From Rooftops to Hydropower: Tata Power’s Q3 Growth Story That Traders Shouldn’t Miss

Source: Shutterstock

Tata Power Company Limited (NSE:TATAPOWER) demonstrated a strong and diversified operational and financial performance in Q3 FY26. The performance highlights the company’s emphasis on renewable energy, T&D, manufacturing, and key energy initiatives, reinforcing its position as a leader in India’s shift toward clean energy.

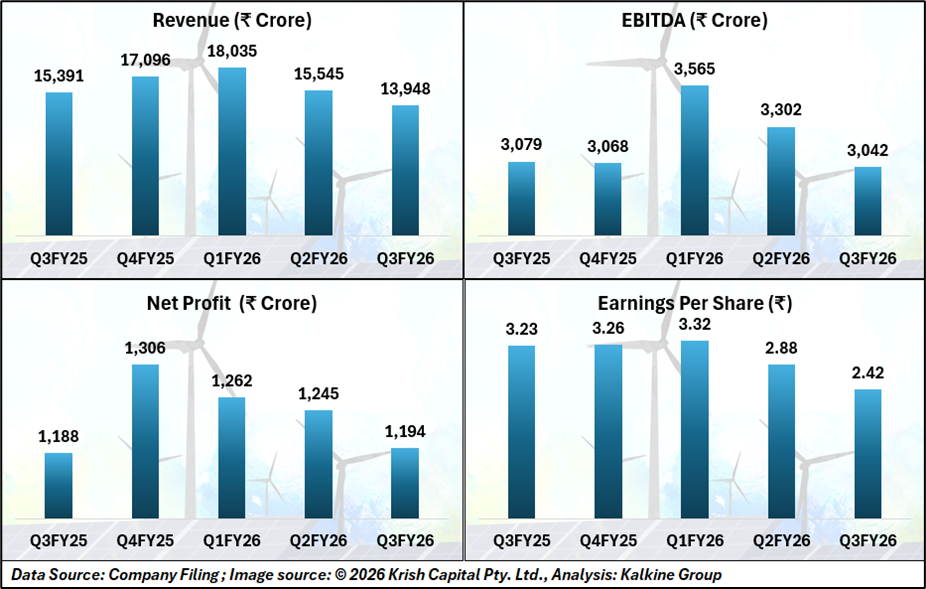

Financial Performance – Q3 and 9M FY26

In Q3 FY26, Tata Power reported a Profit After Tax (PAT) of ₹1,194 crore, marginally up from ₹1,188 crore in the same quarter last year. Consolidated Revenue from Operations for the quarter stood at ₹13,948.41 crore, while EBITDA rose 12% year-on-year to ₹3,042 crore, supported by operational efficiencies and stronger contributions from the renewable energy and distribution businesses.

Renewable Energy – Scaling Clean Power

Tata Power’s renewable energy (RE) business was a major growth driver. Q3 FY26 RE PAT surged 156% YoY to ₹547 crore, with EBITDA increasing 66% to ₹1,637 crore and revenue rising 78% to ₹3,785 crore. The company executed 919 MW of utility-scale renewable projects during the quarter, including 357 MW of in-house capacity.

TP Solar’s cell and module manufacturing plant achieved record production levels with 962 MW of cells and 990 MW of modules, achieving industry-leading plant yields of over 95%. The rooftop solar business also scaled rapidly, installing 372 MWp in Q3, contributing to a 1 GWp addition in 9M FY26 and expanding the customer base beyond 3 lakh with over 4 GWp installed capacity.

Transmission and Distribution – Strengthening Grid and Customer Base

The T&D segment showed robust performance, with Odisha DISCOMs reporting PAT growth of 163% YoY to ₹226 crore in Q3 and reductions in AT&C losses by 1.9%. Tata Power Delhi Distribution Limited (TPDDL) continued its steady PAT growth with strong operational metrics. The company commissioned key transmission lines, including the 400 kV Koteshwar–Rishikesh line, while securing Letters of Intent for projects such as the Jejuri-Hinjewadi 226 Ckm transmission project.

Strategic Hydro and Energy Storage Projects

Tata Power progressed its strategic energy storage and hydro projects. The Bhivpuri 1,000 MW Pumped Storage Project and Dorjilung 1,125 MW Hydro Power Project in Bhutan advanced as planned. The Dorjilung project received long-term financing approval from the World Bank, reinforcing Tata Power’s focus on firm, dispatchable renewable energy capacity and regional energy security.

Outlook

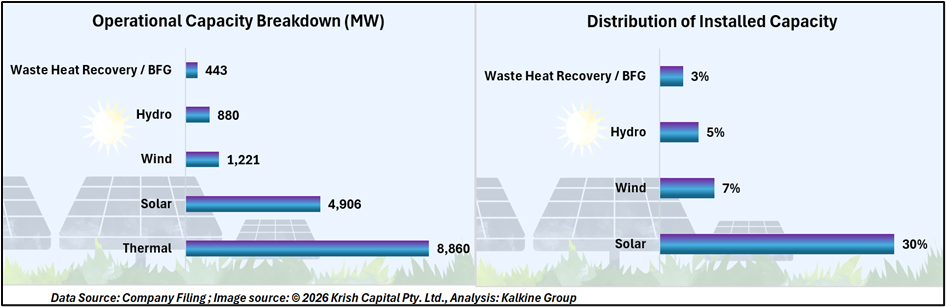

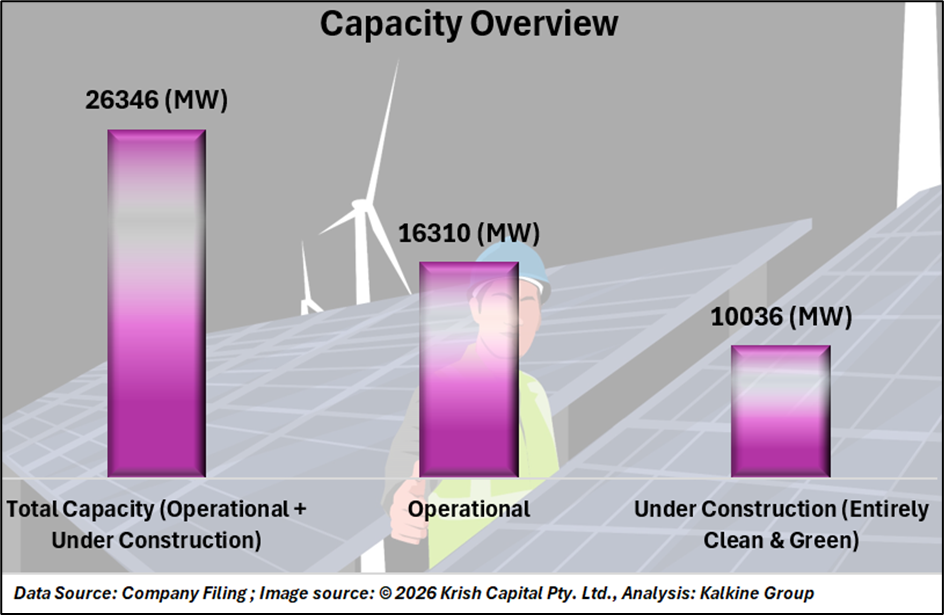

With an operational capacity of 16.3 GW and a total pipeline of 26.3 GW, Tata Power is well-positioned to leverage India’s growing energy demand, urbanization, and industrial expansion. Its integrated portfolio across renewables, thermal, T&D, and manufacturing, combined with strong ESG focus, positions the company for sustainable long-term growth in India’s evolving power sector.

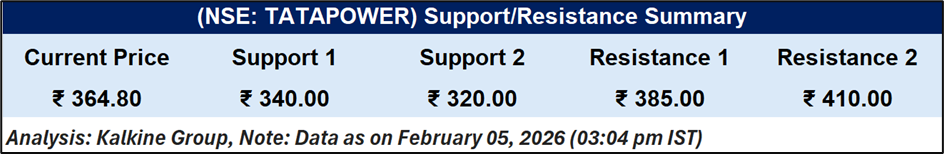

Technical Summary

Tata Power traded at ₹364.80, below its 51-day simple moving average (SMA) of ₹374.15. The stock recently rose from around ₹340, with the next support level near ₹320. Resistance levels are at ₹385 and ₹410. The Relative Strength Index (RSI) is 49.08. Daily trading volumes have been moderate, with occasional increases during earnings announcements.

Conclusion

Tata Power’s Q3 FY26 results reflect steady growth across renewable energy, transmission and distribution, and key energy initiatives, boosting both its revenue and profits. Strong execution in solar manufacturing, rooftop installations, and hydro projects underscores its leadership in India’s clean energy transition.

With a robust 16.3 GW operational capacity, a 26.3 GW pipeline, and disciplined financial management, the company is well-positioned for sustainable long-term growth amid rising energy demand and urbanization. Technical indicators suggest moderate short-term trading momentum.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.