Adani Group Stocks Rally as SEBI Clears Allegations

Source: shutterstock

Shares of Adani Group companies surged sharply on Thursday, with gains of up to 13%, after the Securities and Exchange Board of India (SEBI) dismissed allegations of stock manipulation raised by US-based short-seller Hindenburg Research. The market regulator’s findings provided a major relief to the conglomerate and lifted investor sentiment across its listed entities.

SEBI’s Findings

After a detailed investigation, SEBI concluded that there was no evidence of fraud, round-tripping, or diversion of funds within the Adani Group. The regulator noted that the transactions questioned in the Hindenburg report were in fact regular loan arrangements, with clear documentation and repayment.

The watchdog further clarified that its probe did not reveal any misuse of shareholder capital or manipulation of share prices, countering one of the key claims made in the original allegations.

Market Reaction

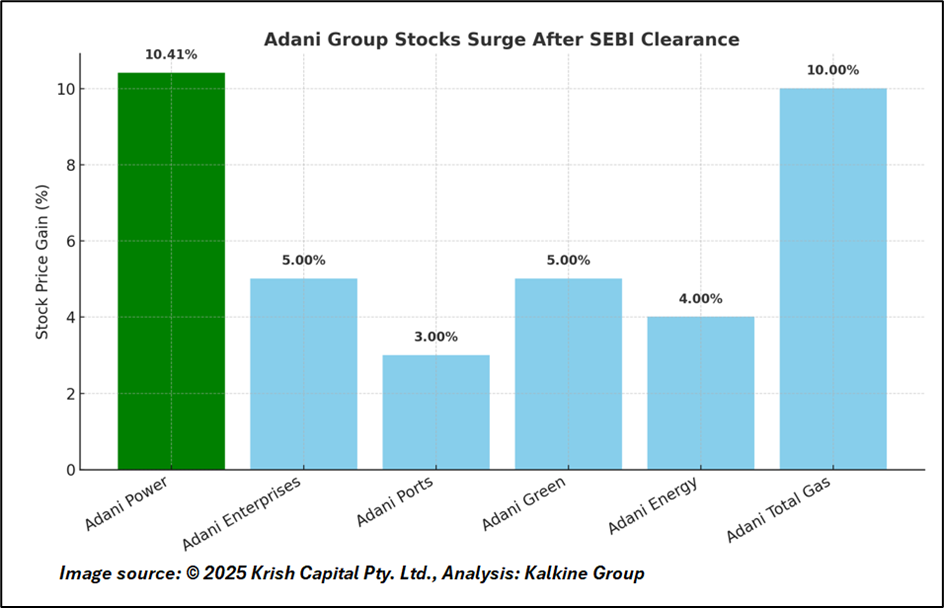

The clean regulatory outcome triggered a wave of buying interest across Adani stocks. Adani Enterprises, Adani Power, and Adani Green Energy were among the top gainers, rising as much as 13% in intraday trade. Other group companies, including Adani Ports and Adani Total Gas, also witnessed strong momentum.

The sharp rebound reflects renewed investor confidence in the group’s fundamentals and governance standards, especially after months of volatility and uncertainty following the Hindenburg report.

Adani Group’s Response

In a statement, Gautam Adani, Chairman of the Adani Group, reaffirmed that the allegations had been baseless from the start. He emphasised the group’s commitment to transparency, compliance, and ethical standards in all business operations. “The findings validate what we have consistently maintained — that our governance practices are robust and our integrity remains intact,” Adani said.

The statement also sought to reassure global investors, highlighting that the group’s growth strategy remains on track and aligned with India’s broader economic development goals.

Outlook

Analysts believe SEBI’s clearance marks a turning point for the conglomerate, potentially unlocking fresh interest from institutional investors who had adopted a cautious stance over the past year. The rally across group companies suggests that markets have largely priced out governance concerns, focusing instead on operational performance and sectoral opportunities.

While near-term volatility cannot be ruled out, the regulatory clean chit is likely to serve as a strong tailwind for the group as it pushes ahead with expansion in infrastructure, energy, and green transition projects.

Conclusion

SEBI’s clearance has lifted a major overhang for the Adani Group, restoring investor confidence and reaffirming governance credibility. While short-term volatility may persist, the clean chit provides momentum for long-term growth, supporting the conglomerate’s expansion in infrastructure, energy, and green projects aligned with India’s economic and sustainability goals.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.