Apollo Tyres’ Strong Performance Reinforces Market Leadership in FY26 Q3

Source: Shutterstock

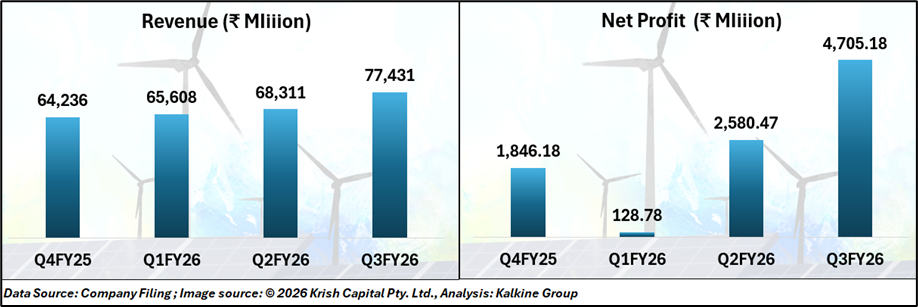

Apollo Tyres Ltd has posted robust financial results for the third quarter of FY26, reflecting the company’s strong operational capabilities and strategic market expansion. Consolidated revenue for reached ₹7,743 crore, marking a 12% increase from ₹6,928 crore in the same period last year. Operating profit jumped 25% to ₹1,186 crore, while net profit surged 40% to ₹471 crore, underscoring efficiency gains and higher sales volumes across key markets.

European Markets Contribute to Global Footprint

European operations also contributed positively, growing in line with regional market trends and further reinforcing Apollo Tyres’ international presence. Cross-currency data shows Q3 revenue at $870.64 million and €748.49 million, highlighting the company’s diversified global reach.

Product and Channel Mix Highlights Balanced Growth

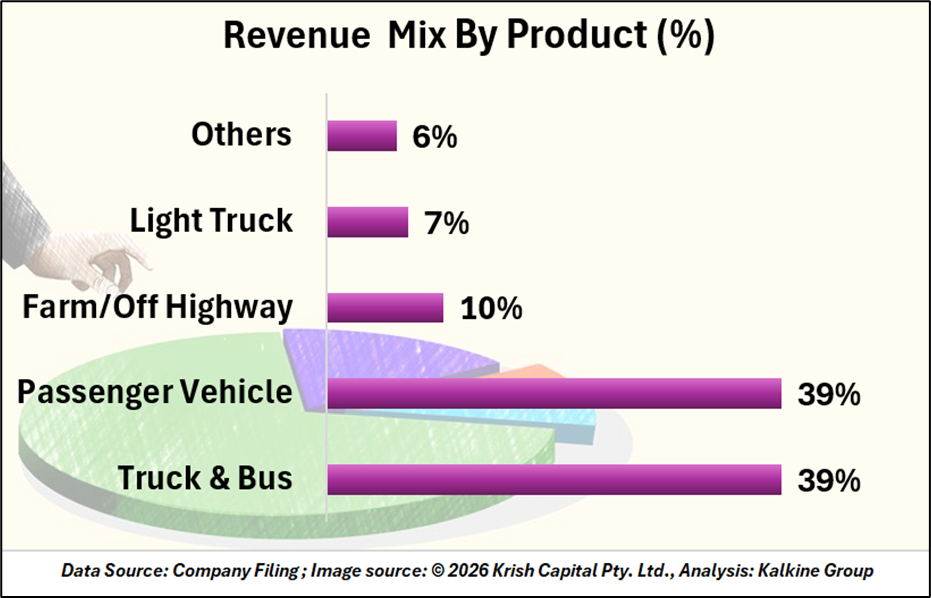

By product, truck and bus tyres and passenger vehicle tyres each contributed 39% to total revenue, while farm/off-highway tyres, light truck tyres, and others accounted for 10%, 7%, and 6%, respectively.

Domestic Operations Shine with Record Growth

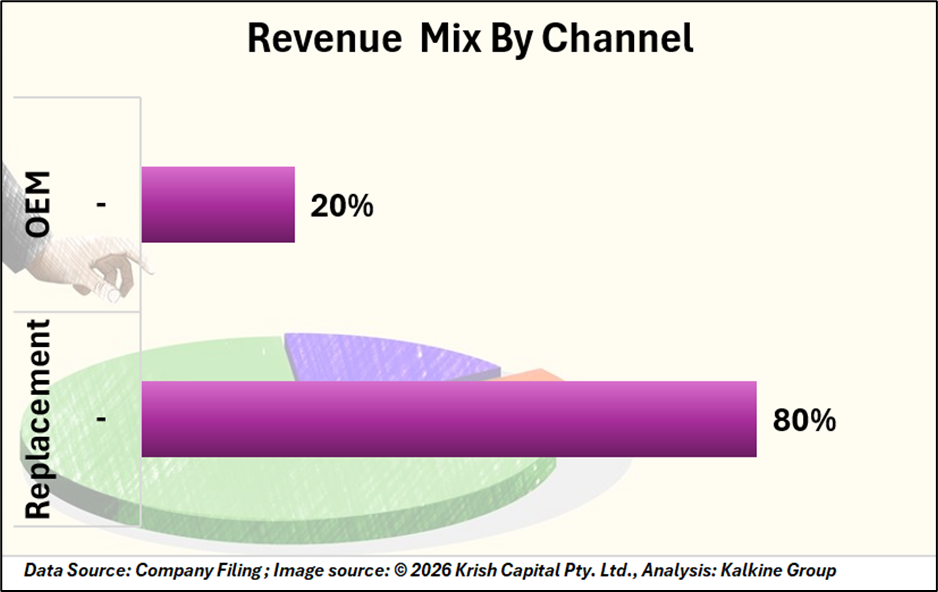

The company’s domestic operations delivered an exceptional performance, achieving the highest quarterly results to date. Growth was driven by a strong rebound in replacement tyre demand, higher exports, and healthy sales through original equipment manufacturer (OEM) channels.

Leadership Confident About Future Momentum

Onkar Kanwar, Chairman of Apollo Tyres, emphasized the encouraging demand momentum and expressed confidence that this growth trajectory would continue in upcoming quarters. With a balanced presence in India and Europe and strong operational performance, Apollo Tyres appears well-positioned for sustained growth and market leadership in the tyre industry.

Technical Summary

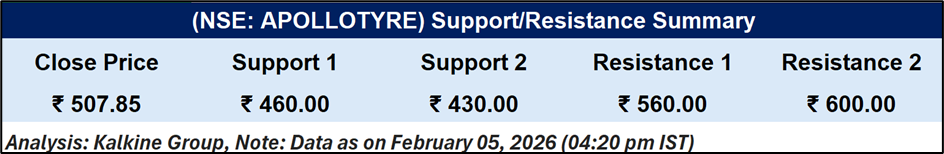

Apollo Tyres closed at ₹507.85, slightly below its 51-day simple moving average (SMA) of ₹509.17. The stock recently rebounded from around ₹480, with the immediate support levels at ₹460 and ₹430. On the upside, resistance is seen near ₹560 and ₹600.

The Relative Strength Index (RSI) stands at 52.10, indicating a neutral momentum. Daily trading volumes were moderate at 3.66 million shares, suggesting active participation around current levels.

Conclusion

Apollo Tyres’ Q3 FY26 results highlight strong revenue growth, robust profitability, and balanced contributions from domestic and European markets. Record domestic performance, efficient operations, and diversified product mix underscore the company’s resilience and market leadership. Technical indicators show neutral momentum with potential upside near ₹560–₹600, supported around ₹460–₹430. With strategic international presence and continued demand momentum, Apollo Tyres is well-positioned for sustained growth and long-term value creation for shareholders.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.