No Rate Cut, No Hike—What’s Behind RBI’s Confidence in India’s Economy?

Source: shutterstock

The Reserve Bank of India decided to keep the policy repo rate unchanged at 5.25% after the Monetary Policy Committee’s meeting held between February 4 and 6, 2026. The standing deposit facility rate continues at 5.00%, while both the marginal standing facility rate and the Bank Rate remain at 5.50%. The MPC also maintained its neutral policy stance, highlighting a balance between growth prospects and inflation risks.

The decision comes amid elevated geopolitical tensions and rising trade uncertainties globally. Despite these headwinds, the Indian economy continues to operate with steady growth momentum and inflation below the tolerance band.

Growth Outlook Holds Steady

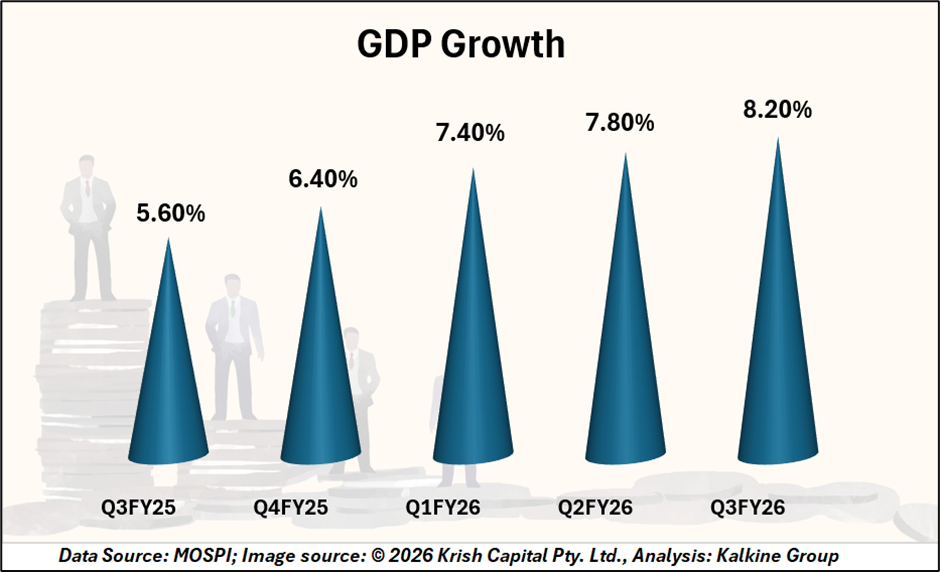

According to the First Advance Estimates, real GDP growth for FY26 is projected at 7.4%, supported by private consumption and fixed investment. Services sector output and manufacturing activity contributed to the supply-side expansion, while net exports remained a drag due to higher imports.

Looking ahead, the RBI expects economic activity to remain stable in FY27. Agricultural output is supported by healthy reservoir levels and improved crop conditions, while manufacturing activity is expected to benefit from improving corporate performance and sustained informal sector momentum. Services activity remains resilient, aided by domestic demand and improving performance in IT services.

GDP growth projections for Q1 and Q2 FY27 have been revised upward to 6.9% and 7.0%, respectively. Full-year projections will be released in April following the introduction of the new GDP series.

Inflation Remains Within Comfort Zone

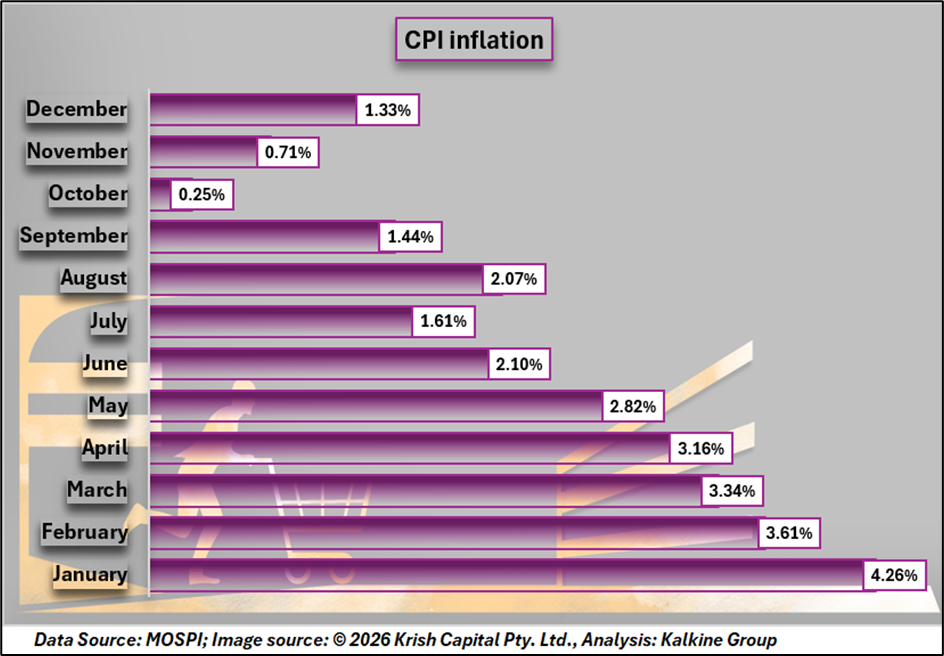

The RBI now projects CPI inflation at 2.1% for FY26, with Q4 inflation estimated at 3.2%. For FY27, inflation in Q1 and Q2 is projected at 4.0% and 4.2%, respectively. The upward revision reflects higher precious metal prices, while underlying inflation pressures remain muted.

Liquidity, External Sector, and Financial Stability

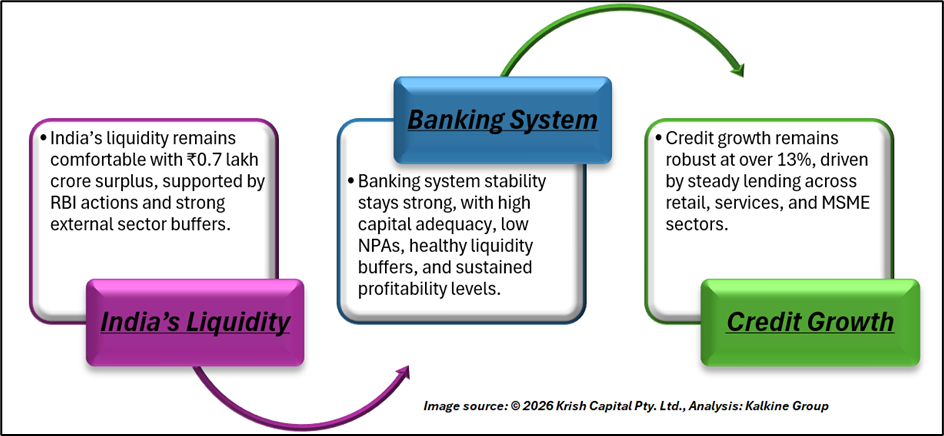

India’s liquidity conditions remain comfortable, with system liquidity in surplus at an average of ₹0.7 lakh crore, supported by the RBI’s open market operations and forex swaps. The external sector remains manageable, backed by strong services exports and inward remittances, while foreign exchange reserves stood at USD 723.8 billion, covering over 11 months of imports.

The banking system continues to remain resilient, with the CRAR at 17.24%, GNPA ratio at 2.05%, and Net NPA at a low 0.47%. Liquidity buffers remain strong with an LCR of 131.68%, while profitability stays healthy with RoA at 1.32% and RoE at 13.06%. Credit growth remains robust, with overall credit rising 13.8% year-on-year and bank credit growing 13.1%, driven by retail, services, and MSME lending.

Balanced Policy Anchors Growth and Stability

The RBI’s decision to maintain the policy rate and a neutral stance reflects confidence in India’s strong macroeconomic fundamentals despite global geopolitical and trade-related uncertainties.

Steady growth prospects, supported by consumption, investment, and resilient services activity, continue to underpin economic momentum. Inflation remains well within the tolerance band, aided by muted core pressures.

Comfortable liquidity, strong foreign exchange reserves, and a resilient, well-capitalised banking system with healthy credit growth further strengthen financial stability, keeping the overall outlook for FY26 and FY27 positive and well balanced.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.