Zinc Prices, Silver Rally and Record Output Put Hindustan Zinc (NSE:HINDZINC) on Market Radar

Source: © 2026 Krish Capital Pty. Ltd.

Highlights

- Zinc futures approached a three-year high amid declining refined output and falling LME inventories.

- Hindustan Zinc reported its highest-ever third-quarter and nine-month mined and refined metal production.

- The stock has risen nearly 50% over six months, with broker targets set up to ₹700.

Hindustan Zinc Limited (NSE:HINDZINC) shares are attracting attention as global zinc prices move closer to multi-year highs amid tightening supply conditions, while silver prices have surged sharply over the past year. The focus has intensified following the company’s announcement of its highest-ever third-quarter and nine-month production figures, alongside continued momentum in its share price and fresh brokerage upgrades.

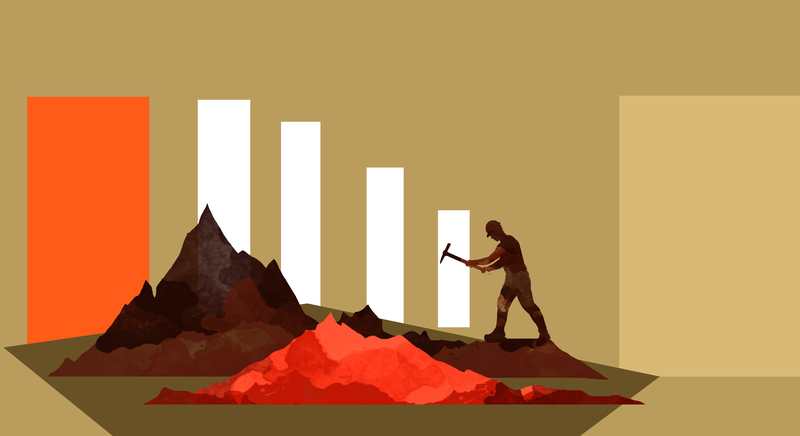

Global Zinc Market Sees Tight Supply Conditions

Zinc futures in the UK climbed to USD 3,220 per tonne, nearing a three-year high of USD 3,250 recorded on January 6, driven by concerns over limited supply in the global base metals market. Refined zinc production was projected to decline by 2% last year despite a 6.3% rise in mined output, reflecting production curbs at smelters in regions such as Kazakhstan and Japan. In Japan, output has been impacted by the closure of the Toho Zinc Annaka plant.

Silver Prices Add to Sector Momentum

Silver prices have recorded a 195% rise over the past year, contributing to increased interest in companies with exposure to both zinc and silver. Hindustan Zinc ranks among the top five silver producers globally, adding another dimension to its market positioning amid ongoing price movements in precious metals.

Hindustan Zinc Reports Record Production

Hindustan Zinc, a Vedanta Group company and the world’s largest integrated zinc producer, reported its highest-ever third-quarter mined and refined metal production for the period ended December 31, 2025.

During 3QFY26, mined metal production reached 276 kilotonnes (kt), supported by higher ore output. Refined metal production stood at 270 kt, aided by the commissioning of debottlenecking projects at Chanderiya and Dariba, ramp-up of the 160 ktpa roaster at Debari, and improved plant availability. Saleable silver production rose 10% quarter-on-quarter to 158 metric tonnes.

For the nine months ended December 2025, mined metal production reached a record 799 kt, while refined zinc output increased 2% year-on-year to 624 kt. Saleable silver production during the period was reported at 451 metric tonnes.

Share Price Performance and Broker Outlook

Hindustan Zinc shares closed at ₹655 on January 14, 2026, up 3.99% for the day. The stock has gained 15.31% over the past month, 49.73% over six months, and 48.17% on a yearly basis.

Brokerages Batlivala & Karani Securities India Pvt Ltd and Jefferies have issued buy ratings on the stock, with target prices of ₹668 and ₹700, respectively.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.