India’s Wine & Liquor Industry Set to Rebound in FY26

Source: shutterstock

The Indian alcoholic beverage (AlcoBev) sector witnessed a sharp deceleration in FY25, with a pronounced dip in urban demand. According to Sula Vineyards Ltd’s annual report, urban consumption took a “temporary pause,” impacting premium categories more significantly. Among all AlcoBev segments, wine bore the brunt, as it remains largely an urban-centric and discretionary product.

While beer and spirits volumes declined by 4% to 7% YoY, the wine segment stagnated, reflecting a pullback in lifestyle spending post-COVID recovery. Urban consumers tightened their wallets amid macroeconomic uncertainty, inflation, and changing social habits reducing on-premises consumption across cities.

FY26: Reopening the Tap on Growth

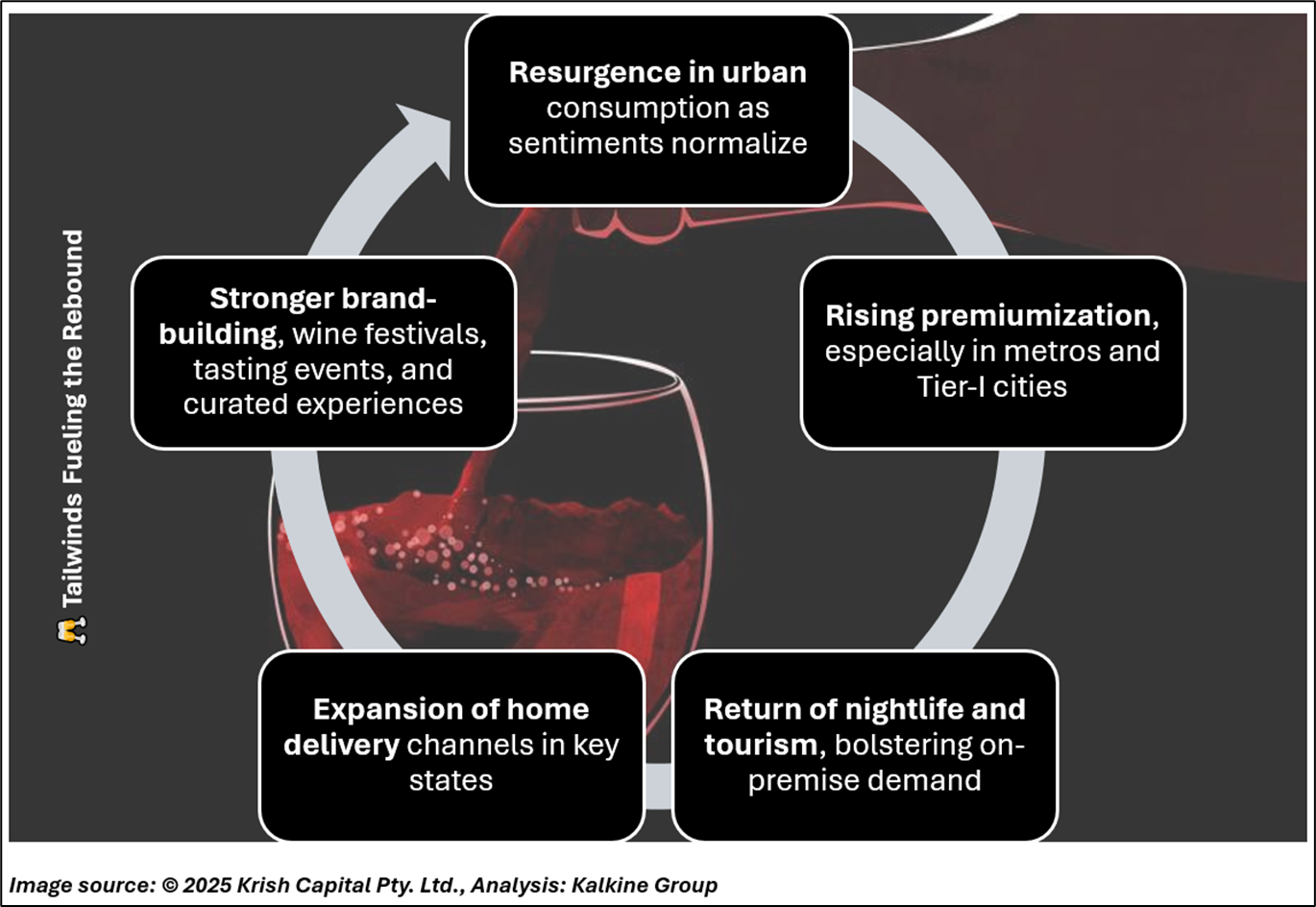

Despite the FY25 hangover, the industry is now turning a corner. With economic stability returning post-elections, moderating inflation, and a shift back to lifestyle spending, demand revival is on the horizon.

Sula Vineyards expects to leverage this momentum through premium labels and wine tourism, cementing its leadership position in India’s growing wine segment.

Listed Stocks to Watch: Poured with Potential

United Spirits

- Premium-led strategy post-Diageo restructuring

- Q4FY25 showed sequential recovery in volumes

- Focus on profitability and high-margin portfolio (e.g., Signature, Black Dog)

United Breweries

- Beer market leader poised for rebound in FY26

- Cooling barley costs may boost gross margins

- Tailwinds from upcoming festive and travel season

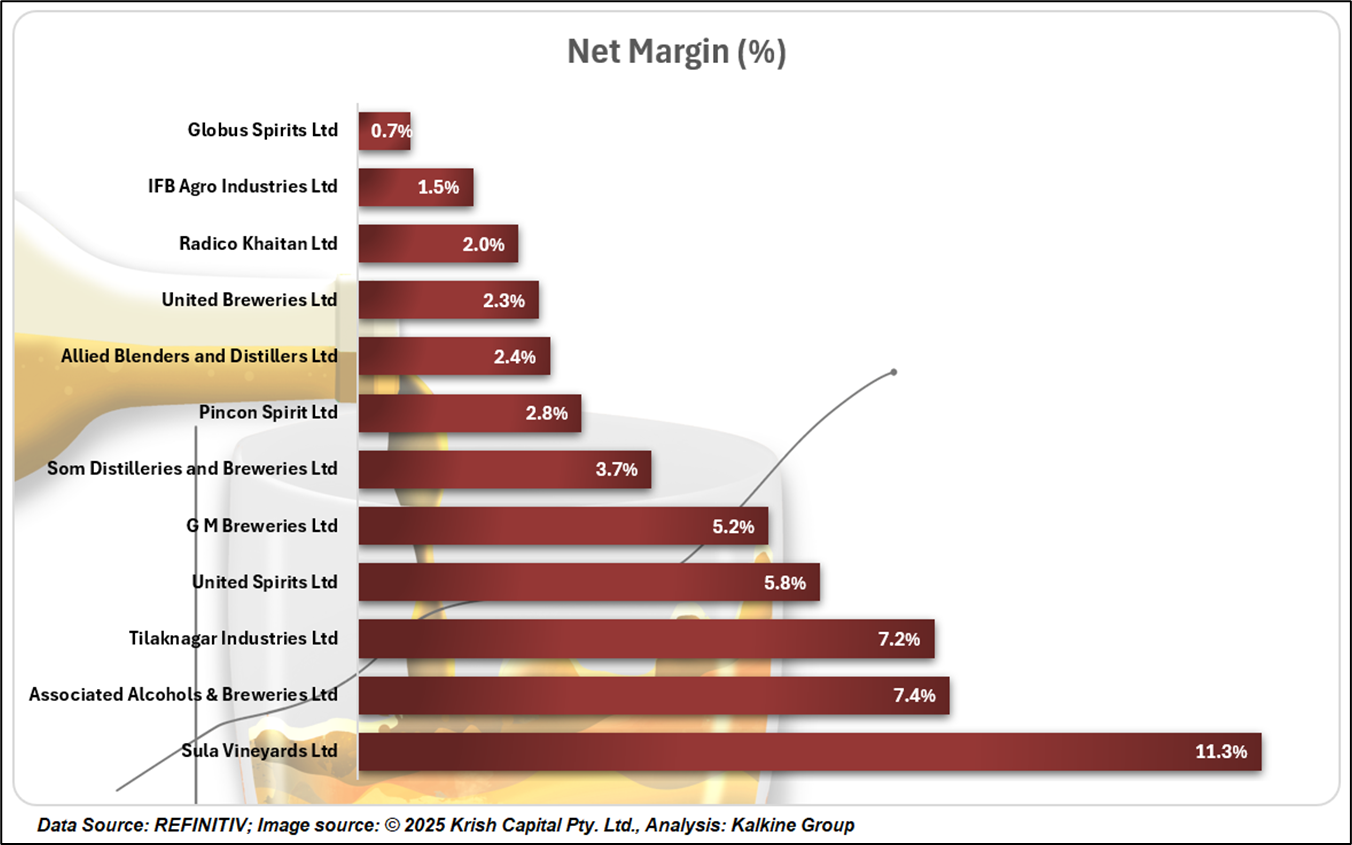

Sula Vineyards

- India’s only listed wine company, riding premiumisation wave

- Asset-light model with strong wine tourism arm (Nashik resort + events)

- Plans to deepen presence through direct-to-consumer (D2C) and tasting rooms

Radico Khaitan

- Diversifying into super-premium spirits with brands like Jaisalmer and Rampur

- Capacity expansion in Sitapur to support growth

- Solid distribution and rural presence

Globus Spirits

- Dual exposure to value liquor and ethanol

- Beneficiary of ethanol blending push and steady IMIL demand

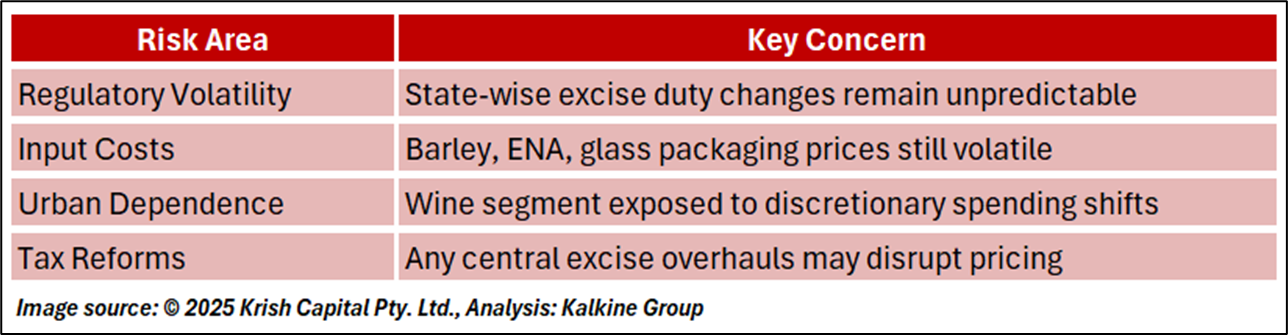

Investment Risks to Watch

Investor Takeaway: Sip Selectively, Stay Premium-Focused

The Indian wine and liquor industry appears well-positioned for a spirited comeback in FY26, especially in the premium and urban-driven categories. While FY25 served as a reset year, easing headwinds and consumption tailwinds suggest stock-specific opportunities for investors.

Conclusion

India’s wine and liquor industry is poised for a strong rebound in FY26, driven by urban demand recovery and rising premiumisation. After a subdued FY25, the sector offers attractive opportunities for investors focused on quality brands and margin expansion. With favourable tailwinds ahead, selectively tapping into AlcoBev leaders could deliver a rewarding blend of growth and returns.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.