India’s sugar industry is experiencing a notable slowdown this season, with production now projected to remain in the high-20 million metric ton range, down from earlier forecasts of over 30 million tons. Excessive and irregular rainfall across major sugarcane-producing states has disrupted crop growth, affecting both yield and sugar recovery.

The reduced output has tightened domestic supply, providing upward support to sugar prices, while export prospects are now expected to fall short of government-set quotas.

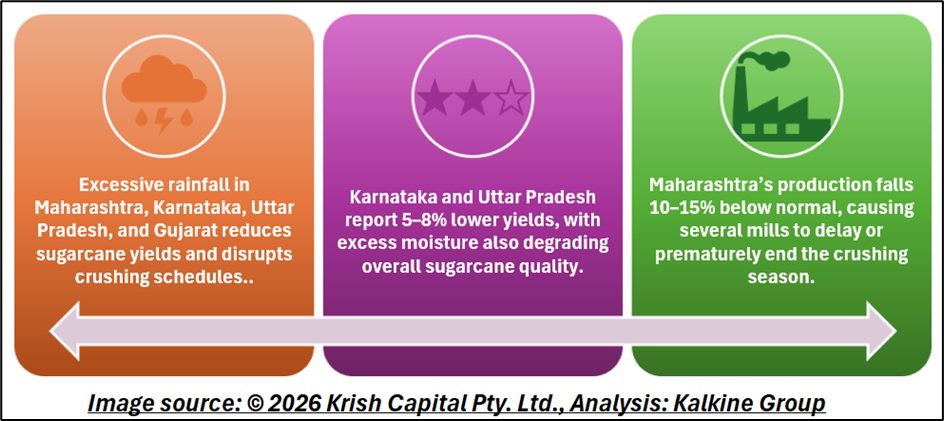

Weather Impacts Hit Cane Yields

Adverse weather has been the main driver of lower production this season. Maharashtra, Karnataka, Uttar Pradesh, and Gujarat experienced heavy and prolonged rainfall, which waterlogged fields, reduced cane weight, and lowered sugar recovery.

Maharashtra, the country’s largest sugar-producing state, yields are estimated 10–15% below normal, forcing several mills to delay crushing or close the season early due to insufficient cane. Karnataka and Uttar Pradesh reported moderate reductions of 5–8% in yield and recovery. Farmers also highlighted that excessive moisture affected the overall quality of sugarcane, further impacting sugar output.

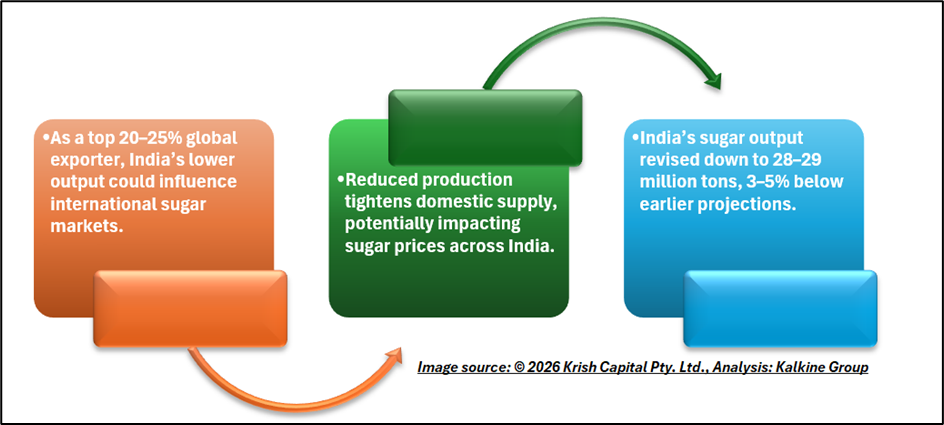

Production Estimates Revised Downward

Earlier projections expected India’s sugar production to cross 30 million metric tons. However, updated assessments suggest output may now remain closer to 28–29 million tons, representing a reduction of approximately 3–5% from initial forecasts. This shortfall is significant because India contributes 20–25% of global sugar exports, meaning even moderate declines can influence both domestic inventories and international prices.

Export Quotas and Domestic Prioritization

Initially, authorities allowed sugar mills to export up to 6 million tons this season. With lower production, mills are prioritizing domestic sales, and actual exports are now expected to reach only about 3 million tons, roughly half the permitted quota. Domestic sugar prices have strengthened by 4–6% due to tighter supply, encouraging producers to retain buffer stocks rather than committing to overseas contracts.

Domestic Prices Strengthen

The combination of lower production and steady domestic demand has provided strong support to sugar prices. With summer consumption increasing, mills have gained leverage in negotiating prices. This benefits producers and farmers, but food and beverage manufacturers may see input costs rise. The current supply-demand scenario has pushed local prices 5–8% higher than last year, reflecting tighter availability and seasonal demand.

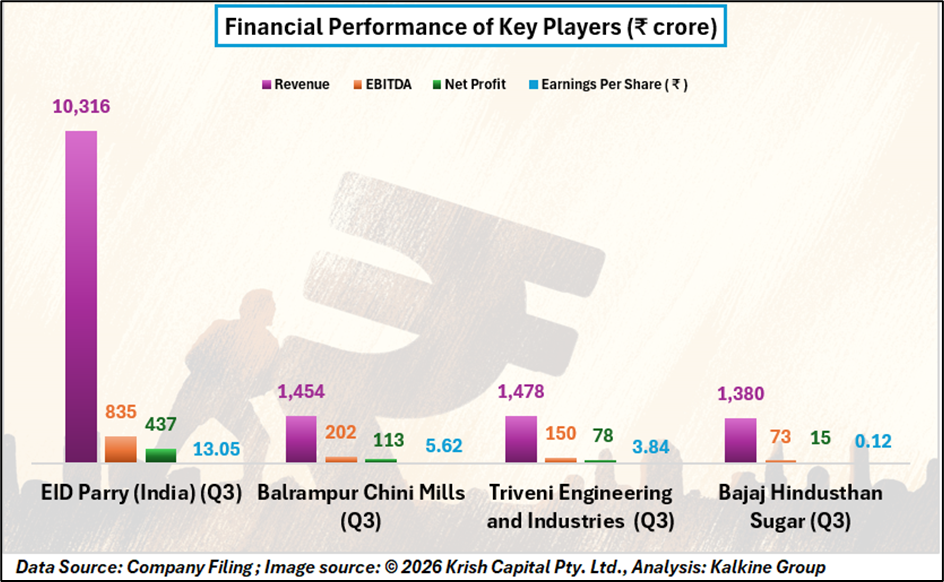

Performance of Major Sugar Companies

The sector’s current challenges are reflected in the financial performance of key players in Q3:

- EID Parry (India): Revenue of ₹10,316 crore, EBITDA of ₹835 crore, net profit of ₹437 crore, earnings per share ₹13.05.

- Balrampur Chini Mills: Revenue of ₹1,454 crore, EBITDA ₹202 crore, net profit ₹113 crore, earnings per share ₹5.62.

- Triveni Engineering and Industries: Revenue ₹1,478 crore, EBITDA ₹150 crore, net profit ₹78 crore, earnings per share ₹3.84.

- Bajaj Hindusthan Sugar: Revenue ₹1,380 crore, EBITDA ₹73 crore, net profit ₹15 crore, earnings per share ₹0.12.

Global Market Implications

India’s revised production estimate has already impacted international sugar markets. As one of the world’s largest producers and exporters, India’s output influences global prices, which had been under pressure. Traders are closely watching weather trends and crushing operations in the remaining season. Any further reduction in production could influence international sugar prices by 2–3%, highlighting India’s importance to global supply.

Conclusion

India’s sugar sector is navigating a challenging season, with production falling to 28–29 million tons due to excessive rainfall and lower cane yields. Domestic prices have strengthened 4–8%, while export volumes are expected to remain below quota. Key sugar companies show mixed financial results, reflecting the impact of tighter supply. Looking ahead, the industry must balance domestic demand, limited exports, and price stability. While late-season recovery may offer some relief, a significantly larger crop appears unlikely this year.