Copper Price Breakout: Top Indian Copper Stocks to Watch in 2025

Source: Shutterstock

Copper prices on the MCX have confirmed a decisive breakout in 2025, pushing above key resistance levels and reinforcing a strong bullish structure on technical charts. The move is not merely speculative it is anchored in structural demand from electrification, renewable energy deployment, EV penetration and AI-led data infrastructure, all of which are copper-intensive.

With momentum indicators turning supportive and prices holding above key moving averages, the red metal’s rally is drawing investor attention toward India-listed stocks with direct and indirect copper exposure. Historically, sustained commodity breakouts tend to transmit into equity performance with a lag making this phase critical for stock selection.

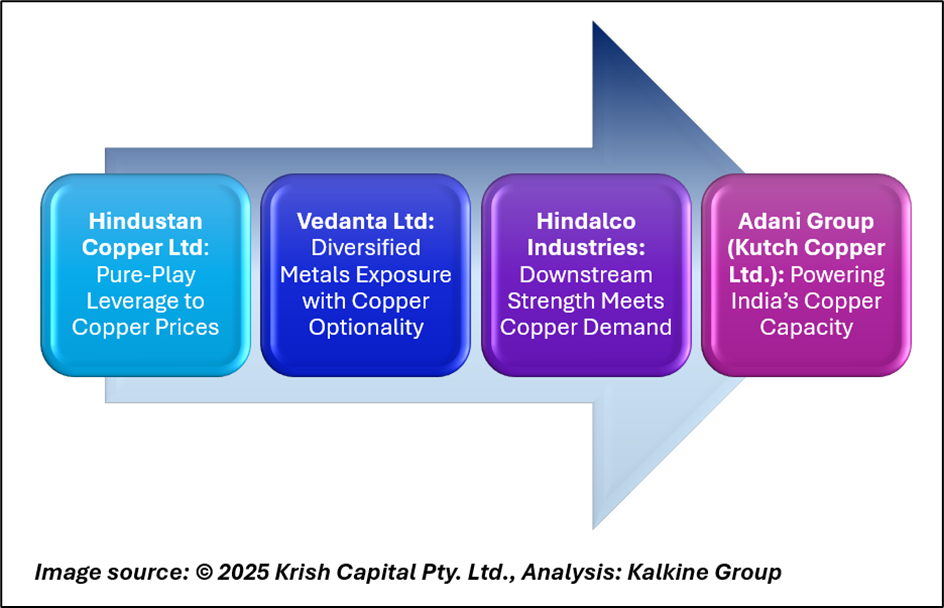

India’s Copper Plays: Stocks Positioned to Ride the Rally

Hindustan Copper Ltd- India’s only vertically integrated copper producer, Hindustan Copper offers direct earnings leverage to copper price movements. Its integrated operations amplify profitability during price upcycles, positioning the stock as a high-beta play on copper rallies. Ongoing capacity expansion and strategic importance to India’s resource security further enhance its appeal in metal-led market upswings.

Vedanta Ltd- Vedanta provides copper exposure within a diversified natural resources portfolio. While not a pure-play, rising copper prices add an incremental earnings tailwind. Improved visibility following demerger approvals supports valuation discovery during broader commodity upcycles.

Hindalco Industries- Hindalco’s copper operations are largely downstream and value-added, serving power, electronics and industrial segments. This enables participation in rising copper demand through volume growth and stable spreads, offering relatively lower volatility than upstream miners.

Adani Group (Kutch Copper Ltd.)- Adani’s Kutch Copper project has completed installation of its Phase-I plant with a capacity of 5 lakh tonnes per annum. The copper smelter and refinery are currently under commissioning, marking a key step toward India’s expanding domestic copper processing capacity and reduced reliance on imports.

Mid & Small Caps with Copper Exposure- Select smaller industrials such as Bhagyanagar Industries and Precision Wires offer niche copper-linked exposure through alloy and downstream segments, though with higher volatility.

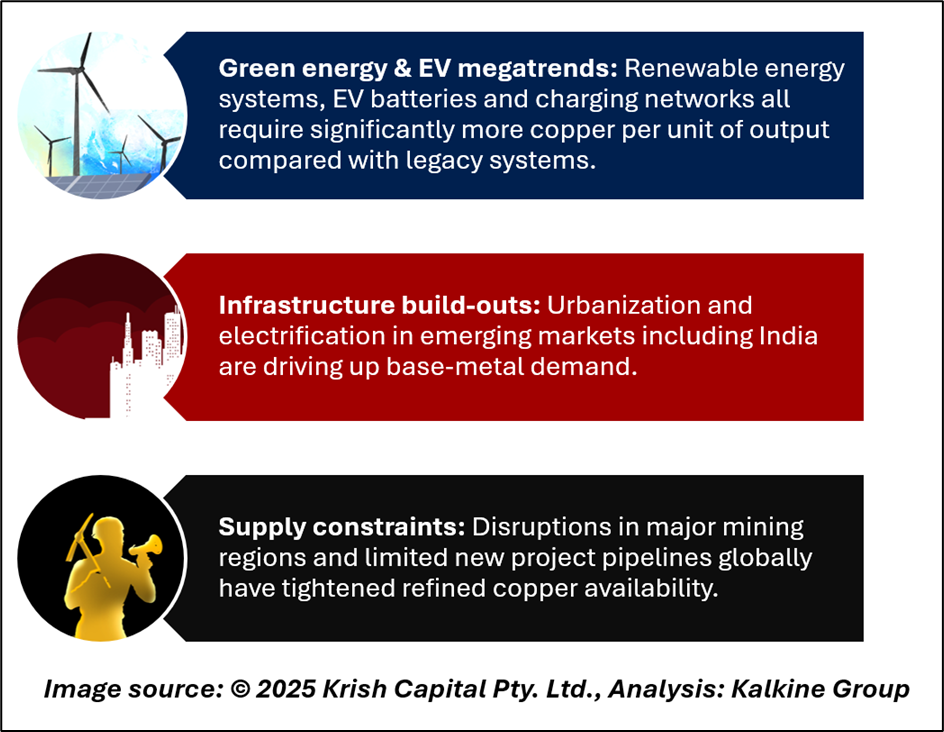

The Structural Case for Copper

Copper’s breakout is underpinned by long-term structural trends:\

Technical Analysis

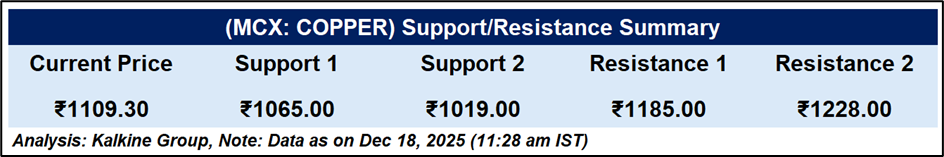

Copper futures are showing upward momentum, trading above a key horizontal trendline and the 21-period Simple Moving Average. The 50-period SMA, located above current prices, continues to reinforce near-term support. The RSI at 68.78 remains in positive territory, reflecting improving momentum with signs of divergence. Support is placed in the 1,065–1,019 zone, while resistance is seen around 1,185–1,228.

Conclusion

Copper’s confirmed breakout reflects both technical strength and powerful structural demand drivers. As prices sustain above key support levels, Indian equities with copper exposure are well positioned to benefit. Stock selection across integrated, diversified and downstream players will be crucial as the commodity upcycle gradually transmits into equity performance.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.