India–US Trade Strain Raises Concerns for India’s IT Sector

Source: Shutterstock

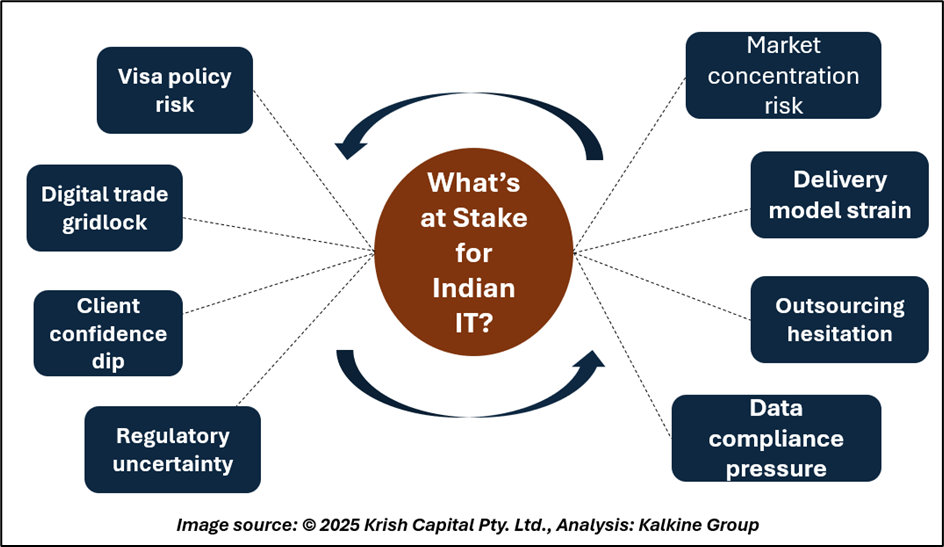

While the recent US decision to double tariffs to 50% on Indian goods primarily targets manufactured exports, its implications ripple beyond merchandise trade. The IT and technology services sector India’s largest export engine to the US is now operating under a cloud of strategic uncertainty.

Although not directly affected by the tariffs, the tech industry is highly sensitive to broader diplomatic cues. “The souring of relations, especially with no forward movement on digital trade norms or visa reforms, can slow the pace of business and policy alignment,” an analyst said.

Indian IT firms derive 50–70% of their revenue from the US market, primarily through software services, consulting, cloud management, and AI support. Any turbulence in this relationship has a material impact on earnings visibility and client engagement, particularly in high-growth verticals such as healthcare, fintech, and retail.

Visa and Workforce Dynamics in Spotlight

The deteriorating relationship also raises concerns around non-tariff barriers particularly immigration and workforce mobility. The H-1B visa program, essential for Indian tech professionals operating in the US, has already seen heightened scrutiny in recent years. Analysts now fear further tightening. “With rising trade tensions, regulatory obstacles like visa caps or stricter compliance regimes could emerge as retaliatory pressure points,” said an analyst.

Any disruption to talent flows could impact both onshore delivery models and client engagements, especially in critical areas like digital transformation, cybersecurity, and AI development. Furthermore, secondments and long-term assignments may see new administrative hurdles, delaying project execution timelines.

Digital Trade Uncertainty and Strategic Response

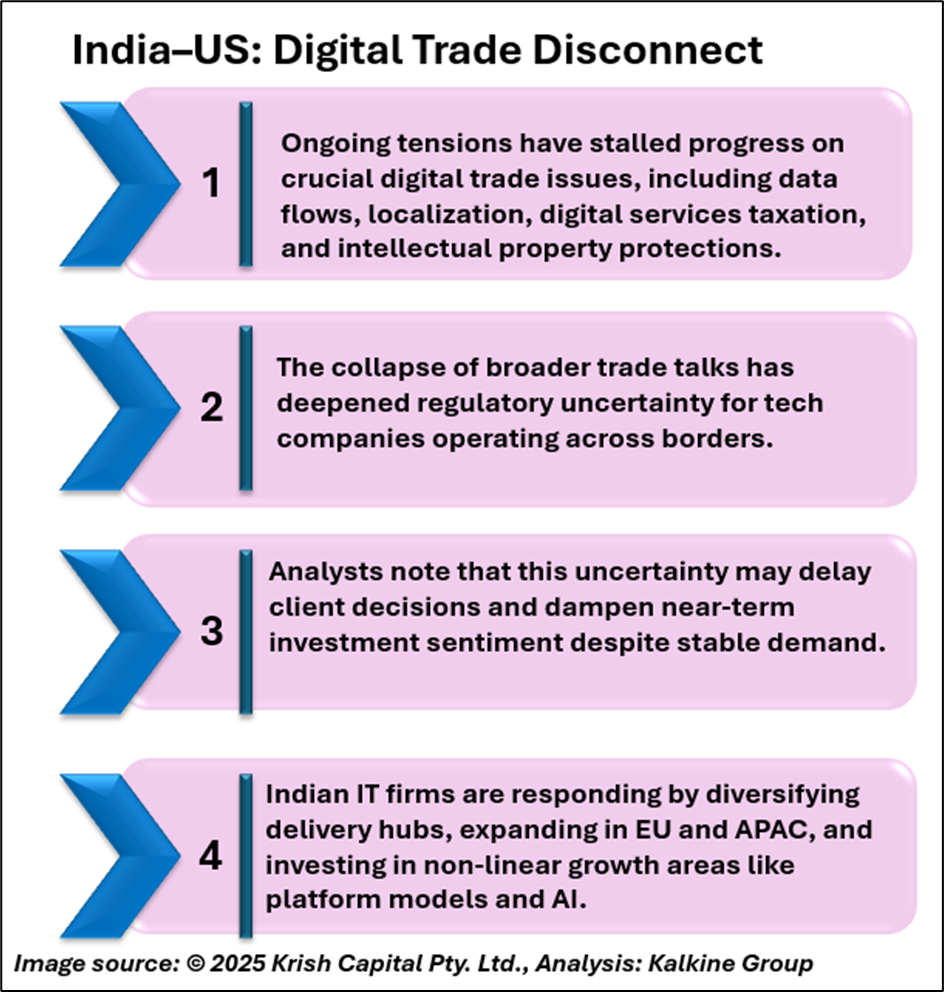

India and the US have long engaged in sporadic negotiations over digital trade norms covering cross-border data flows, localisation, digital taxation, and intellectual property. The collapse of broader trade talks has stalled progress, leaving tech companies in regulatory limbo. This uncertainty may prompt multinationals to rethink outsourcing and data centre expansion plans in India. “IT and ITeS companies thrive on predictability unclear rules of digital engagement across borders hurt confidence and investment,” an analyst observed.

In response to the growing geopolitical and regulatory risk, Indian IT firms are proactively diversifying their delivery hubs and expanding partnerships in Europe and the Asia-Pacific. There is also a strong shift towards non-linear revenue models such as platform offerings and enterprise AI. However, with over half of their earnings tied to the US, firms cannot afford a sustained chill. Many are now investing in enhanced geopolitical risk assessment, scenario planning, and strengthening local US talent pipelines to mitigate exposure.

Conclusion

The doubling of US tariffs on Indian goods reflects a deeper shift in the bilateral dynamic one that may indirectly affect India's IT sector through tightened policy, disrupted negotiations, and diminished goodwill. For an industry built on global trust and seamless delivery, India’s tech leaders must now prepare for greater geopolitical complexity in their largest export market. Strategic resilience, regulatory foresight, client diversification, and continuous innovation will be critical in safeguarding long-term growth and ensuring sustained operational agility amid rising global and regional uncertainty.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.