Execution Over Allocations Defence Stocks to Track Ahead of Budget 2026

Source: shutterstock

As the Union Budget 2026 approaches, market expectations for India’s defence sector remain constructive but more grounded than in previous years. While an 8% to 10% rise in defence outlay is widely anticipated and anything above this would be viewed as a positive surprise investors are increasingly focused on execution momentum rather than headline allocations.

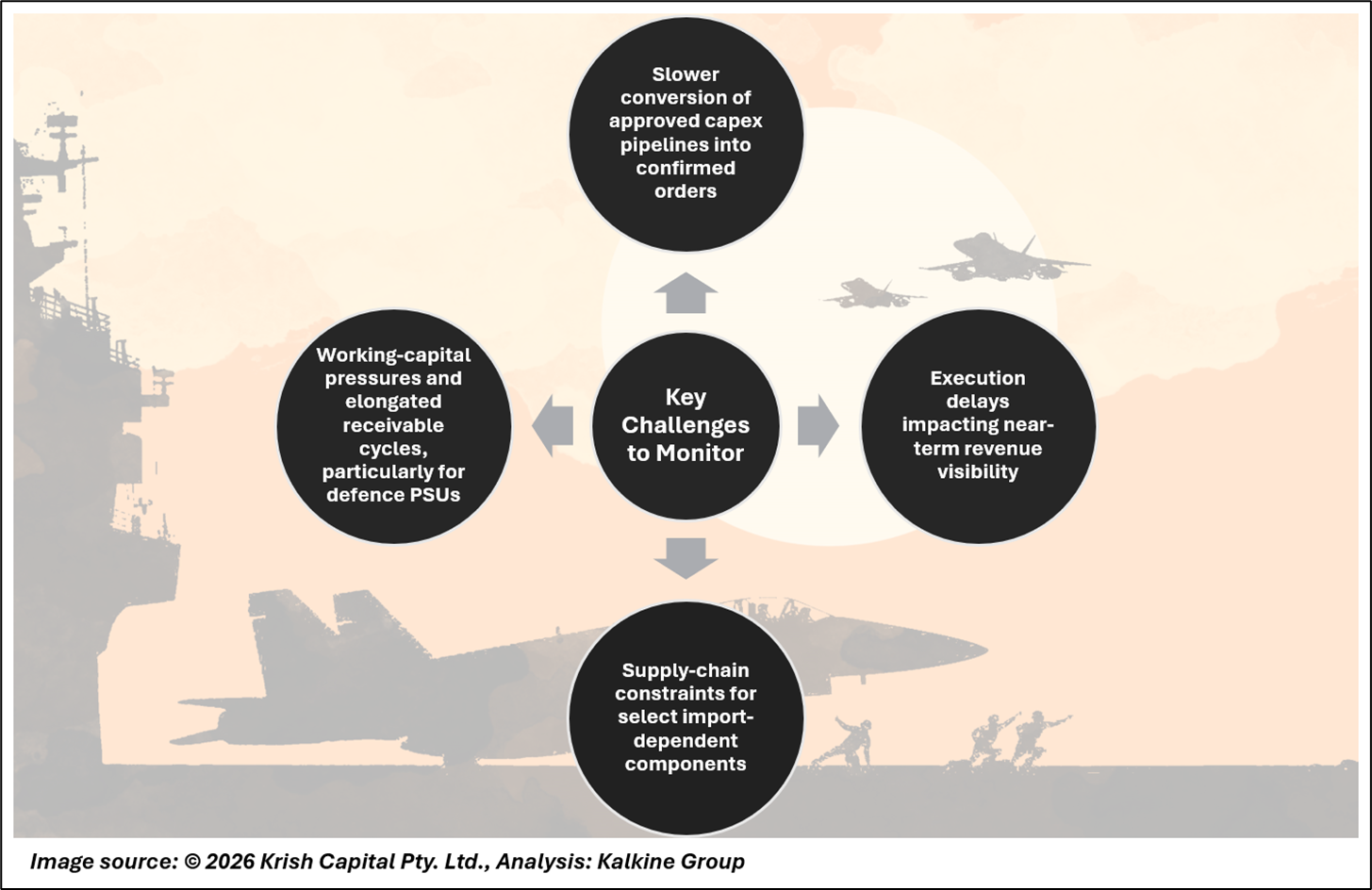

With sizeable order books already in place, execution levels near cyclical peaks, and long-term visibility supported by defence modernisation, indigenisation, and exports, the sector’s downside risks appear contained. However, defence stocks remain sensitive to Budget Day cues, particularly around capital allocation clarity and order finalisation timelines.

What the Market Is Watching in Budget 2026

The market’s attention has shifted from broad policy announcements to how efficiently approved projects convert into executable orders. Key expectations include:

- Clearer visibility on capital allocations across services

- Faster translation of Defence Acquisition Council (DAC) approvals into firm contracts

- Better alignment between budgetary intent and on-ground execution schedules

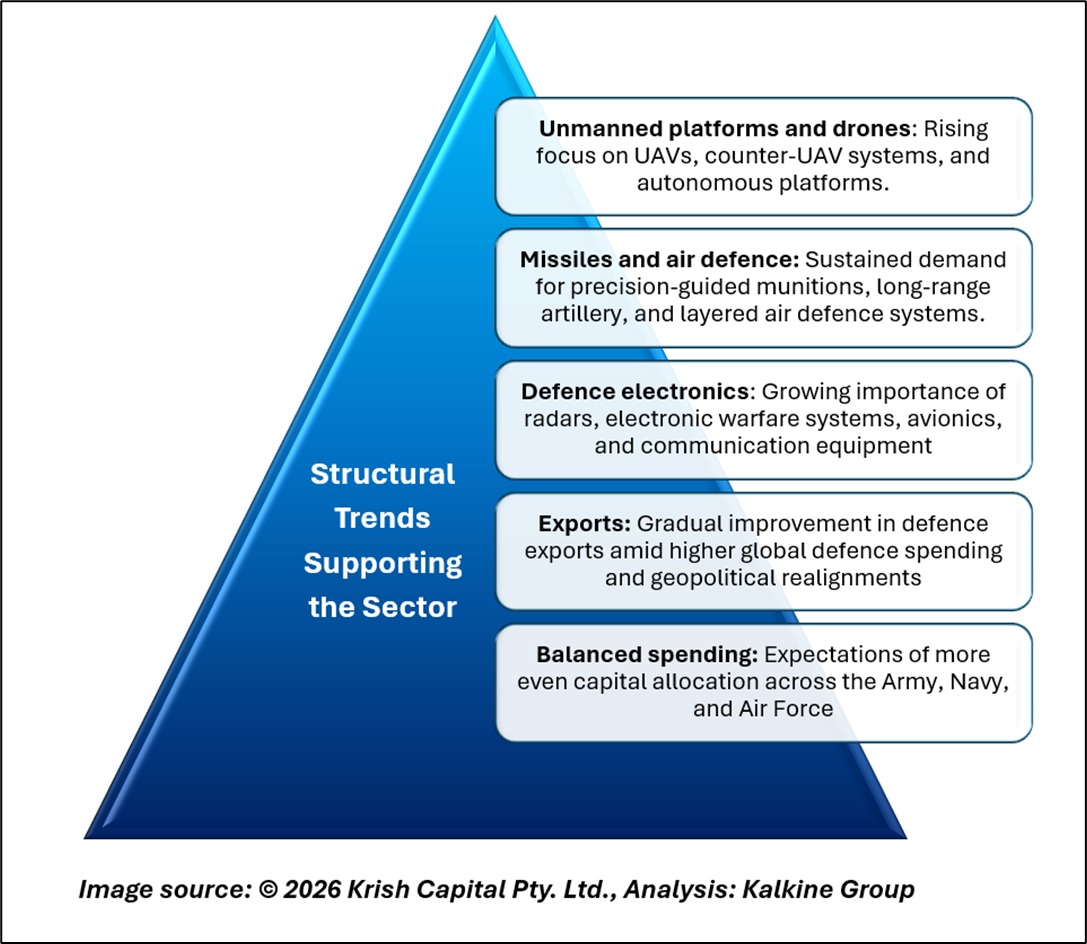

While Budget Day may act as a short-term catalyst, the medium-term investment narrative continues to hinge on indigenisation, modern warfare requirements, and export-led growth.

Key Listed Defence Players to Watch

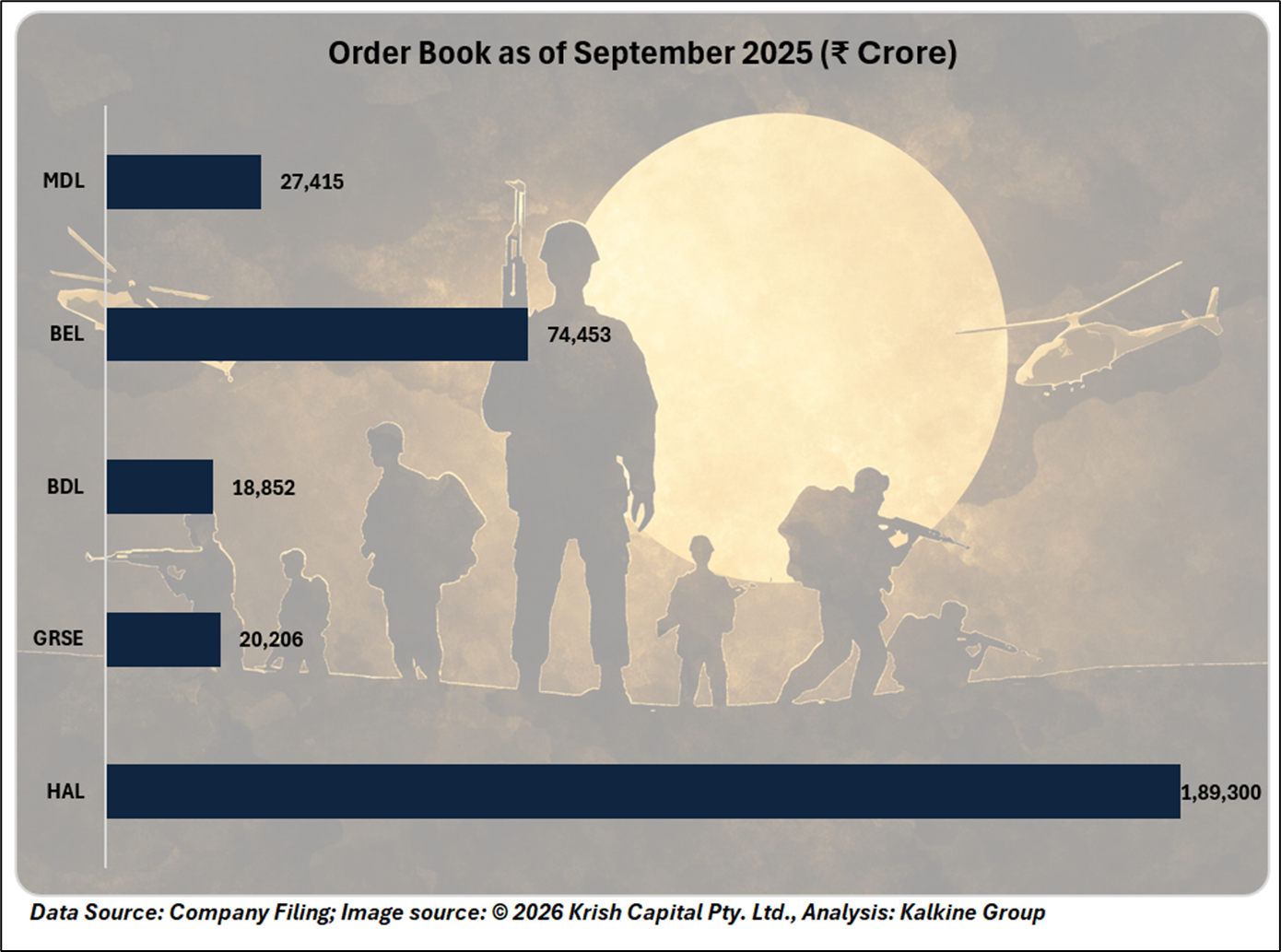

- Hindustan Aeronautics Limited (HAL)- Strong visibility from aircraft platforms, engines, and long-term service contracts; valuation appears reasonable given execution depth.

- Garden Reach Shipbuilders & Engineers Limited (GRSE)- Healthy naval order book with steady execution; valuations remain comfortable on medium-term estimates.

- Bharat Dynamics Limited (BDL)- Attractive positioning in missile and guided munitions, contingent on timely large-order materialisation.

- Bharat Electronics Limited (BEL)- Beneficiary of rising defence electronics spend, including radars, EW systems, and communication solutions.

- Mazagon Dock Shipbuilders Limited (MDL)- Exposure to submarines and frontline naval platforms, though execution timelines remain critical.

Budget 2026: Likely Outcomes

- Defence budget growth of around 8–10%, viewed as a comfortable outcome

- Incremental allocations favouring drones, arms and ammunition, and defence electronics

- Continued emphasis on long-tenure, platform-based programmes

- Improved clarity on execution schedules and order finalisation

A very large positive surprise is unlikely given competing fiscal priorities, but stable-to-positive allocations should support sector sentiment.

Sector Outlook: Constructive but Disciplined

The defence sector’s outlook remains structurally positive but increasingly execution driven. Elevated order books, near-peak execution levels, and long-term visibility from modernisation, indigenisation, and exports provide support. However, returns are likely to be more selective, favouring companies with disciplined execution, manageable working capital, and clear earnings visibility.

Budget Day may set the tone, but sustained performance will depend on how efficiently intent translates into delivery.

Conclusion

Overall, Budget 2026 is expected to reinforce a steady, execution-focused outlook for the defence sector. While allocations may remain measured, clearer timelines and smoother order conversion will be crucial. Select companies with strong execution discipline and visibility are better positioned to sustain medium-term investor interest.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.