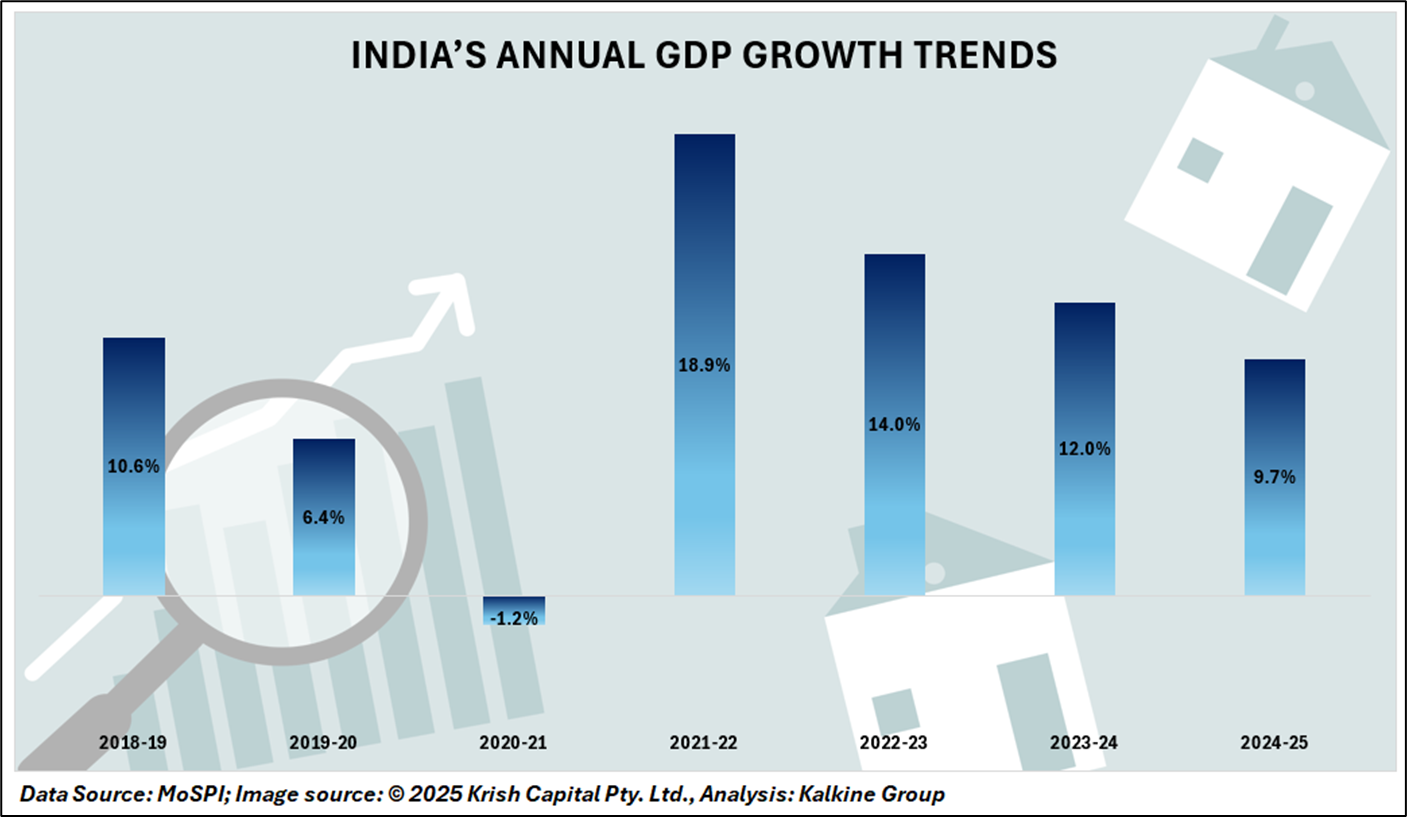

India’s economy is expected to continue its moderate but steady growth trajectory in FY25–26 and beyond, despite a four-year low in GDP growth last fiscal year and multiple global headwinds. A recent Reuters poll of 51 economists conducted between June 17–26 projected India’s GDP to expand 6.4% in FY25–26, slightly below the 6.5% growth rate in FY24–25, which was the weakest since the pandemic-hit FY20–21.

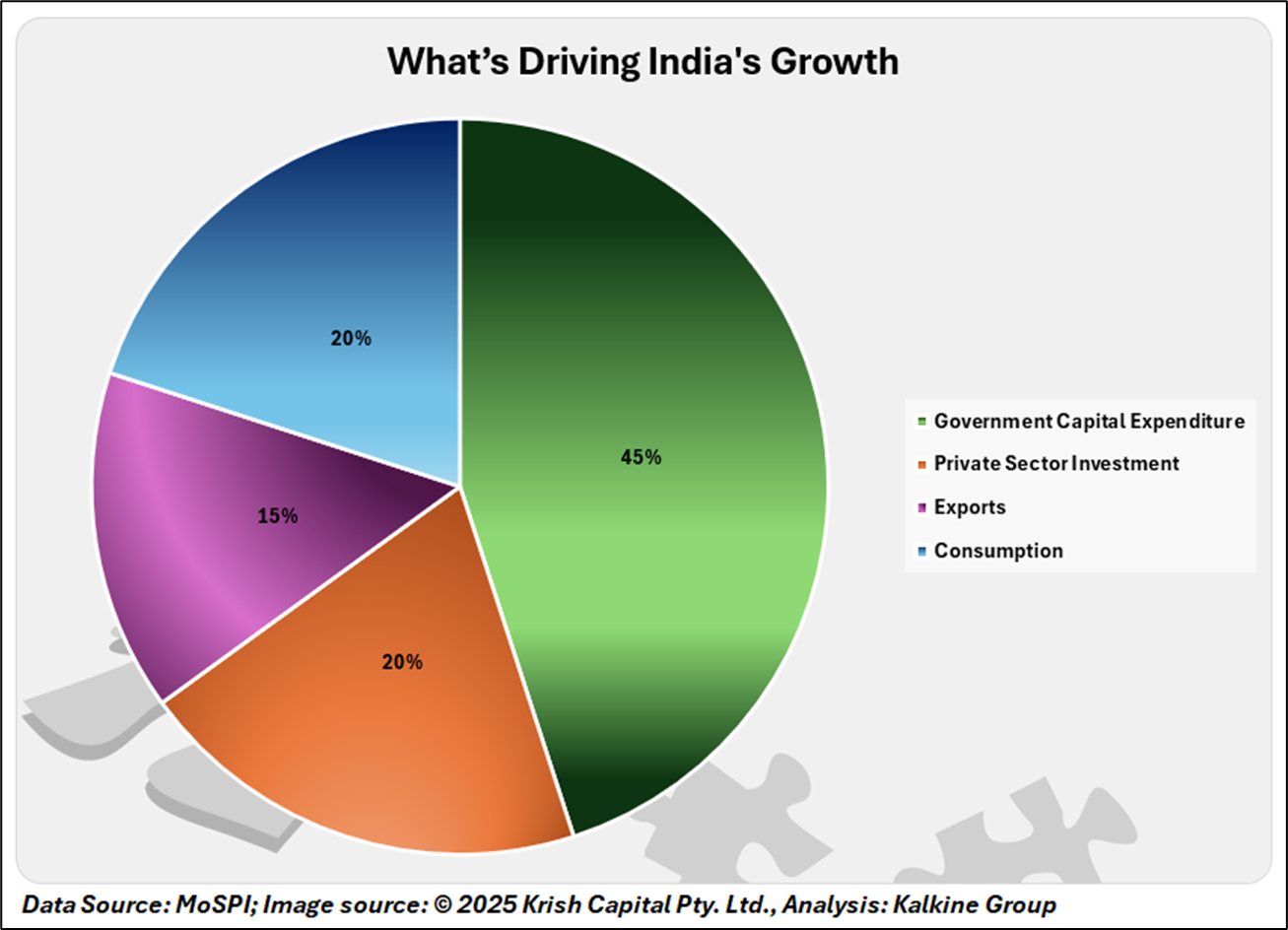

Despite global economic pressures, the country still holds its title as the world’s fastest-growing major economy, driven largely by public capital expenditure, which continues to be a cornerstone of India’s fiscal policy. However, concerns are mounting that private sector investment remains weak, and job creation has not kept pace with the growing labor force.

Resilience in Government-Led Investment

India remains the fastest-growing major economy, largely driven by robust public capital investment. While global economic pressures including high commodity prices, geopolitical instability, and weak external demand have tested the country’s resilience, government infrastructure spending has remained a vital driver of growth.

“Most of the growth seen so far has been driven largely by government capital expenditure, which is expected to flatten out in the coming quarters,” said economists. They also noted that private investment and job creation continue to be major areas of concern.

Weak Job Creation Limits Consumption-Led Growth

The economy’s structural challenge lies in its underperforming labor market. Although India benefits from a large and young working population, job creation especially in formal, higher-productivity sectors has not been robust enough to raise incomes meaningfully. As a result, domestic consumption remains restrained, which in turn reduces the incentive for private sector expansion.

This circular drag where low job growth leads to weak demand, which discourages investment remains a core concern for medium-term economic prospects.

Free Trade Agreement Standoff with U.S.

India’s economic trajectory may also hinge on ongoing trade negotiations with the United States. A proposed bilateral trade agreement remains in limbo, with talks reportedly stalled over issues related to auto parts, steel, and agricultural imports. The 90-day pause on reciprocal tariffs ends on July 9, 2025, and failure to reach a resolution could lead to renewed trade tensions.

“If the FTA isn’t finalized, it could slightly weigh on export sentiment and dampen investor confidence in the second half of the fiscal year,” noted one official involved in the discussions.

Nonetheless, some analysts remain cautiously optimistic, having slightly upgraded their FY26–27 growth forecasts in anticipation of a potential breakthrough in trade negotiations, while cautioning that the global macroeconomic environment remains a limiting factor.

RBI’s Policy Response and Inflation Outlook

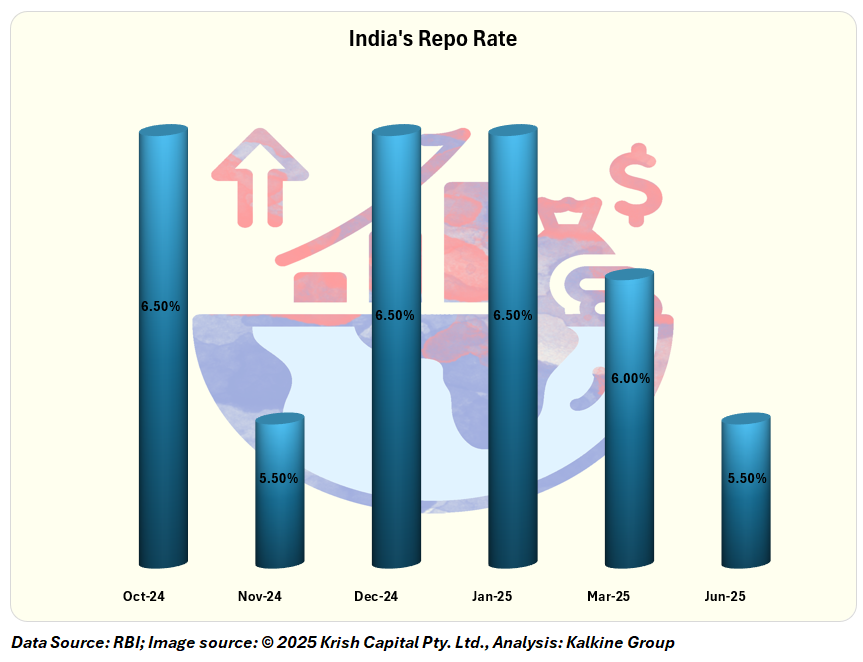

Amid rising uncertainties, the RBI has adopted a more neutral stance. Following a rate cut from 6.50% to 5.50% earlier this year, the central bank signaled a pause in its easing cycle during the June 6 meeting.

“Even with the rate cuts, we’ve been cautious not to overstimulate demand-side inflation,” RBI Governor Shaktikanta Das said at the latest monetary policy briefing.

Consumer inflation is expected to average 3.6% in FY25–26, rising slightly to 4.3% in FY26–27—comfortably within the RBI’s 2% to 6% target range.

Conclusion

While India’s economic fundamentals remain sound, the outlook depends on several external and domestic variables resolution of trade disputes, oil price stability, and a rebound in private investment. Despite the RBI’s supportive monetary stance, experts warn that structural reforms and labor market improvements are crucial for sustaining medium-term growth.