Reliance Power Resets Strategy with New BOM Amid Rising Renewable Focus

Source: shutterstock

Reliance Power Ltd. (NSE:RPOWER) has approved the formation of a Board of Management (BOM) aimed at strengthening governance and strategic oversight. The new BOM will comprise the CEO, Key Managerial Personnel, and senior business leaders, reflecting the company’s commitment to enhanced decision-making, operational efficiency, and long-term value creation.

Governance and Strategic Oversight

The newly formed BOM is designed to ensure effective governance and agile decision-making across Reliance Power’s operations. By involving senior business leaders alongside the CEO and KMPs, the company aims to strengthen execution capabilities, especially as it scales renewable energy projects alongside conventional power generation. This structural enhancement is expected to improve strategic alignment and accelerate growth initiatives.

Financial Performance

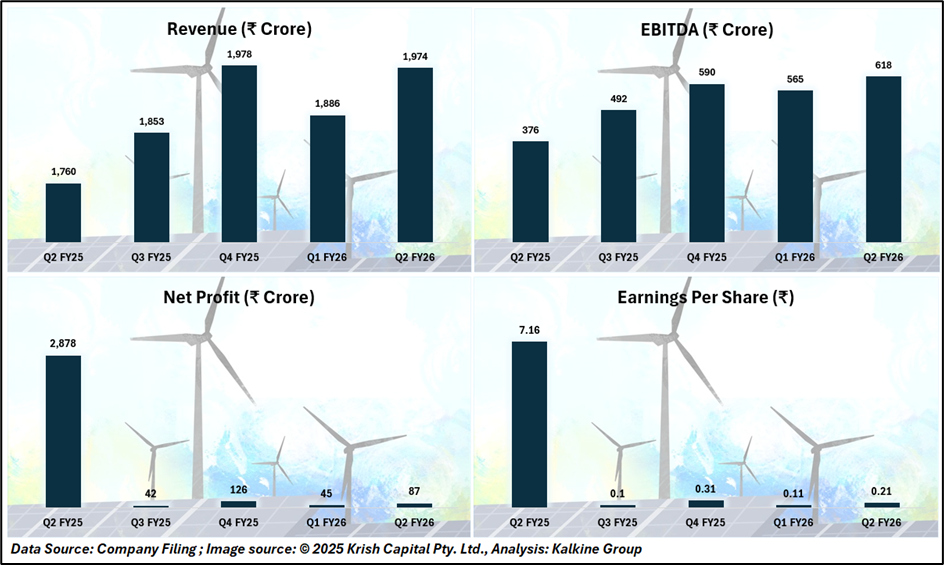

In Q2 FY26, Reliance Power reported revenue of ₹1,974 crore, marking a 12.2% growth compared to Q2 FY25 and a sequential rise from ₹1,886 crore in Q1 FY26. The company managed expenses at ₹1,356 crore, supporting an EBITDA of ₹618 crore with a margin of 31%, reflecting sustained operational efficiency. Net profit for the quarter stood at ₹87 crore, a sequential improvement from ₹45 crore in Q1 FY26, translating into an EPS of ₹0.21.

Operational Performance and Capacity

Reliance Power operates with a total installed capacity of 5,305 MW, including 3,960 MW from its Sasan Power unit. The company is actively expanding into renewable energy, focusing on solar and battery energy storage systems. The robust Q2 FY26 performance demonstrates operational resilience, supporting the company’s objective of balancing conventional and renewable power capacities while maintaining strong margins.

Technical Analysis

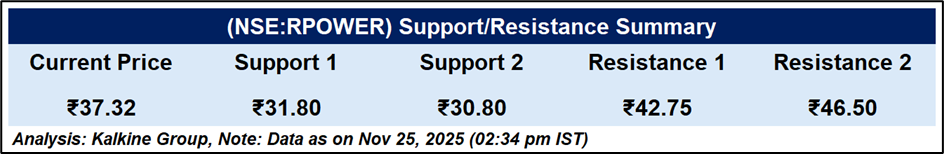

Reliance Power trades near key support at ₹34, with sustained weakness below the 50-day EMA. Momentum is bearish as RSI stays near oversold levels. Price remains in a declining trend, and a break below ₹33 may trigger further downside, while holding above this zone could prompt a short-term bounce.

Conclusion

Reliance Power’s formation of a Board of Management, steady financial recovery, and strategic push into renewables support long-term stability. While operational performance remains strong, the stock’s technical setup signals caution near key support. Sustained strength above ₹34 is crucial for sentiment to improve and unlock meaningful upside prospects.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.