Big Numbers, Better Margins: Why SBI’s Q3FY26 Performance Is Turning Heads

Source: shutterstock

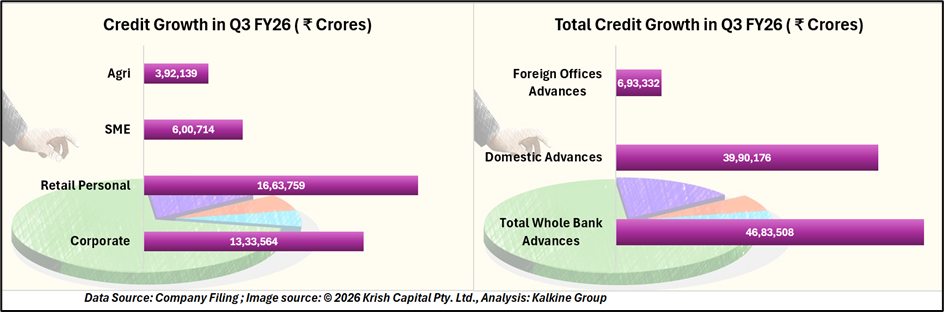

State Bank of India reported total business of over ₹103 trillion in Q3FY26, comprising advances of ₹46.83 trillion and deposits of ₹57.01 trillion. Whole bank advances grew 15.14% year-on-year, driven by demand across domestic and overseas operations. Domestic advances increased 15.44% YoY, while foreign office advances rose 13.41% YoY, led by activity in the US, GIFT City, Middle East, and East Asia.

Segment-wise, the SME portfolio crossed ₹6 lakh crore, recording 21.02% YoY growth. Agriculture advances grew 16.56% YoY, while retail personal loans increased 14.95% YoY, reflecting diversified credit distribution.

Profitability Trends and Earnings Profile

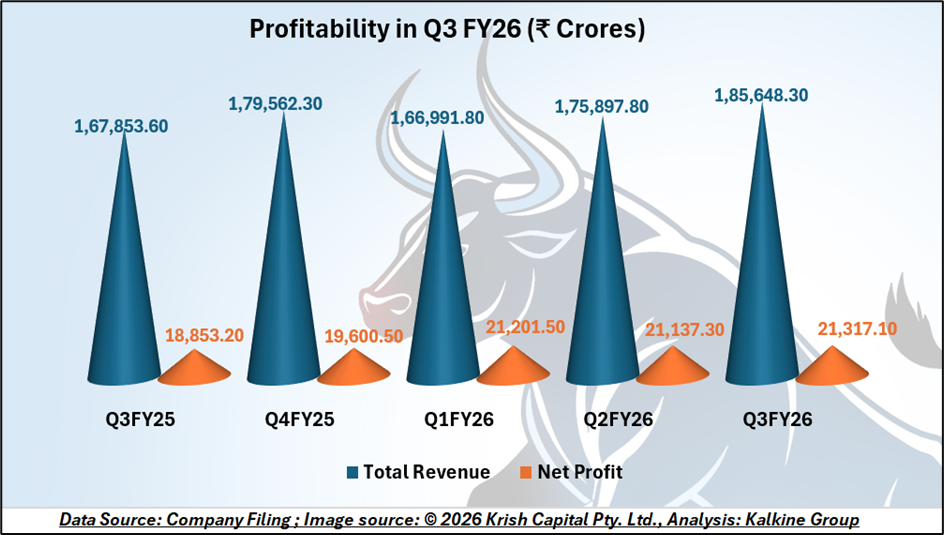

For Q3FY26, the bank posted a net profit of ₹21,028 crore, up 24.49% YoY. Operating profit rose 39.54% YoY to ₹32,862 crore, supported by growth in operating income and controlled expenses. Net Interest Income for the quarter stood at ₹45,190 crore, registering a 9.04% YoY increase.

For the nine-month period ended FY26, net profit increased 15.48% YoY to ₹60,348 crore. Return on Assets improved to 1.16%, while Return on Equity was reported at 20.68%.

Margins, Fees, and Operating Metrics

During the quarter, domestic Net Interest Margin was reported at 3.12%, while whole bank NIM stood at 2.99%. The cost-to-income ratio improved to 48.29%. Non-interest income was supported by a 15.65% YoY increase in fee income, recoveries from AUCA accounts, and treasury-related income.

Deposits and Liability Mix

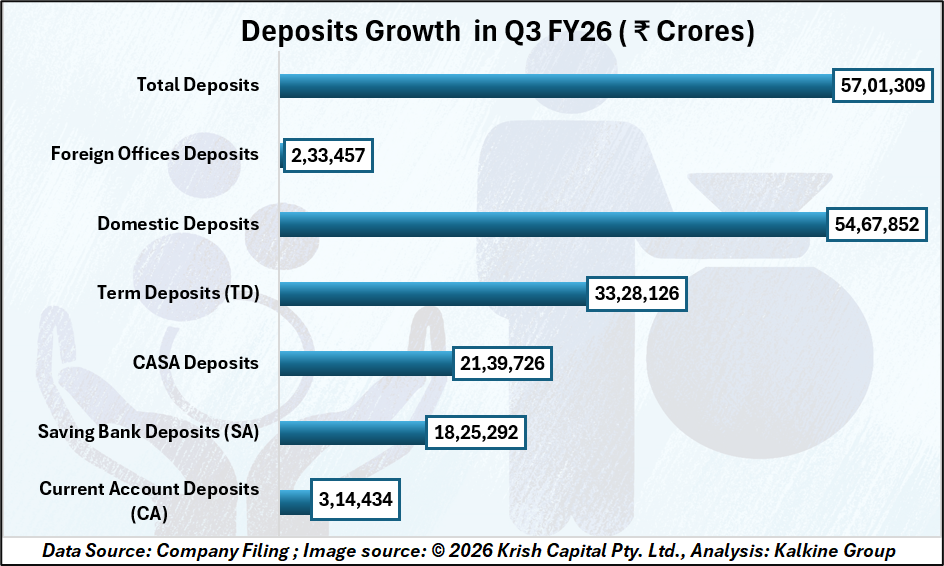

Total deposits rose 9.02% YoY to ₹57.01 trillion. CASA deposits increased 8.88% YoY, with the CASA ratio at 39.13% as of December 31, 2025. Current account balances grew 10.32% YoY, while retail term deposits increased 14.54% YoY.

Asset Quality and Capital Position

Gross NPA declined to 1.57%, while Net NPA stood at 0.39%. Provision Coverage Ratio improved to 75.54%, and PCR including AUCA reached 92.37%. Credit cost for the quarter was 0.29%. Non-NPA provisions amounted to ₹30,642 crore.

Capital Adequacy Ratio stood at 14.04%, with CET-1 at 10.99% and Tier-1 at 12.07%.

Digital and Sustainability Metrics

During 9MFY26, 98.6% of transactions were executed through alternate channels. The YONO platform recorded 9.65 crore registered users, with over 68% of savings accounts opened digitally in Q3FY26. The sustainable finance portfolio crossed ₹1.54 lakh crore, while CSR spending for 9MFY26 stood at ₹616 crore.

Technical Summary

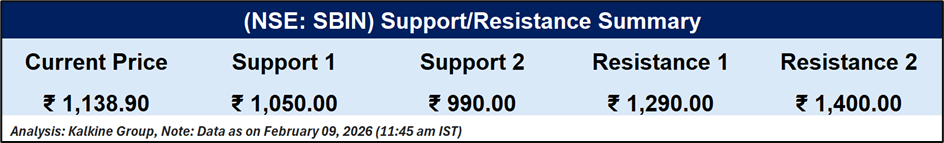

State Bank of India traded at ₹1,138.90 on the daily chart and remains positioned above its 51-day simple moving average near ₹1,005, reflecting sustained price strength relative to the medium-term trend. The broader structure shows a series of higher highs and higher lows over recent months, supported by an increase in trading volumes during the latest session.

On the downside, immediate support is observed near ₹1,050, with a secondary support level around ₹990. On the upside, resistance levels are identified near ₹1,290 and ₹1,400, marking key overhead price zones.

A Strong Finish Backed by Scale and Stability

State Bank of India’s Q3FY26 performance highlights resilient growth, improving profitability, and a stronger balance sheet. Broad-based credit expansion, healthy margins, lower NPAs, and robust capital adequacy underline operational strength. With accelerating digital adoption and rising sustainable finance exposure, SBI remains well-positioned to sustain earnings momentum and navigate future growth opportunities with confidence.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.