SoftBank Stock Drops on Nvidia Exit, Eyes AI Ventures

Source: © 2025 Krish Capital Pty. Ltd.

SoftBank Group has sold its entire holding of 32.1 million Nvidia shares, raising approximately $5.83 billion. The sale, completed in October at an average price of $182 per share, same just below Nvidia’s high of $212 in late October.

This move marks SoftBank’s full exit from one of the world’s most valuable semiconductor companies. Nvidia has been a key player in the global artificial intelligence (AI)boom, drawing interest from investors amid surging demand for AI chips.

Even after selling its shares, SoftBank emphasized that it is not stepping away from AI. Instead, the company plans to use the proceeds to invest directly in AI projects and strengthen its role in the sector.

Funds Channelled Toward OpenAI Investments

SoftBank confirmed that the proceeds from the Nvidia sale will support new AI-focused initiatives, including increased funding for OpenAI, the developer of ChatGPT. The company has already invested billions of dollars into the startup and recently committed an additional $22 billion to further develop its AI ecosystem.

According to Chief Financial Officer Yoshimitsu Goto, SoftBank is utilizing its existing assets to generate liquidity for new opportunities. The move reflects the company’s strategy to transition from passive equity holdings in tech giants toward active participation in the development of next-generation AI infrastructure.

Market Reaction and Investor Sentiment

Following this announcement, SoftBank’s shares fell nearly 10% on the Tokyo Stock Exchange. Investors reacted cautiously, viewing the exit from Nvidia as both a profit-booking measure and a potential signal of tightening liquidity.

Nvidia’s stock also slipped over 3% amid broader concerns about overheating valuations in the AI sector. Market participants have recently debated whether the surge in AI-related stocks signals long-term growth or the formation of a speculative bubble.

Balancing AI Ambitions with Market Realities

SoftBank’s sale of Nvidia shares reflects a strategic portfolio realignment, moving from passive holdings toward direct investment in AI ventures. While the transaction contributed to short-term stock volatility, it positions the company to participate more actively in high-growth AI opportunities, highlighting a focus on long-term growth and strategic reinvestment in emerging technology sectors.

Technical Analysis

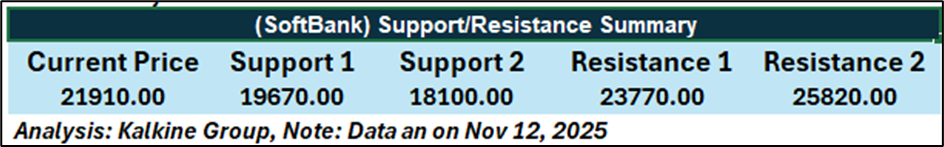

SoftBank is currently trading at ¥21,910. Key support levels are ¥19,670 and ¥18,100, while resistance levels stand at ¥23,770 and ¥25,820. The stock is closer to its first resistance, suggesting cautious upward potential, with downside protection near the first support.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.