Is Bharti Airtel’s Q3 FY26 Growth Story Built on Premiumization and Africa Outperformance?

Source: shutterstock

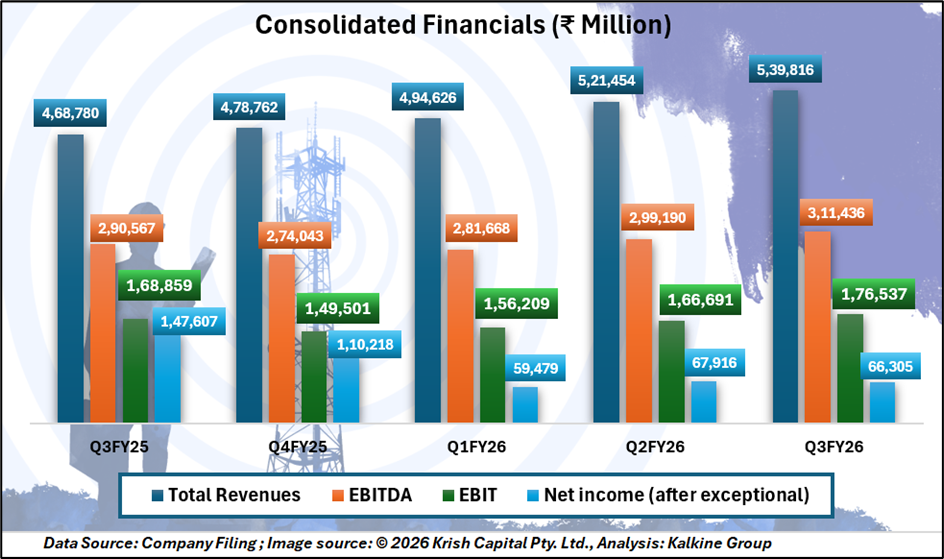

Bharti Airtel Limited delivered an impressive financial performance in Q3 FY26, highlighting the strength of its diversified business model and disciplined execution. For the quarter ended December 31, 2025, consolidated revenues rose 19.6% year-on-year to ₹53,982 crore, supported by steady growth in India and an outstanding showing in Africa. Sequential revenue growth stood at 3.5%.

Consolidated EBITDA increased 25.2% YoY to ₹31,144 crore, with margins expanding to a strong 57.7%, reflecting operating leverage and cost efficiencies. EBITDA after lease grew 29% YoY to ₹27,705 crore, while EBIT surged 34.5% YoY to ₹17,654 crore. Net income before exceptional items reached ₹6,920 crore, underlining improved profitability.

India Business: Premium Customers Drive Momentum

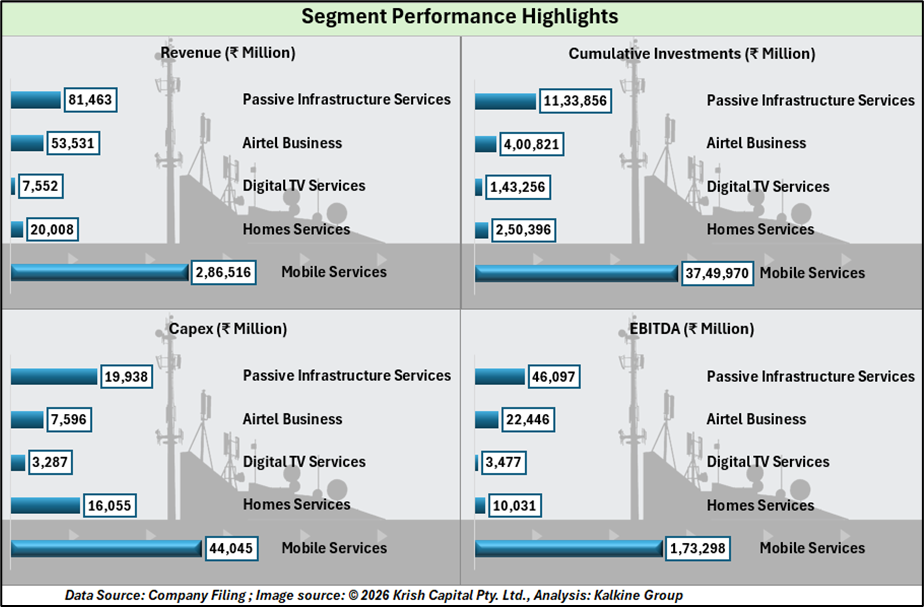

Airtel’s India operations continued to benefit from premiumisation, with revenues rising 13.2% YoY to ₹39,226 crore. India EBITDA grew 19.3% YoY to ₹23,676 crore, with margins improving to 60.4%.

India Mobile revenues increased 9.1% YoY, driven by ARPU expansion and higher-value subscribers. Mobile ARPU improved to ₹259 from ₹245 last year. Smartphone data customers rose by 20.8 million YoY, forming nearly 79% of the mobile base, while data usage climbed 29.2% YoY to 29.8 GB per user per month. Postpaid additions remained strong at 0.62 million, taking the base to 28.1 million.

Steady Subscriber Growth and Network Expansion

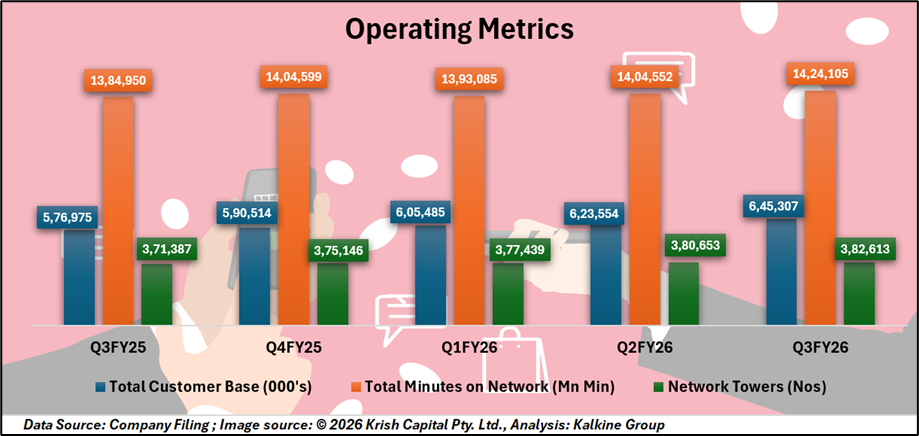

Bharti Airtel’s operating metrics show consistent expansion over the past five quarters, reflecting sustained network scale-up and rising customer engagement. The total customer base increased steadily from 576.9 million in Q3 FY25 to 645.3 million in Q3 FY26, highlighting continued subscriber additions across segments.

Total minutes on the network also trended upward, rising from 1,384,950 million minutes to 1,424,105 million minutes over the same period, indicating stable usage demand and improving network stickiness.

Supporting this growth, Airtel continued to strengthen its infrastructure, with the number of network towers expanding from 371,387 to 382,613, reinforcing coverage quality and capacity to handle higher traffic volumes.

Homes, Business & Digital Services Stay Resilient

The Homes segment delivered standout growth, with revenues up 32.6% YoY and record net additions of 1.16 million customers, lifting the base to 13.1 million. Airtel Business saw steady sequential growth, supported by demand in cloud, cybersecurity, IoT, and digital services, alongside key partnerships and contract wins. Digital TV revenues stood at ₹755 crore, supported by growing IPTV adoption.

Africa Outperformance and Balance Sheet Strength

Airtel Africa reported strong constant currency revenue growth of 24.7% YoY, with EBITDA margins expanding to 49.3%. The balance sheet continued to strengthen, with net debt-to-EBITDA improving to 1.47x, reflecting robust cash flows and sustained deleveraging.

Technical Summary

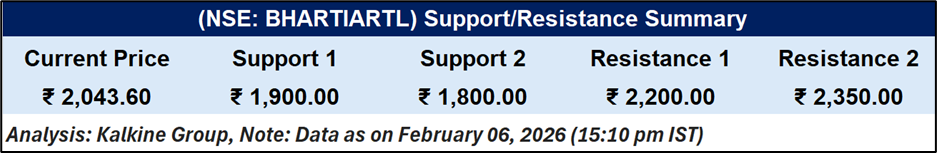

Bharti Airtel traded at ₹2,043.60, with the price remaining above the key support levels identified on the chart. The first support is placed near ₹1,900, followed by the next support around ₹1,800, which marks a lower reference level during pullbacks.

On the upside, the stock has resistance near ₹2,200, while the next resistance level is seen around ₹2,350. These levels outline the current trading range and highlight the price zones that may influence near-term price movement.

Conclusion: Balanced Growth Story

Bharti Airtel’s Q3 FY26 performance reflects strong execution across India and Africa. Premiumisation, rising ARPU, and robust Homes growth continue to lift margins, while Africa adds a high-growth edge. Improved leverage and cash flows strengthen the balance sheet, positioning Airtel well for sustained, long-term growth.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.