Crude Prices Slide 5% After Ceasefire, Offering India Relief on Inflation and Deficit

Source: Shutterstock

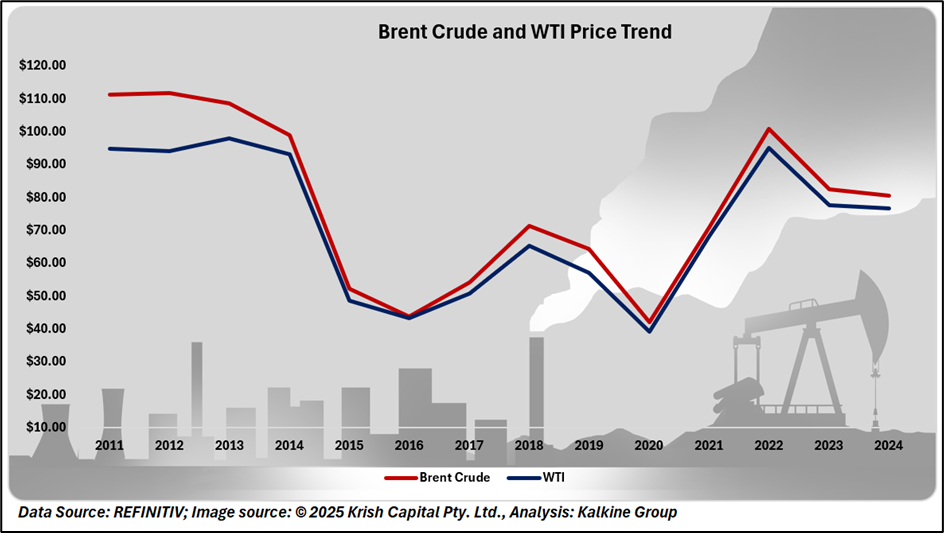

Global oil markets witnessed a dramatic shift as crude prices plunged over 5% on Tuesday following a U.S.-mediated ceasefire agreement between Israel and Iran. Brent slipped to $67.66 and WTI to $64.76 per barrel marking a two-week low. This geopolitical de-escalation has wiped out the risk premium that had kept prices elevated for months.

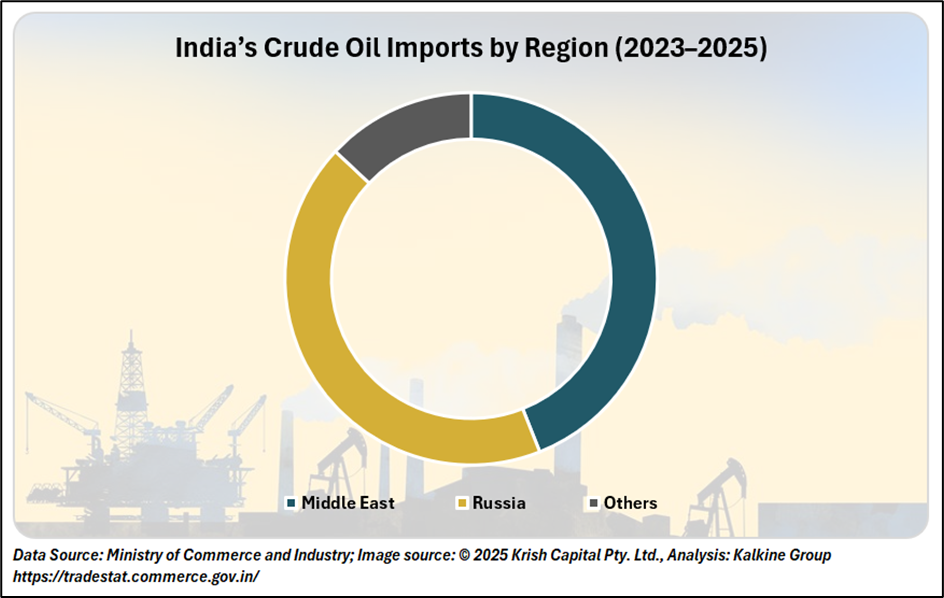

For India, one of the world's largest crude oil importers, the timing couldn’t be better. With over 85% import dependence on crude oil, primarily sourced from the Middle East, a price correction translates into immediate macroeconomic relief.

India’s Crude Exposure: An Economic Pressure Point

Oil prices are more than just numbers on a screen — they shape India’s inflation, trade deficit, fiscal policy, and even monetary stance. In FY24, India imported 232.5 million tonnes of crude, amounting to a staggering $157 billion import bill (Ministry of Petroleum & Natural Gas).

India’s Oil Dependence: Shifting Dynamics, Steady Impact

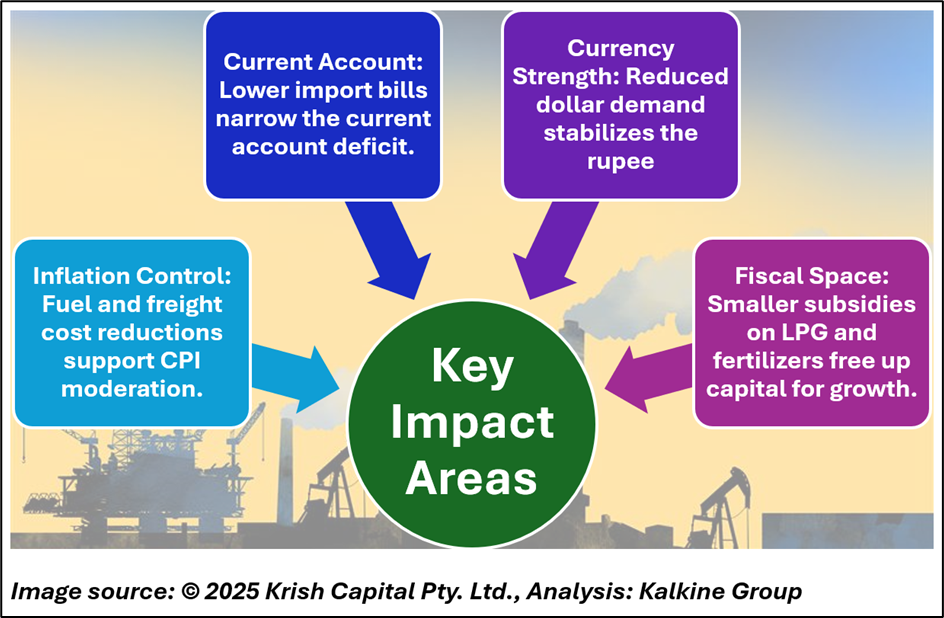

Oil prices ripple through India’s economy influencing inflation, subsidies, trade, and the rupee. With CPI at 4.75% in May 2025, falling crude offers inflation relief, fiscal breathing room, and scope for monetary easing.

On the Fiscal Side cheaper crude can lower the government's subsidy burden on LPG and fertilizers, improving the fiscal math. This creates headroom for capital expenditure in key development areas like infrastructure, healthcare, and education. The government has targeted a fiscal deficit of 5.1% of GDP for FY26, as per the Union Budget 2025–26, and lower oil-related spending could help meet this goal without compromising growth investments.

Currency and Market Implications: Gains with Caution

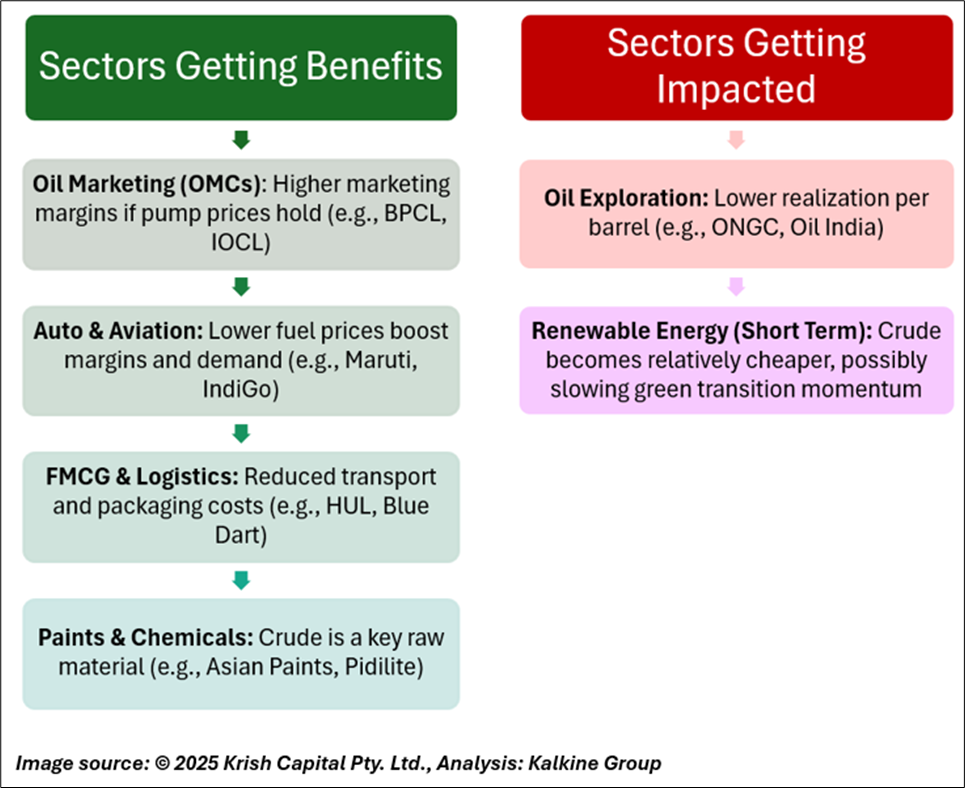

Falling crude prices typically ease India’s dollar demand, supporting rupee appreciation and reducing imported inflation. A stronger rupee enhances macro stability and investor sentiment, prompting increased FII inflows—particularly into rate-sensitive sectors like consumption and banking. Historically, such inflows have coincided with broader equity market rallies during periods of declining oil prices.

In past such as 2014–15 and 2020 sharp drops in crude prices contributed to lower inflation, accommodative monetary policy, and a rebound in equity markets.

However, the current relief may be short-lived. The sustainability of lower oil prices depends on geopolitical stability, particularly the Israel-Iran ceasefire, and global supply-demand dynamics. Any renewed tensions or OPEC+ cuts could quickly reverse the trend. Indian refiners may also face margin pressure due to inventory losses from high-cost crude procurement. As such, while the outlook is currently favourable, vigilance remains essential amidst ongoing volatility.

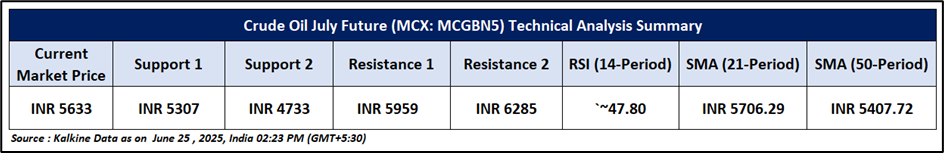

Technical Analysis

Crude Oil MCX July contract is currently trading around ₹5,633, recovering 0.90% after a sharp pullback from recent highs above ₹6,400. The price is holding above the 50-day SMA at ₹5,407.72 while facing immediate resistance near the 21-day SMA at ₹5,706.29. The 14-day RSI stands at 47.80, indicating neutral momentum and ongoing consolidation. For traders, sustaining above ₹5,959 keeps the short-term outlook stable, while a breakout above ₹5,959 could trigger a fresh upside toward ₹6,285. On the downside, a break below ₹5,307 may invite further weakness. Until then, dips toward support may offer favourable buying opportunities.

Conclusion

The recent plunge in crude oil prices presents a timely breather for India's economy, easing inflationary pressures, improving fiscal space, and strengthening currency stability. However, the durability of this relief depends on global geopolitical calm and market discipline. Strategic policy moves and continued vigilance will be key to converting this short-term gain into long-term resilience.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.