21% year-on-year surge in pre-sales for FY25, reaching ₹176.3 billion, surpassing its ₹175 billion estimated, compared to ₹145.2 billion in FY24. The Q4FY25 saw pre-sales rise 14% to ₹48.1 billion from ₹42.3 billion in Q4FY24. Strong demand in Mumbai Metropolitan Region, Pune, and Bengaluru fuelled this growth, with the company launching 10 new projects valued at ₹237 billion in gross development value. In its Digital Infra segment, Macrotech expanded with two new sites in NCR and Chennai and acquired its joint venture partner’s stake in the existing platform.

Revenue for FY25 climbed 34% to ₹137.8 billion from ₹103.2 billion in FY24, with the net profit margin improving to 20% from 15%, reflecting enhanced operational efficiency. Collections also grew significantly, with Q4FY25 collections up 26% to ₹44.4 billion compared to ₹42.3 billion in Q4FY24, and FY25 total collections rising 29% to ₹144.9 billion from ₹112.6 billion in FY24.

Macrotech’s focused micro-market strategy yielded impressive outcomes, especially in MMR’s western suburbs, where pre-sales soared 140% to ₹25 billion in FY25. In Q4FY25, the company expanded into Pune, launching two new projects with a gross development value of ₹43 billion, boosting annual pre-sales in the region to exceed ₹25 billion for FY25.

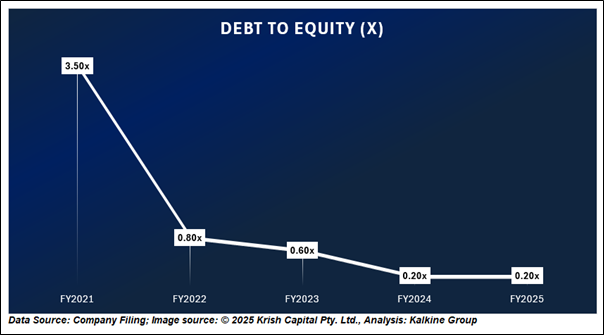

Despite substantial investments, Macrotech significantly lowered its net debt from ₹160 billion in FY21 to ₹40 billion in FY25, achieving a reduction of ₹120 billion over five years. The company also improved its debt-to-equity ratio from 3.60x to 0.20x during this period.

Management Guidance

Macrotech Developers has projected pre-sales of ₹210 billion and operating cash flows of ₹77 billion for FY26. The company plans to launch new projects worth ₹250 billion during the year. Additionally, it aims to initiate a pilot project in a new city as part of its expansion strategy.

Technical Analysis

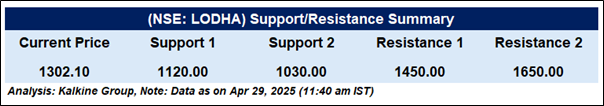

Macrotech Developers Ltd (NSE: LODHA) is currently exhibiting a bullish trend, with the stock trading at ₹1,302.10, well above its 51-day exponential moving average of ₹1,214.54. This indicates sustained upward momentum over the medium term. The Relative Strength Index (RSI) stands at 59.00, reflecting moderate bullish sentiment while suggesting some cooling off from recent highs. The stock has been forming higher highs and higher lows, signalling strength in price action. While there may be short-term consolidation following the recent rally, the overall technical setup remains positive.

Outlook

Macrotech Developers’ strong Q4 and FY25 results, marked by record pre-sales, robust revenue growth, and improved margins, reflect solid execution and strategic focus. The company's sharp reduction in debt and expanding project pipeline provide a sturdy foundation for continued momentum in FY26, supported by healthy demand across key markets.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.