FMCG Under Pressure as FIIs Exit ₹6,128 Cr

Source: shutterstock

Foreign institutional investors (FIIs) stayed careful in the Indian stock market during the first half of January, according to NSDL data. The numbers show that FIIs sold shares in many big sectors, mainly those linked to daily consumption and services. At the same time, they invested money in a few selected sectors, which created a mixed trend across the market. Overall, the data suggests that FIIs are moving money from one sector to another instead of buying the market.

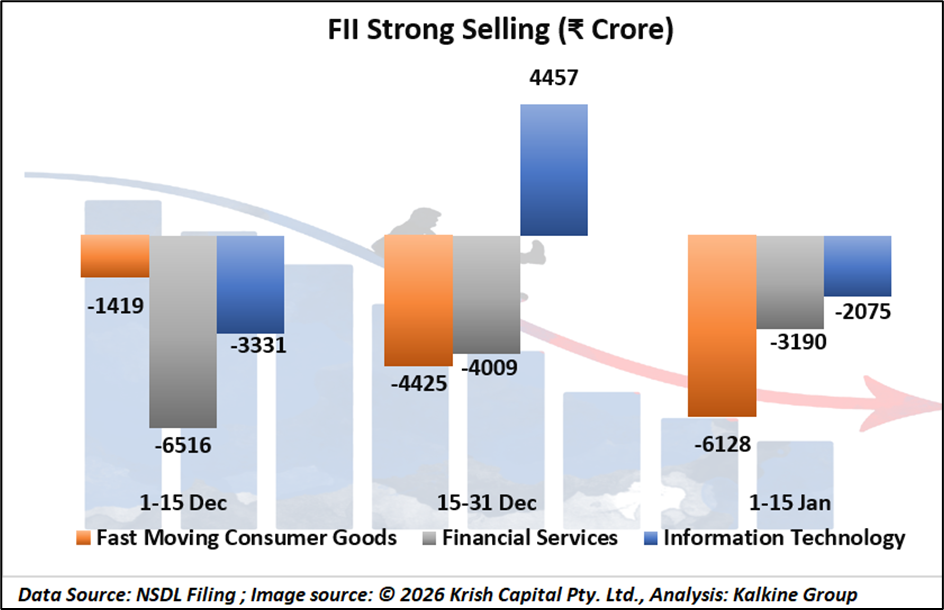

FMCG, Financials and IT See Strong Selling

FMCG stocks saw the maximum selling during January 1–15. FIIs sold FMCG shares worth ₹6,128 crore in this period, adding to the selling seen in both halves of December. This shows that FIIs have been slowly cutting their exposure to consumer goods companies. Financial services also stayed under pressure, with FIIs selling ₹3,190 crore worth of shares in early January, after heavy selling in December. The IT sector also turned weak again, as FIIs sold ₹2,075 crore in the first half of January, after buying some IT stocks in late December.

Services, Healthcare and Realty Remain Weak

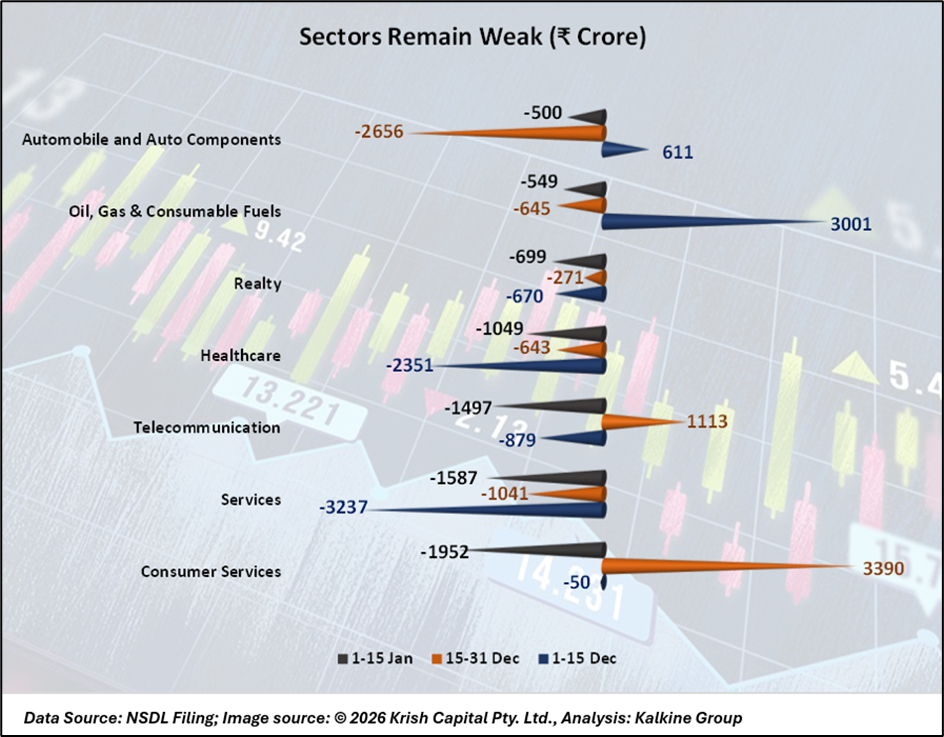

Selling was not limited to just three sectors. Consumer services saw outflows of ₹1,952 crore in early January. The broader services sector also faced selling of ₹1,587 crore during the same period. Telecom stocks saw FIIs sell ₹1,497 crore, giving up the buying seen earlier.

Healthcare stocks continued to see selling, with outflows of ₹1,049 crore, while realty stocks also remained under pressure with ₹699 crore worth of selling. Oil, gas and consumable fuels saw mild selling of ₹549 crore, and automobile and auto components stocks recorded outflows of ₹500 crore.

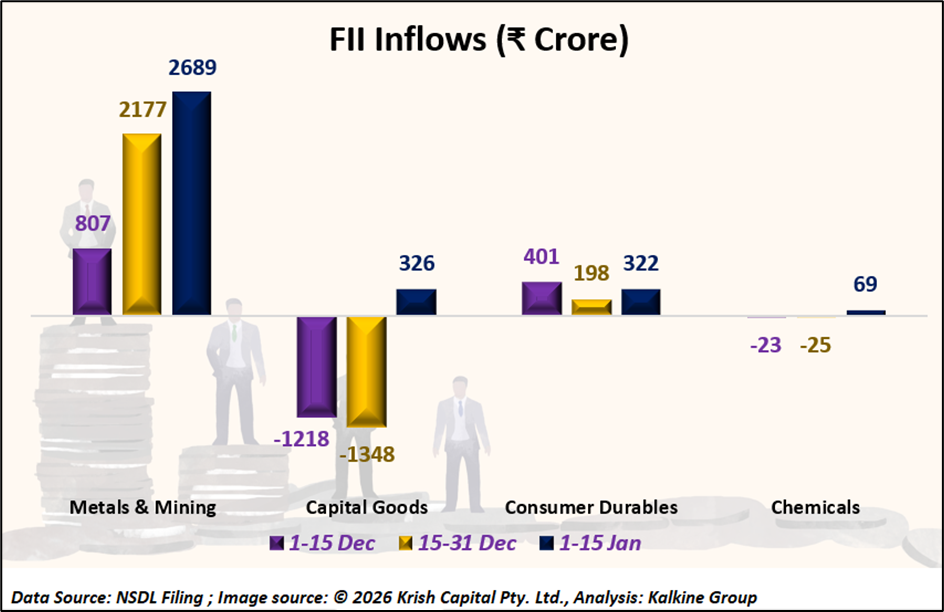

Metals and Manufacturing Stocks See Buying

On the positive side, metals and mining stocks attracted strong FII buying. FIIs invested ₹2,689 crore in this sector during the first half of January, after steady buying in December. Capital goods stocks also saw fresh buying of ₹326 crore, showing renewed interest after earlier selling.

Consumer durables attracted ₹322 crore of FII inflows, continuing the positive trend. Chemicals saw small inflows of ₹69 crore. Overall, NSDL data shows that FIIs continued to sell in most consumer and service sectors in early January, while metals and some manufacturing sectors attracted buying support.

Conclusion

Overall, NSDL data shows that FIIs stayed cautious in the first half of January. Strong selling continued in FMCG, financials, IT and other service-related sectors. At the same time, metals and mining attracted steady buying, supported by continued inflows. Capital goods and consumer durables also saw some fresh investment. The data suggests FIIs are shifting money between sectors, focusing on select areas while reducing exposure to others.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.