Ramkrishna Forgings: Order Momentum and Global Foray Support Long-Term Growth Amid Margin Headwinds

Source: shutterstock

Ramkrishna Forgings Limited, one of India’s largest forging companies, delivered a stable financial performance in Q1FY26, reflecting sustained demand across automotive and non-automotive segments, continued export momentum, and a firm strategic outlook despite profitability compression.

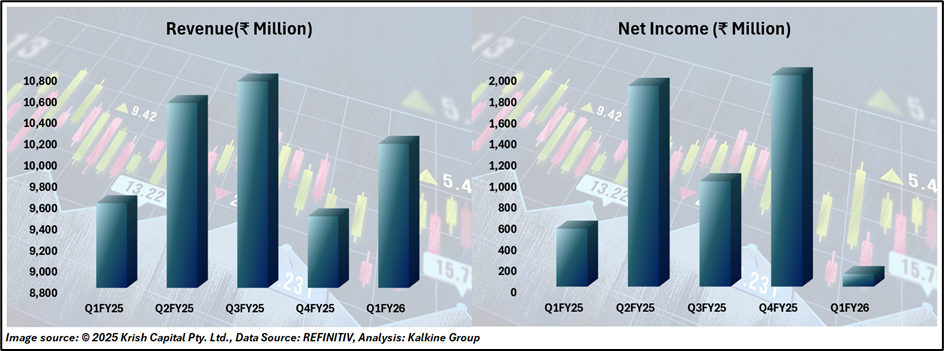

Financial Performance

In Q1FY26, Ramkrishna Forgings reported consolidated revenue of ₹ 1,01,526 lakh, marking a 6% sequential growth from ₹ 95,948 lakh in Q1FY25. This uptick was primarily driven by a healthy order pipeline and robust execution across geographies. However, EBITDA declined to ₹ 14,861 lakh from ₹ 16,906 lakh a year ago, leading to a contraction in the EBITDA margin from 14.6% to 17.6%, largely due to higher raw material costs and commissioning-related expenses.

PAT for the quarter stood at ₹ 1,179 lakh, down 78% YoY from ₹ 5,473 lakh in Q1FY25, impacted by lower operational leverage and absence of exceptional gains recorded in prior periods. PAT margin compressed to 1.2% from 5.7%.

For the full year FY25, Ramkrishna reported revenue of ₹ 4,03,411 lakh, a 9% YoY increase. FY25 PAT came in at ₹ 41,503 lakh (10.3% margin), including ₹8,150 lakh from exceptional items, compared to ₹ 29,121 lakh (7.9% margin) in FY24.

Business Updates

Ramkrishna Forgings secured ₹660 crore in new orders during Q1FY26, including ₹502 crore in exports to North American and European PV/CV markets. Domestic orders stood at ₹158 crore, ₹99 crore from off-highway and ₹59 crore from CVs. It also received ₹23 crore in railway orders.

Notably, the company’s JV with Titagarh Rail Systems won a ₹2,000 crore contract to supply 228,000 forged wheels annually to Indian Railways. With a 51% stake, Ramkrishna leads the project. The Chennai-based facility, set to be Asia’s second largest, is expected to begin operations by January 2026. As of June 2025, ₹370 crore has been invested into the venture.

Company Outlook

Ramkrishna Forgings continues to strengthen its global presence with the launch of its Mexico subsidiary, where machining operations have begun and orders secured from a North American customer. This aligns with its strategy to integrate deeper into global automotive supply chains.

On the growth front, the company is scaling up its forging capacity to 333,400 MTPA and casting capacity to 62,400 MTPA. It is also diversifying into non-automotive and EV segments while exploring inorganic growth opportunities for technological and geographic expansion.

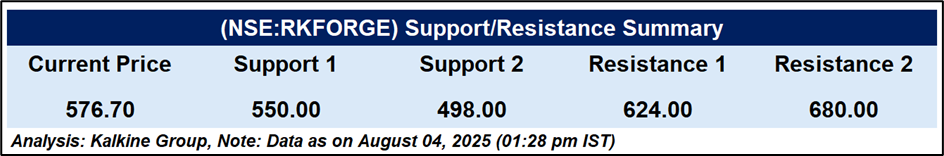

Technical Analysis

RKFORGE is trading at ₹576.70, below its 51-day EMA of ₹637.29, showing continued bearish momentum. It’s forming lower highs and lows, with RSI at 31.15 near oversold levels, hinting at a possible short-term bounce. Support lies at ₹550; a break could take it to ₹498. On the upside, a move above ₹624 may trigger a rally toward ₹680. While the stock saw a modest recovery today, sustained gains above ₹600 are essential to confirm any trend reversal.

Conclusion

Despite near-term technical weakness and margin pressure, Ramkrishna Forgings remains fundamentally strong with robust order inflows, global expansion, and strategic diversification. Its leadership in high-value rail projects and presence in key export markets position it well for long-term growth, provided technical recovery aligns with improving operational execution and financial stability.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.