Eicher Motors shares surge after strong quarter: What should investors do now?

Source: shutterstock

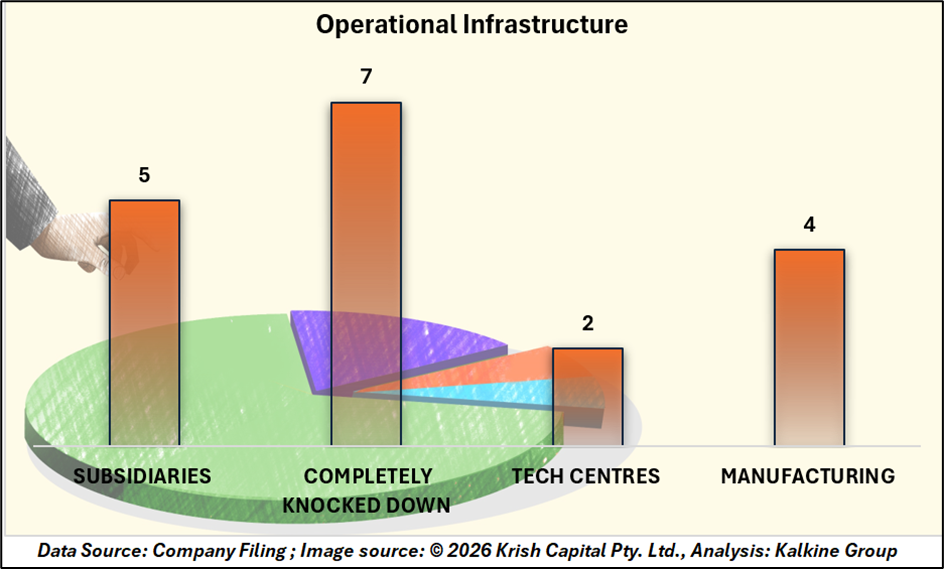

Eicher Motors Limited, which owns the renowned Royal Enfield motorcycle brand and operates in India’s commercial vehicle space through VE Commercial Vehicles (VECV), has released its unaudited consolidated financial results for the quarter ended December 31, 2025.

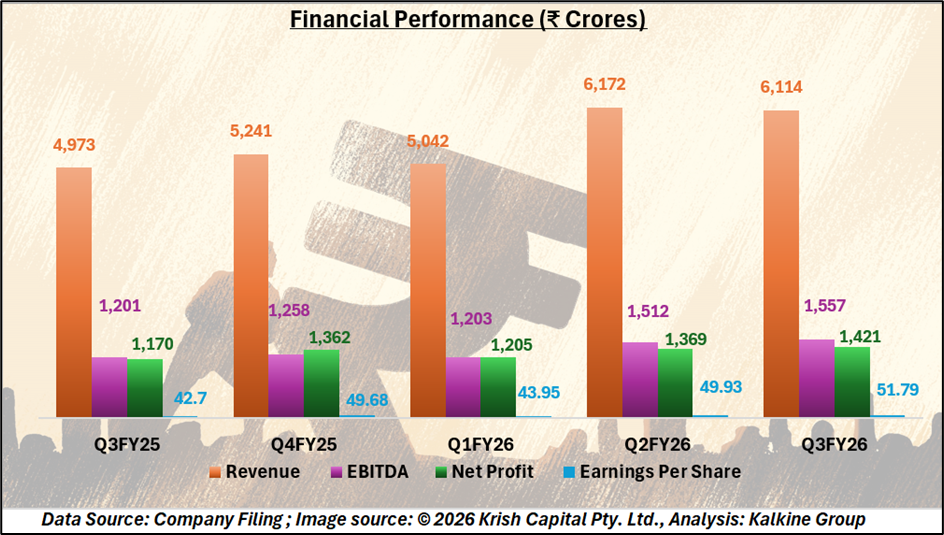

The company reported record performance across revenue, earnings, and sales volumes. Revenue from Operations for Q3 FY25-26 stood at ₹6,114 crores, a 23% increase year-on-year, while EBITDA surged 30% to ₹1,557 crores. Profit After Tax rose 21% to ₹1,421 crores, reflecting strong consumer demand, strategic product launches, and operational efficiencies.

Royal Enfield Sales Surge Amid Strong Global Demand

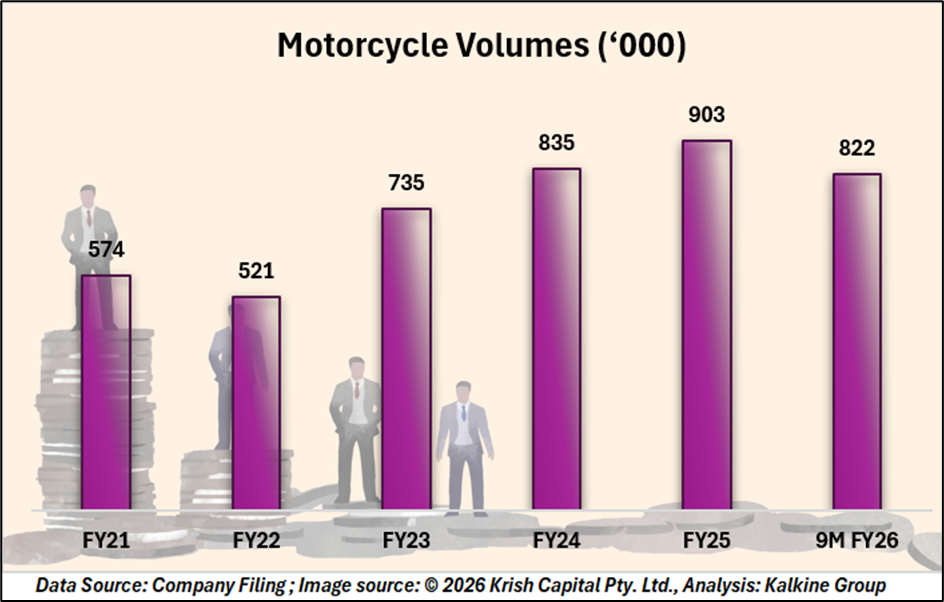

Royal Enfield motorcycles continued to drive EML’s growth, with sales reaching 325,773 units, up 21% from 269,039 units in Q3 FY24-25. Healthy domestic and international demand, along with a robust product pipeline and consistent engagement with the global riding community, contributed to this performance.

The quarter was highlighted by Royal Enfield’s 125-year milestone celebrations at EICMA 2025, featuring the unveiling of models including the Bullet 650, Flying Flea S6, Himalayan Mana Black, and Meteor 350 Sundowner.

VECV Achieves Best-Ever Q3 Performance

VE Commercial Vehicles Ltd (VECV) recorded sales of 26,086 vehicles, up 24% from 21,010 units in the prior year. Revenue rose 21% to ₹7,019 crores, EBITDA increased 26% to ₹652 crores, and PAT climbed to ₹338 crores from ₹299 crores. The results were driven by a post-monsoon recovery in the commercial vehicle industry, GST reforms, and festive-season demand.

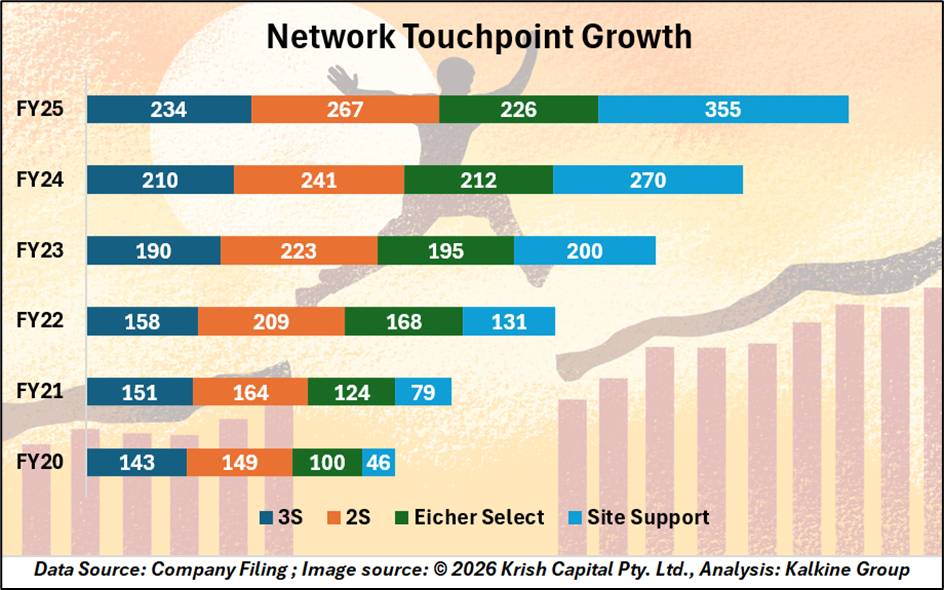

VECV continued to hold a leading position in the Light and Medium Duty (LMD) truck category, while also broadening its presence in the bus and heavy-duty truck segments.The company added 25 new service touchpoints during the quarter, enhancing customer reach and uptime support.

Royal Enfield to Expand Manufacturing Capacity

Eicher Motors’ Board approved a brownfield expansion at the Cheyyar manufacturing facility in Tamil Nadu, increasing Royal Enfield’s annual production capacity from 14.6 lakh to 20 lakh units over the next two years.

The expansion, estimated at ₹958 crores, will enable faster capacity ramp-up, cost-efficient operations, and the ability to meet growing domestic and global demand for Royal Enfield motorcycles.

Outlook: Sustained Growth and Global Leadership

With strong growth across motorcycles and commercial vehicles, combined with strategic capacity expansion, Eicher Motors is well-positioned to sustain its upward trajectory and reinforce its leadership in both India and international markets.

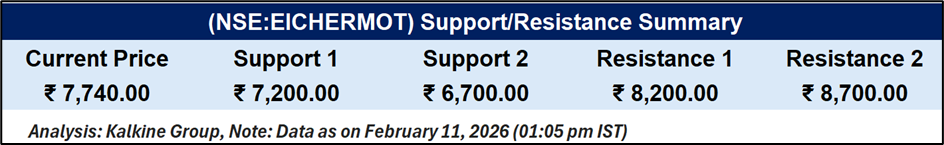

Technical Summary

Eicher Motors Limited rose 6.09% to ₹7,740.00, approaching the upper end of its recent consolidation range. The stock trades comfortably above its 50-day SMA at ₹7,238.34, maintaining a constructive structure with higher lows visible on the daily chart. The 14-day RSI at 68.22 reflects strengthening momentum, nearing elevated levels. Immediate support is seen around ₹7,200–₹6,700, while resistance is placed near ₹8,200–₹8,700. A sustained move above resistance could extend the upward structure.

Growth Engine Accelerates, Momentum Builds

Eicher Motors has delivered a standout quarter, backed by record earnings, surging Royal Enfield demand, and VECV’s best-ever Q3 performance. Strategic capacity expansion at Cheyyar further strengthens its long-term growth visibility.

Technically, the stock remains in a firm uptrend with improving momentum indicators. With strong fundamentals and positive price structure aligning, Eicher appears well-positioned to sustain its growth trajectory ahead.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.