Adani Energy Solutions Posts Steady Q2 Growth Across Core Segments

Source: shutterstock

Adani Energy Solutions Limited (NSE: ADANIENSOL), India’s largest private transmission and distribution company and part of the Adani portfolio, reported a steady performance for the quarter ended September 30, 2025 (Q2 FY26). Growth remained consistent across its transmission, distribution, and smart metering businesses, reflecting operational stability.

Financial Performance

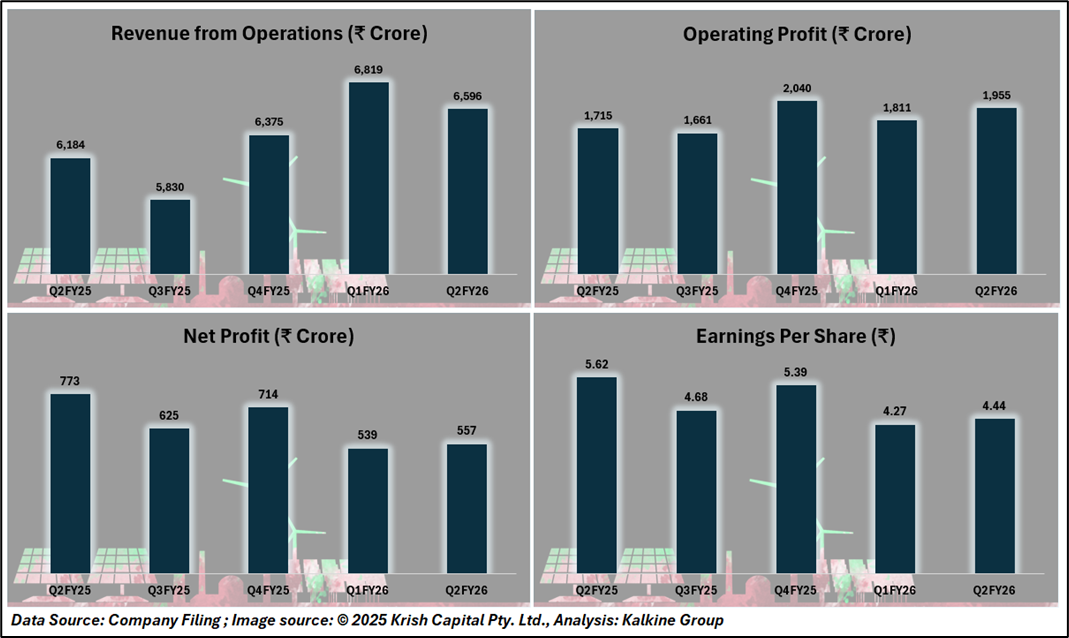

In Q2 FY26, AESL reported consolidated revenue from operations of ₹6,596 crore, an increase of 7% year-on-year compared to ₹6,184 crore in Q2 FY25. On a sequential basis, revenue declined 3.7% from ₹6,767 crore in the previous quarter.

The company’s consolidated net profit stood at ₹557 crore, a 27% decline year-on-year compared to ₹ 773 crore in Q2 FY25. The consolidated operational EBITDA for the quarter was ₹1,825 crore, reflecting a 9.5% increase from the corresponding period last year, supported mainly by the transmission and smart metering segments.

Segment Performance

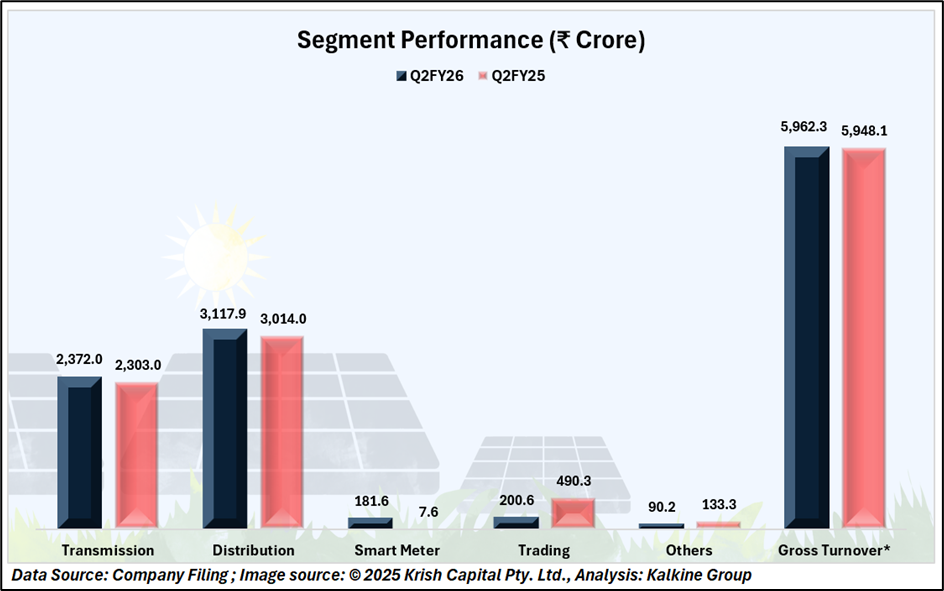

Under segment performance, the transmission business recorded a 3% year-on-year rise in revenue to ₹2,371.96 crore, the distribution business reported 4% growth to ₹3,117.9 crore, and the smart metering business posted revenue of ₹181.6 crore, compared to ₹7.6 crore in Q2 FY25.

Operational Highlights

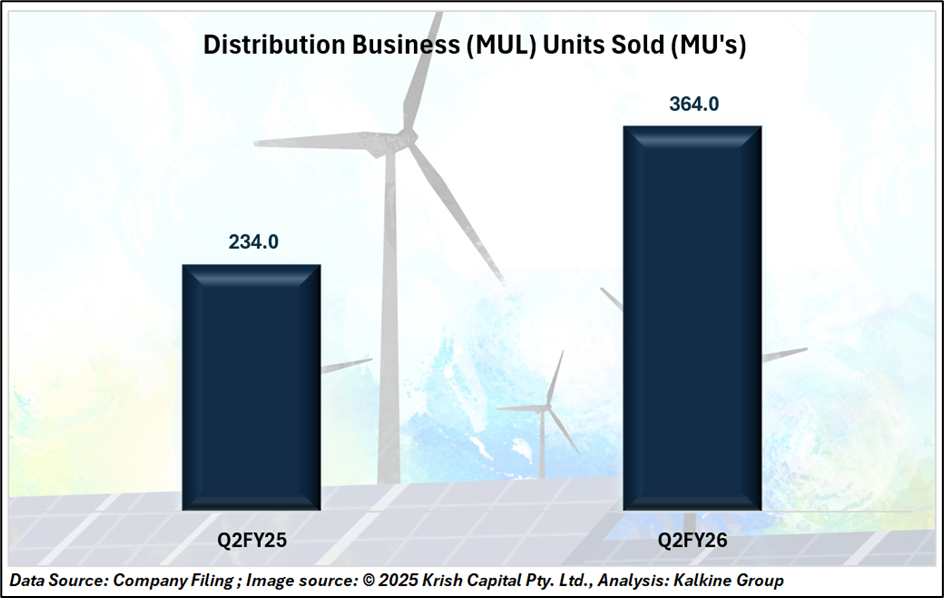

AESL expanded across key segments during the quarter. In transmission, it secured four new cost-plus projects worth ₹700 crore, adding 4,000 MVA to its pipeline and extending its reliable 23,000 ckm network. In distribution, AEML and MUL posted steady performance, with MUL’s energy sales up 55% YoY to 364 million units.

In the smart metering segment, AESL installed 1.82 million new meters during the quarter, bringing the total to 7.37 million smart meters. The company continues to expand its presence across multiple states under ongoing implementation projects.

Strategic Developments and Outlook

AESL’s project pipeline grew in Q2 FY26 with new transmission wins. Capex is set to rise through FY26 as projects advance toward execution. CEO Kandarp Patel highlighted sustained sector opportunities from policy reforms and the energy transition, with steady progress expected across all operations.

Technical Analysis

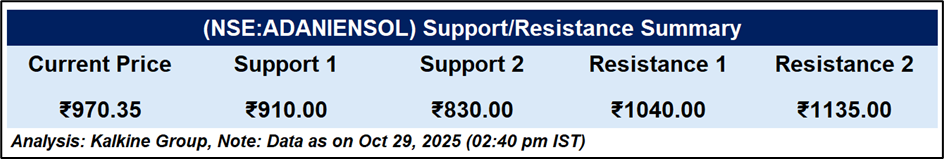

Adani Energy Solutions Ltd surged 5.34%, trading at ₹970.35, continuing its recent upward momentum. The stock remains comfortably above the 51-day EMA (₹888.68), reinforcing bullish sentiment. The RSI at 64.9 reflects healthy momentum without overbought pressure, indicating room for further gains while maintaining near-term support around ₹900.

Conclusion

Adani Energy Solutions delivered a stable Q2 performance with steady growth across transmission, distribution, and smart metering. Expanding project wins, rising capex, and robust operational metrics underscore long-term growth visibility. With strong sector tailwinds and improving technical momentum, AESL remains well-positioned to capitalize on India’s evolving power infrastructure opportunities.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.