FY27 Outlook: Top Indian Sector Trends Set to Be Driven by Earnings Growth

Source: shutterstock

Key Takeaways

- FY27 earnings growth is expected to outpace valuation expansion

- Cyclical sectors are driving upside, but valuation discipline is improving

- Energy and IT stand out for income and value

- Financials remain the earnings backbone of the market

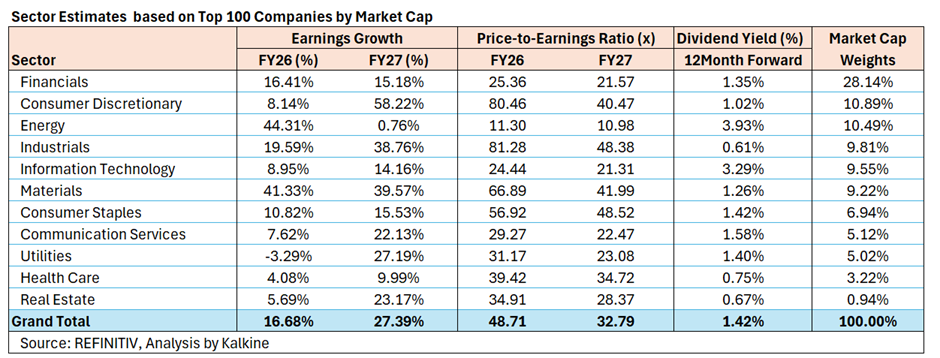

Consensus estimates for the top 100 companies by market capitalisation signal a decisive shift in market dynamics heading into FY27, with earnings growth—not valuation expansion—set to become the primary driver of returns. According to consensus estimates data provided by REFINITIV and analysed by Kalkine, aggregate earnings growth is forecast to accelerate from 16.7% in FY26 to 27.4% in FY27, even as the blended forward price-to-earnings (P/E) ratio compresses sharply from 48.7x to 32.8x.

Let’s have a look at sector wise expected performance for the next 2 years:

This combination points to a healthier market structure, where indications of excess optimism are gradually replaced by earnings delivery and cash-flow visibility.

Earnings Momentum Favors Cyclicals

Consumer Discretionary leads the earnings recovery, with FY27 profits expected to surge 58.2%, driven by improving consumption trends and margin normalisation. Importantly, this growth is accompanied by a sharp valuation reset, as forward P/E declines from 80.5x to 40.5x, reflecting earnings catching up with price expectations.

Industrials and Materials are also positioned for robust FY27 growth of 38.8% and 39.6%, respectively. These sectors stand to benefit from infrastructure-led demand, easing cost pressures, and a gradual rebound in global activity. Despite strong growth prospects, valuations across both sectors are expected to compress materially, reinforcing the earnings-led re-rating narrative.

Information Technology: Valuation Comfort with Income Support

The Information Technology sector offers a relatively balanced risk-reward profile. Earnings growth is expected to improve from 9.0% in FY26 to 14.2% in FY27, reflecting gradual recovery in global tech spending and stabilisation in deal pipelines.

What differentiates IT is valuation comfort. Forward P/E is projected to ease from 24.4x to 21.3x, placing the sector below the broader market multiple while maintaining earnings visibility. Additionally, IT offers one of the highest dividend yields at 3.3%, making it attractive for investors seeking a combination of defensive earnings, reasonable valuations, and income stability.

Value and Income Themes Remain Relevant

The Energy sector is forecast to see earnings growth slow from an exceptional 44.3% in FY26 to just 0.8% in FY27. However, energy stocks remain attractive on valuation and yield metrics, trading at the lowest forward P/E of around 11x while offering the highest dividend yield at 3.9%.

Financials, which account for over 28% of total market capitalisation, are expected to deliver stable mid-teens earnings growth across both fiscal years. With forward valuations easing to 21.6x in FY27, the sector continues to provide earnings stability and index-level support.

Bottom Line

Consensus estimates suggest FY27 could mark a turning point, where sustainable earnings growth, rather than multiple expansion, drives equity returns. In such an environment, investors may increasingly favour sectors offering scalable profits, reasonable valuations, and resilient cash flows, reinforcing the case for a fundamentally selective investment approach.

Data Source: Refinitiv | Analysis: Kalkine

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.