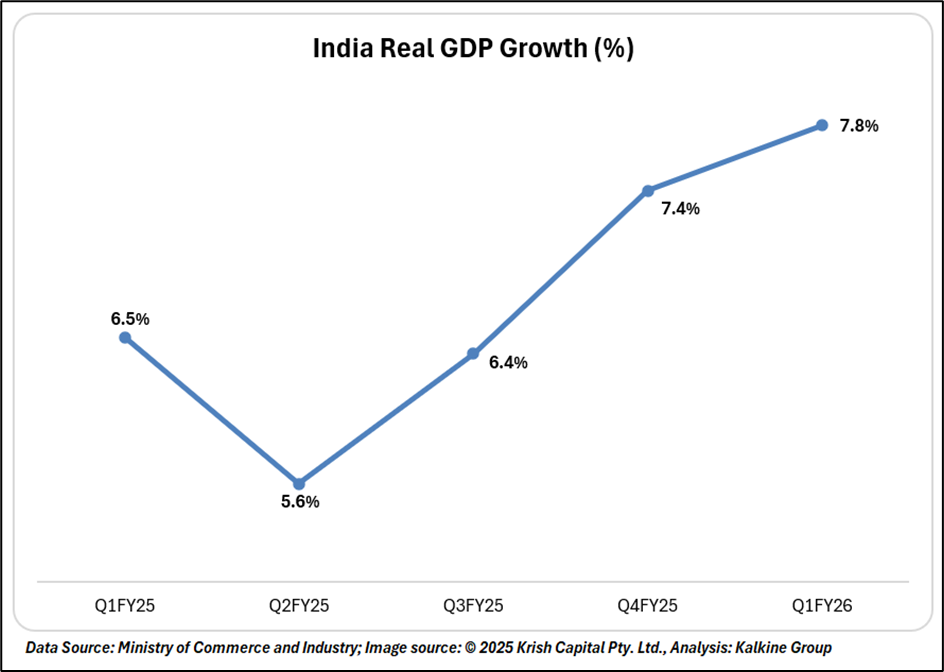

India is once again showcasing its economic resilience, with recent data underscoring a rare combination of robust domestic demand, manufacturing revival, and strong services activity. Even as global trade tensions intensify, particularly after the United States doubled tariffs on Indian exports to 50%, the country remains firmly positioned as the world’s fastest-growing major economy.

Manufacturing at a 17-Year High

India’s HSBC Manufacturing PMI rose to 59.3 in August 2025 from 59.1 in July, marking the quickest enhancement in operating conditions in over 17 times due to strong domestic demand and accelerated plant affair.

Most importantly, optimism about future production has strengthened, with firms increasingly confident that domestic demand will offset weaker export growth caused by the new US tariffs.

Services: The Star Performer

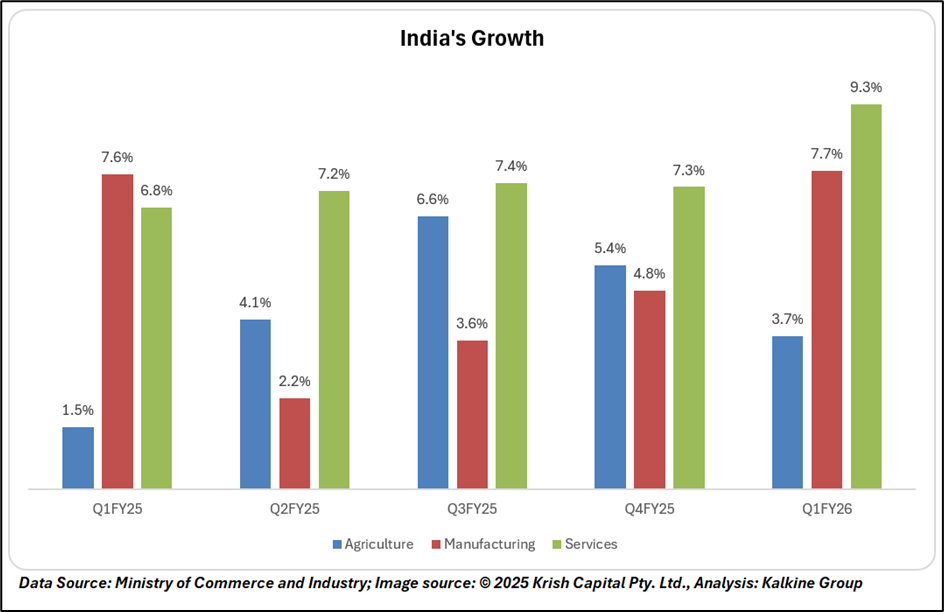

- Services sector growth hit 9.3%, the highest in two years, lifting overall activity.

- Sub-segment highlights:

- Trade, Hotels, Transport & Broadcasting: 8.6% (vs 5.4% a year ago).

- Financial, Real Estate & Professional Services: 9.5% (vs 6.6% last year).

- Public Administration, Defence & Other Services: 9.8%, reflecting strong government spending.

Manufacturing and Construction Cushion Growth

The manufacturing sector expanded 7.7%, supported by resilient domestic demand and supply-side reforms. Construction, while slower at 7.6%, remained above-trend despite disruptions from heavy rains.

- Agriculture: 3.7% (vs 1.5% last year)

- Mining and Quarrying activities slowed down due to weather-related disruptions.

- Utilities (Electricity, Gas, Water): 0.5%, hit by reduced seasonal demand

Consumption and Investment Dynamics

- Private Consumption: 7% growth, modest but stable compared to 8.3% a year ago.

- Gross Fixed Capital Formation (Investments) grew by 7.8%, reflecting a deceleration from the previous quarter's 9.4%, yet maintaining a strong and healthy investment pace.

- Government Consumption: Rebounded sharply by 7.4%, reversing last quarter’s contraction.

This suggests India’s growth story continues to be broad-based, supported by both household demand and public spending.

The Tariff Challenge

On August 27, the US doubled tariffs on Indian goods to 50%, citing New Delhi’s continued imports of Russian crude and defence purchases. While policymakers admit this is a downside risk, the economy’s resilience so far has muted its immediate impact.

Conclusion

India’s Q1 FY26 performance highlights a resilient economy powered by strong services and steady manufacturing momentum. Despite escalating US tariff pressures, domestic demand, government spending, and investment continue to drive growth. Despite ongoing external challenges, India’s widespread economic growth highlights its status as the fastest-growing major economy globally.