Vedanta Soars After Demerger Green Light- Is This Just the Beginning?

Source: shutterstock

Vedanta Limited’s shares moved higher after the National Company Law Tribunal approved the company’s demerger proposal, lifting market sentiment. The stock touched a new record high of ₹580.45, reflecting investor expectations of value creation and sharper operational focus following the restructuring.

The NCLT’s approval clears the way for Vedanta to separate into five distinct entities spanning aluminium, oil and gas, ferrous, power, and steel businesses. This clearance follows earlier concerns raised by the government in August regarding the timing of the demerger in relation to the recovery of outstanding dues.

The approval marks a key step in Vedanta’s broader restructuring strategy, aimed at creating focused, independently managed companies with clearer strategic direction. Each entity will operate with its own capital structure, enabling more disciplined allocation of resources and sector-specific decision-making. Management indicated that the sanction allows the company to proceed with implementation, supporting its long-term operational and growth objectives.

Financial Performance Overview

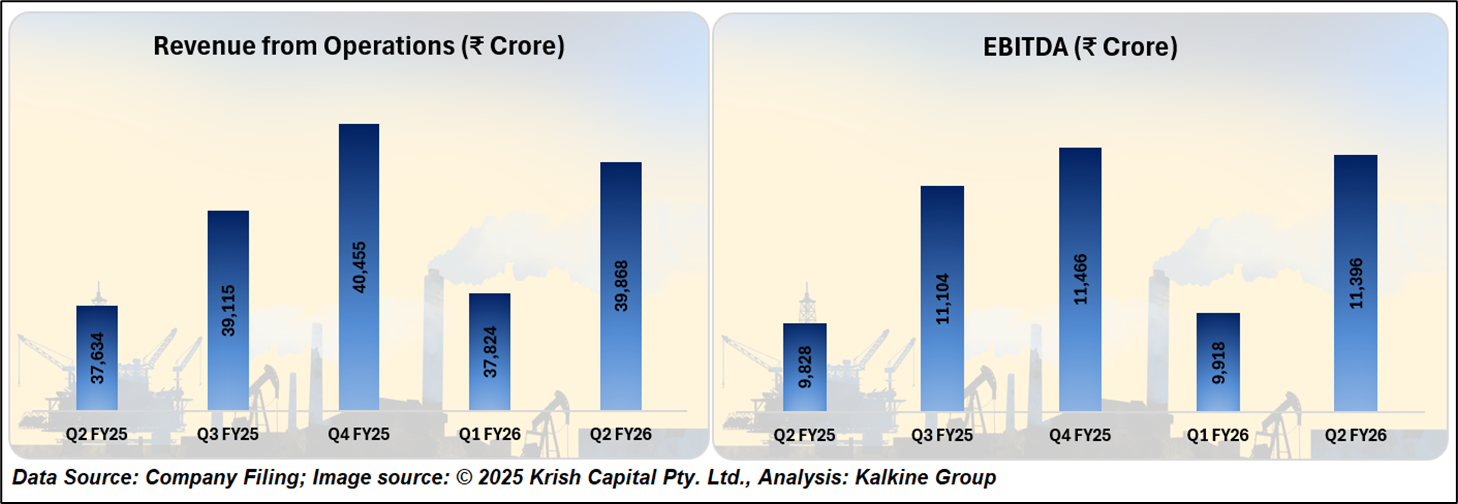

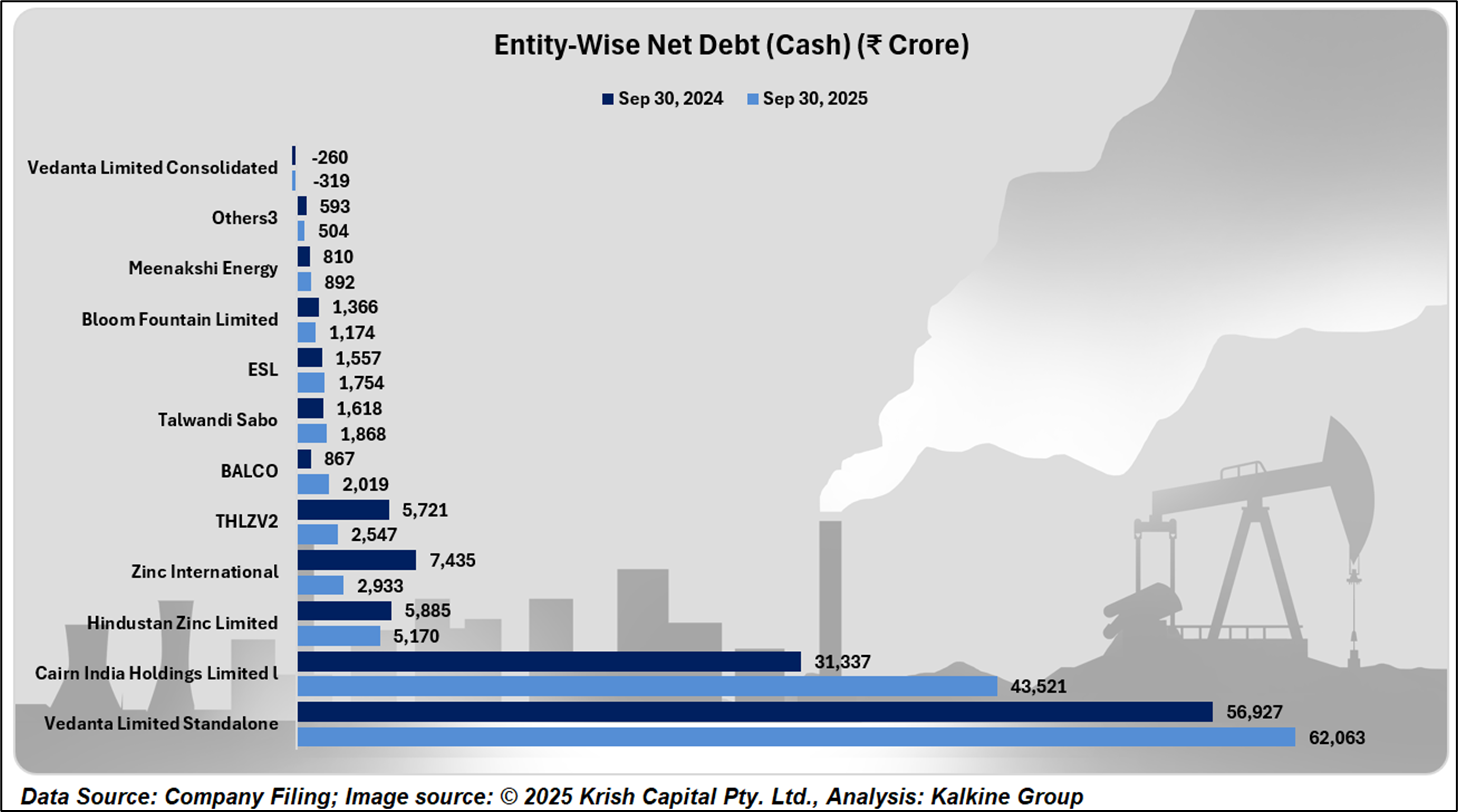

Vedanta Limited delivered a strong Q2FY26 performance, reporting record quarterly revenue of ₹39,218 crore, up 6% YoY, supported by improved commodity prices, premiums and forex gains. EBITDA rose 12% YoY to ₹11,612 crore, with margins at 34%. Profit before exceptional items increased 13% YoY to ₹5,026 crore, while net debt-to-EBITDA improved to 1.37x, reflecting disciplined capital management and deleveraging.

Technical Analysis

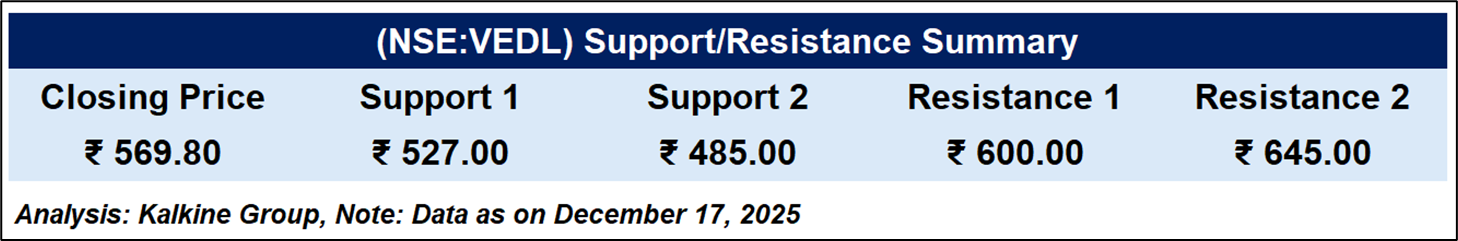

Vedanta Limited continues to trade in a well-defined uptrend, holding firmly above its 50-day EMA near 511, which reinforces the medium-term bullish structure. The breakout to a fresh all-time high reflects strong momentum supported by rising volumes. The RSI around 72 indicates elevated momentum, suggesting near-term consolidation, while support is seen near 527–485.

Conclusion

The NCLT’s approval of Vedanta’s demerger marks a pivotal step in its transformation into a set of focused, sector-specific companies, easing earlier regulatory overhangs and strengthening strategic clarity. While recent financials show pressure on net profit and earnings, improving revenues and operational momentum indicate underlying business resilience. Strong investor response, reflected in the stock’s rally, heavy volumes, and robust valuation metrics, underscores market confidence that the restructuring could unlock long-term value despite near-term earnings volatility.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2026 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.