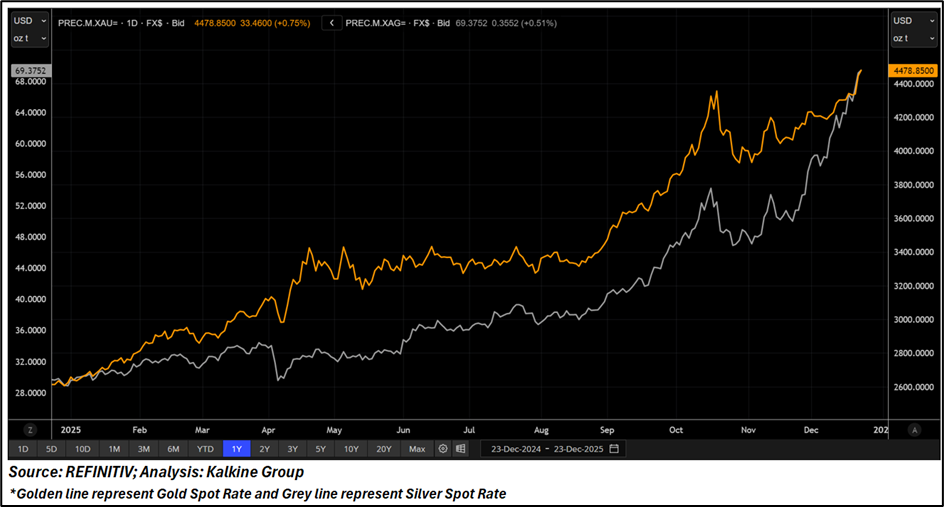

Precious metals remain in a powerful uptrend, reflecting a structural repricing rather than a cyclical upswing. Gold has convincingly moved above USD 4,400 per ounce, while silver has rallied sharply toward the USD 70 per ounce level after breaking USD 53.34, marking one of the strongest advances in modern commodity markets. This rally is not driven by speculative excess; instead, it reflects the convergence of macroeconomic shifts, monetary dynamics, and sustained structural demand that is reshaping global capital allocation.

Gold: From Store of Value to Strategic Asset

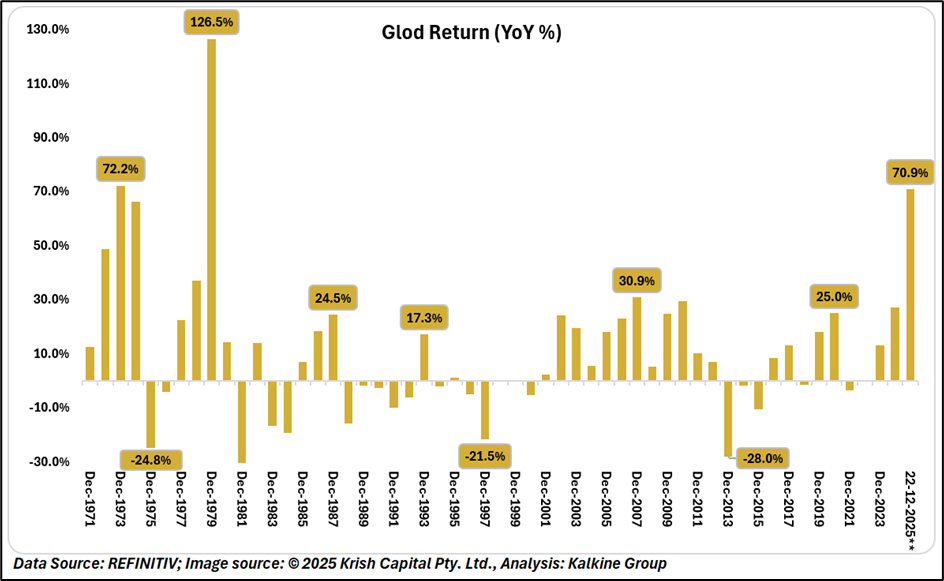

Gold’s rally has been relentless and historically significant. From USD 2,623.81 per ounce in December 2024 to USD 4,483.69 per ounce by 22 December 2025, gold has delivered an extraordinary 70.88% YoY return, placing it among the strongest annual performances in its recorded history.

For perspective, gold’s best-known rally occurred in 1979, when prices jumped from USD 226 per ounce in December 1978 to USD 512 per ounce in December 1979, a 126.55% YoY gain during a period marked by inflation shocks and monetary instability. While the current rally is less extreme numerically, it is arguably more durable, as it is supported by broader institutional participation and long-term reserve diversification.

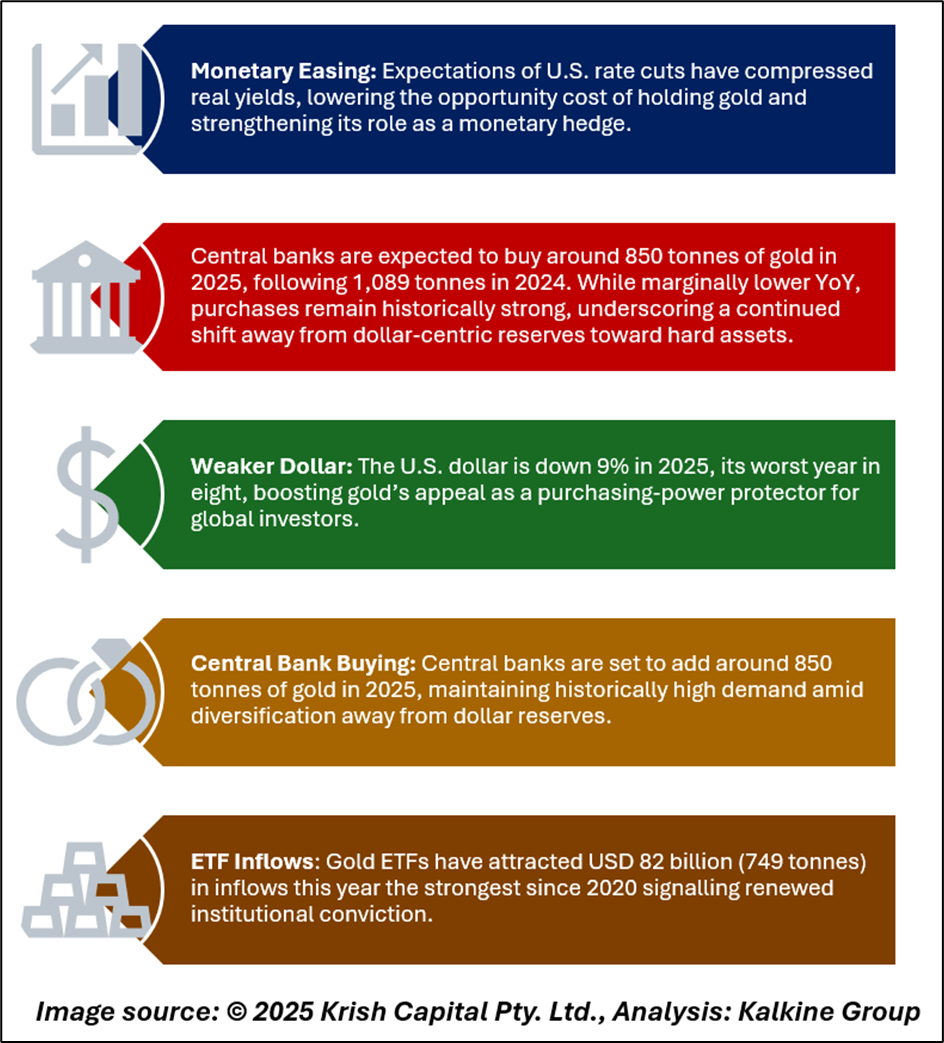

Why Gold Remains Structurally Bullish?

Silver: The High-Beta Metal Leading the Cycle

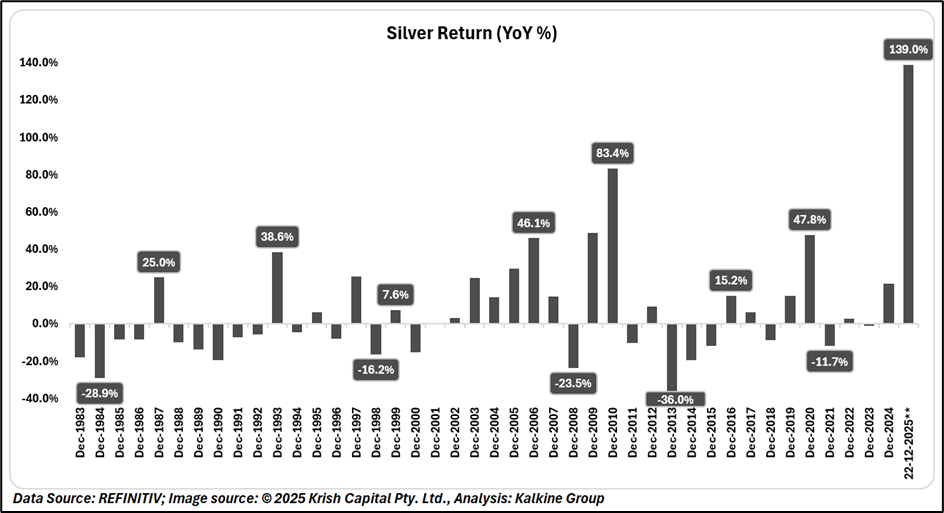

Silver has surged from USD 28.87 per ounce in December 2024 to USD 69.02 per ounce by 22 December 2025, delivering a staggering 139.04% YoY return the highest annual return ever recorded for silver. This decisively eclipses its previous standout rally in 2010, when silver gained 83.36% YoY.

Unlike gold, silver’s bull case is not purely monetary it is deeply industrial and structural.

What Truly Drives Silver Demand?

Clearing the Nuclear Misconception

Nuclear energy accounts for less than 1% of global silver demand. While silver is used in control rods, electrical systems, and niche radiation instruments, these applications are limited, one-time, and non-recurring. The silver bull market is not driven by nuclear it is driven by electrification.

Why Silver Is Outperforming Gold?

Silver’s dual identity as both a monetary and industrial metal gives it natural leverage in reflationary and growth-linked cycles. With physical supply tight, ETF inflows exceeding 4,000 tonnes, and real yields remaining compressed, silver is behaving as a high-beta expression of the broader precious-metals thesis.

Momentum amplifies fundamentals. In bull markets, silver historically outpaces gold and 2025 has reaffirmed that pattern emphatically.

Conclusion

The ongoing rally in precious metals reflects a structural realignment rather than a short-term price cycle. Gold’s ascent underscores its evolving role as a strategic monetary asset amid policy uncertainty and reserve diversification, while silver’s outperformance highlights its unique leverage to electrification and industrial growth. Together, they represent a durable hedge and a compelling allocation in an increasingly fragmented global macro environment.