Trent’s Q3 Prints Stability, But Is a Bigger Story Brewing?

Source: Shutterstock

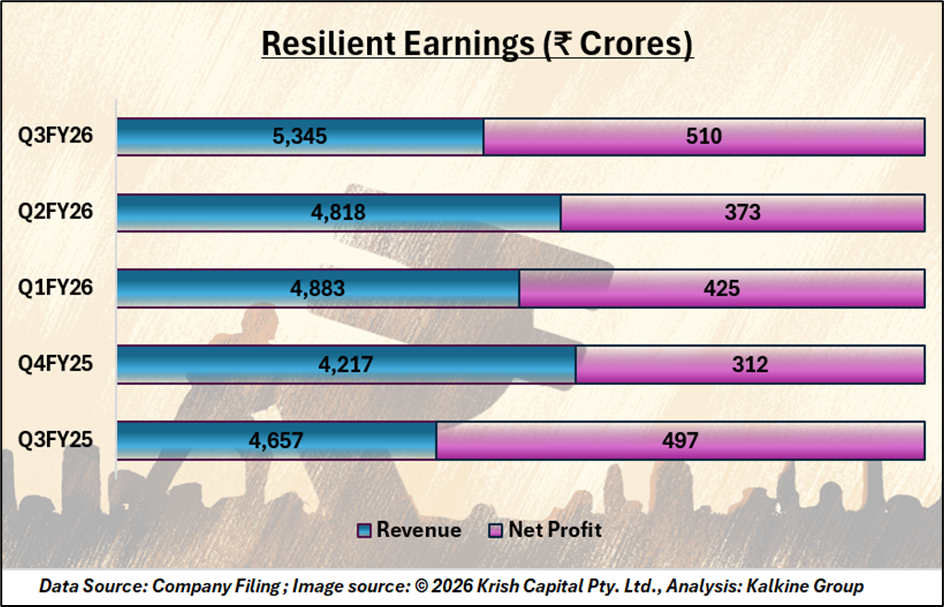

Trent Limited delivered a steady operating performance in Q3 FY26, with standalone revenue rising 16% year-on-year to ₹5,259 crore and consolidated revenue increasing 15% to ₹5,345 crore, despite an early festive season and softer consumer sentiment. Operating efficiency improved, with standalone EBIT up 21% to ₹727 crore and margins expanding to 13.8%, while consolidated EBIT rose 20% to ₹734 crore. Standalone profit after tax jumped 36% to ₹640 crore, supported by operating leverage, scale benefits, and disciplined cost optimisation.

Portfolio Diversification Gains Traction Beyond Core Apparel

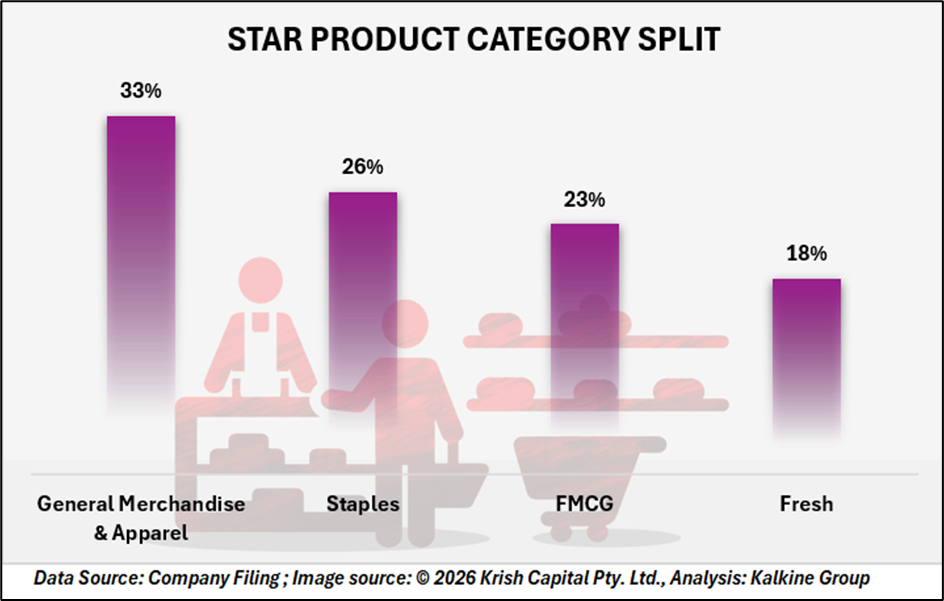

While like-for-like growth in the fashion portfolio was marginally negative during the quarter due to festive calendar shifts, performance over the nine-month period showed low single-digit growth. Emerging categories such as beauty, personal care, innerwear, and footwear now contribute over 21% of total revenues, supporting diversification across consumption segments.

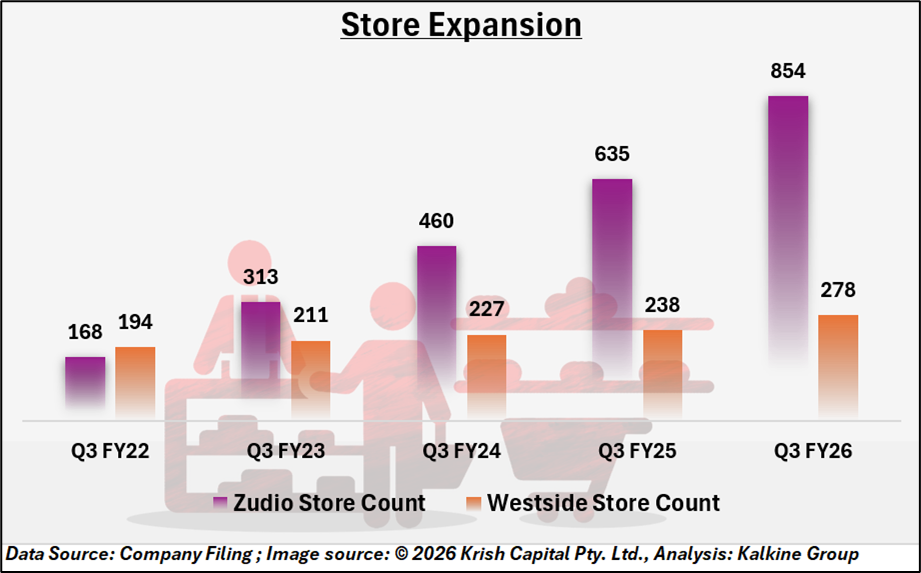

Store Expansion Accelerates Across Tier I, II and Emerging Markets

Trent continued to expand its physical retail footprint at a steady pace. During Q3 FY26, the company opened 65 fashion stores, including 17 Westside and 48 Zudio outlets, with one Zudio store added in the UAE. As of 31 December 2025, Trent operated 1,164 stores across 274 cities, covering a retail area of approximately 15.8 million square feet. Zudio remained the primary growth driver, with a majority of new stores launched in Tier II and Tier III cities.

Digital Channels and Technology Investments Support Efficiency

Trent’s online business continued to scale, with Westside’s digital revenues rising 38% year-on-year and contributing over 6% of brand revenues. Investments in automation, RFID-enabled supply chains, and technology-led processes supported productivity gains and helped maintain stable operating economics.

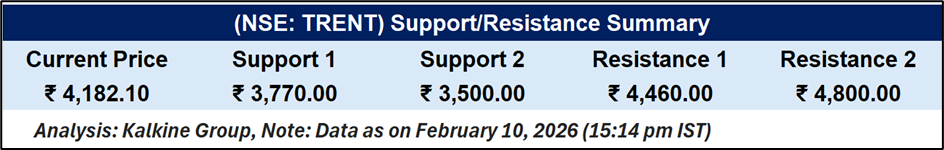

Technical summary

Trent traded at ₹4,182.10, between identified support and resistance levels. Support is located near ₹3,770, with an additional level around ₹3,500. Resistance is observed at ₹4,460, followed by another level near ₹4,800. The price is currently within this range, and movement may remain confined between these levels unless there is a clear shift above resistance or below support.

Steady Growth Anchored by Scale, Diversification and Execution

Trent Limited delivered a resilient Q3 FY26 performance, balancing revenue growth with margin expansion despite a challenging consumption environment. Strong operating leverage, disciplined cost control, and rapid store expansion—led by Zudio—supported earnings momentum. Portfolio diversification beyond core apparel and rising digital penetration are strengthening long-term growth drivers. With a robust physical footprint, improving efficiencies, and stable technical positioning, Trent remains well-placed to sustain steady growth, even as near-term stock movement may stay range-bound.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.