From Scale to Strength: JFSL Posts Breakout Quarter Across Verticals

Source: shutterstock

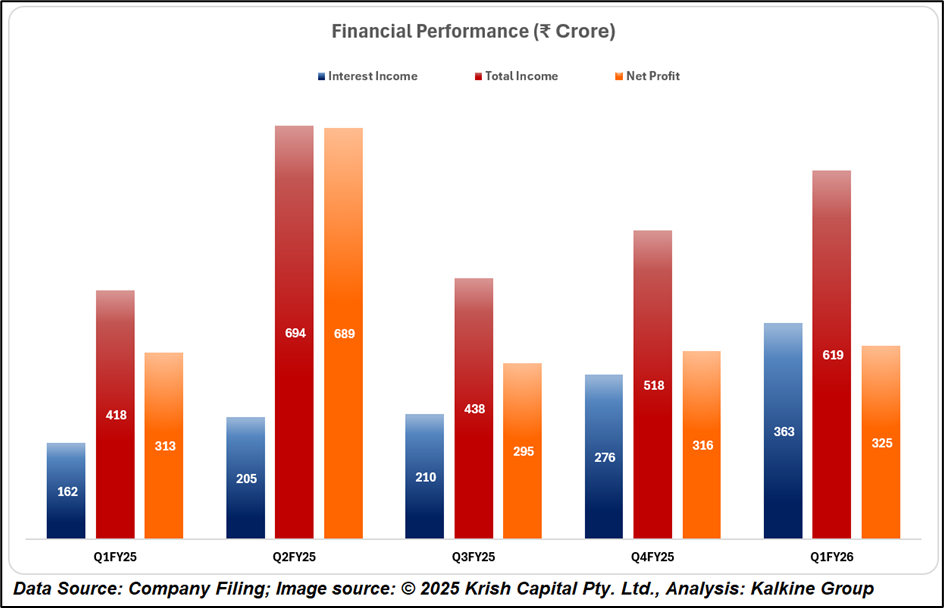

Jio Financial Services Limited (JFSL), a Reliance Group company, reported a robust set of results for Q1 FY26, underscoring its rapid progress in building a diversified, technology-led financial services platform. With consolidated total income rising 48% year-on-year to ₹619 crore and profit after tax reaching ₹325 crore, the quarter reflected strong traction across its lending, payments, asset management, and insurance verticals.

Diversified Business Mix Driving Financial Performance

JFSL’s revenue mix continues to shift toward core business income, which stood at ₹219 crore in Q1, up nearly four-fold from the previous year. This now accounts for ~40% of the company’s consolidated net total income, compared to just 12% in Q1 FY25. Pre-provisioning operating profit was ₹366 crore, growing 8% year-on-year. With a consolidated net worth of ₹1.4 lakh crore, the company retains significant financial flexibility to fund long-term growth.

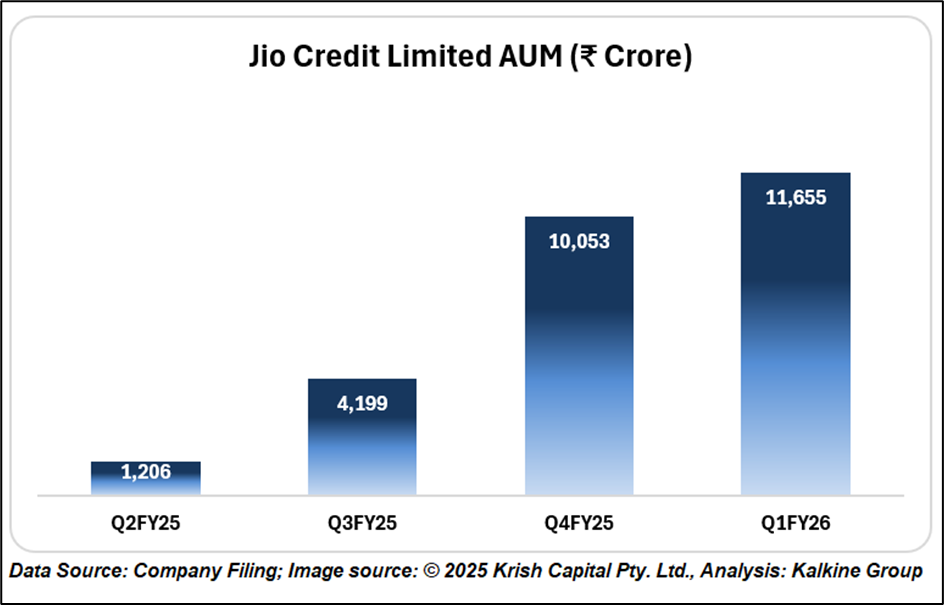

NBFC Arm Reports Exponential AUM Growth

Jio Credit Limited, the company’s non-banking finance subsidiary, reported an AUM of ₹11,665 crore, up from ₹217 crore in the year-ago quarter. This growth was led by secured lending products such as home loans, loan against property, and loan against mutual funds and shares. Corporate lending also gained scale. Net interest income rose 240% YoY to ₹118 crore, while PAT grew 24% to ₹45 crore. Jio Credit now operates in 11 cities, supported by a “AAA” rating from CARE and CRISIL.

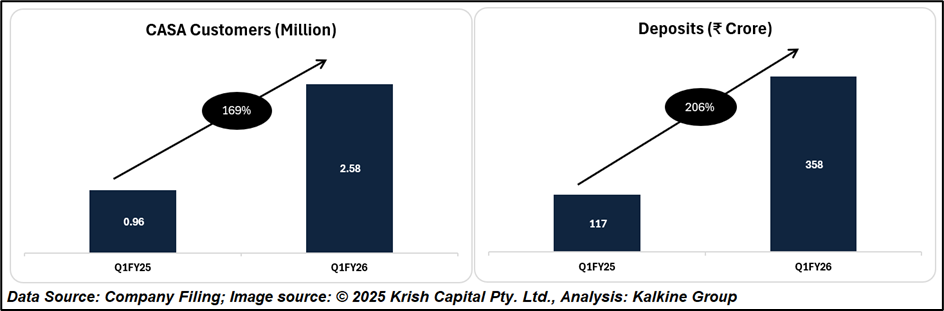

Payments Ecosystem Scaling Rapidly

The payments segment experienced robust growth in both banking and merchant services. Deposits at Jio Payments Bank reached ₹358 crore, representing a 206% year-on-year increase, while its business correspondent network expanded beyond 50,000 locations. Total Payment Volume (TPV) processed by Jio Payment Solutions climbed 93% year-on-year to ₹7,717 crore. This momentum was driven by innovations such as UPI-based offerings, a developer portal tailored for SMB integrations, and compliance with toll collection mandates. Additionally, the introduction of premium CASA accounts and wallet-linked products contributed to a broader revenue mix.

Asset Management JV Gains Investor Confidence

The Jio BlackRock joint venture posted an AUM of ₹17,876 crore after its successful maiden New Fund Offering, attracting over 67,000 retail and 90+ institutional investors. Regulatory approvals for five new index funds have been received, and broking operations are now licensed under the Jio BlackRock umbrella. The partnership leverages BlackRock’s Aladdin® platform to deliver scalable investment solutions.

Technical Summary

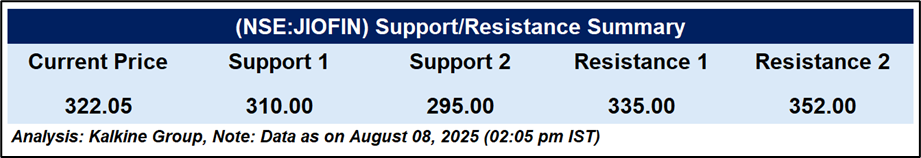

Jio Financial Services is currently trading at ₹322.05, down 1% on the day, after facing resistance near the downward sloping trendline around ₹335. The price remains above the 51-day EMA at ₹309.73, indicating short-term support is intact. RSI stands at 52.44, showing neutral momentum but with slight weakening from recent highs. A break above ₹335 could trigger further upside towards ₹352, while immediate support lies at ₹310, followed by stronger support at ₹295. Overall, the stock is consolidating just below resistance, with a breakout or breakdown likely to dictate the next directional move.

Conclusion

Jio Financial Services continues to strengthen its position as a tech-driven, diversified financial powerhouse. With strong fundamentals, growing business verticals, and a consolidating stock setup, JFSL is well-positioned for long-term value creation, though near-term price action hinges on a breakout above resistance or support validation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.