Alkem Laboratories Ltd (NSE:ALKEM), has announced its intent to acquire a majority stake in Occlutech Holding AG, a Switzerland-based leader in minimally invasive cardiac implants. Under the proposed agreement, Alkem MedTech plans to acquire up to 55% of Occlutech for EUR 99.4 million (approximately INR 1,074 crore / $118 million), subject to regulatory approvals.

This acquisition represents a major milestone in Alkem MedTech’s strategic global expansion, enabling entry into advanced cardiovascular devices and reinforcing the company’s long-term vision of establishing itself as a global healthcare player.

Occlutech: Global Expertise in Structural Heart Devices

Occlutech is recognized internationally for its innovative structural heart devices, with robust R&D, manufacturing, and distribution capabilities in Germany, Turkey, Sweden, and the United States. The company reported revenues of EUR 49.4 million in 2025, reflecting a three-year compound annual growth rate (CAGR) of 15.7%, driven predominantly by the European and US markets.

B. N. Singh, Executive Chairman of Alkem Laboratories, emphasized, “This acquisition is a significant step in Alkem MedTech’s global expansion strategy, combining our domestic strength with Occlutech’s expertise in high-barrier markets. It positions us to lead in advanced cardiovascular devices while strengthening our long-term global healthcare ambitions.”

Kaustav Banerjee, CEO of Alkem MedTech, added, “Occlutech’s world-class manufacturing standards, strong regulatory framework, and innovative product portfolio provide a solid foundation for sustainable growth in the cardiology segment.”

Alkem Laboratories Q3 FY26: Strong Revenue and Profit Growth

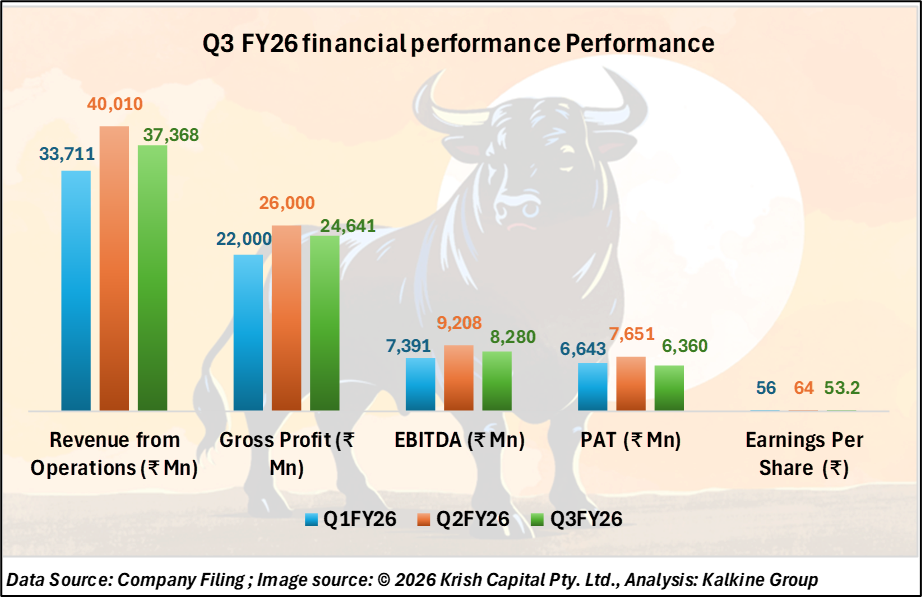

Alkem Laboratories’ Q3 FY26 performance provides a strong backdrop for its global expansion. The company reported total revenue of ₹37,368 million, a 10.7% year-on-year (YoY) increase. Domestic sales contributed ₹24,959 million, growing 5.5% YoY, while international sales surged 26.6% to ₹12,157 million, driven by the US market (₹7,533 million, +18.8%) and non-US international markets (₹4,624 million, +41.6%).

EBITDA for the quarter grew 9% YoY to ₹8,280 million, with a margin of 22.2%, while net profit rose 1.6% YoY to ₹6,360 million. According to IQVIA (SSA), Alkem outperformed the Indian Pharmaceutical Market (IPM) in key segments, with acute therapies growing 8.6% versus IPM 7.8%, and chronic therapies at 15.8% versus IPM 15.6%.

Focus therapy areas Anti-infectives, VMN, Pain, Anti-Diabetic, Respiratory, and Derma demonstrated strong domestic portfolio execution, highlighting Alkem’s capability to maintain consistent growth across diverse therapeutic segments.

Strategic Expansion: MedTech and Global Footprint

The Occlutech acquisition aligns with Alkem’s long-term global ambitions in medtech. Through this deal, Alkem MedTech gains access to high-quality cardiovascular devices and a strong international manufacturing and regulatory framework. The acquisition also complements Alkem’s biotech arm, Enzene Biosciences, creating synergies across innovative therapies and medical technologies.

The transaction is expected to close by June 2026, following regulatory approvals and satisfaction of other conditions precedent. Boston Consulting Group (BCG) served as the strategic advisor to Alkem MedTech on this deal.

Investment in R&D and Regulatory Excellence

Alkem continues to prioritize research and development, spending ₹1,390 million in Q3 FY26, accounting for 3.7% of total revenue. The company’s quality and compliance credentials remain strong, with successful USFDA inspections across 18 manufacturing facilities, including sites in India and the US. During the quarter, Alkem filed 2 ANDAs and received 7 approvals in the US, reflecting a robust pipeline for international expansion.

Looking ahead, the launch of the GLP-1 semaglutide in March 2026 is expected to further strengthen Alkem’s product portfolio, supporting execution discipline, revenue growth, and competitiveness across both domestic and international markets.

Technical Summary

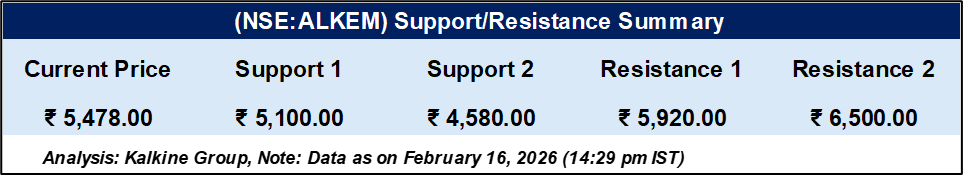

Alkem Labs Ltd (NSE:ALKEM) is trading at ₹5,478. Key support levels are at ₹5,100 and ₹4,580, while resistance levels are at ₹5,920 and ₹6,500. The stock is currently positioned between these support and resistance points, showing the range of recent price activity. These levels serve as reference points for tracking price movements.

Conclusion

Alkem Laboratories’ $118M acquisition of a 55% stake in Occlutech marks a major step in its global medtech expansion. Leveraging Occlutech’s expertise in structural heart devices, advanced manufacturing, and regulatory compliance, Alkem strengthens its cardiovascular portfolio while enhancing international growth prospects.

Coupled with strong Q3 FY26 revenue and profit growth, this strategic move positions Alkem MedTech to deliver sustainable growth, expand its global footprint, and reinforce its long-term vision of becoming a leading player in innovative healthcare solutions.