Why IndiGo Shares Slipped After Q3 FY26 Results Despite Healthy Operating Metrics?

Source: shutterstock

InterGlobe Aviation Ltd. (IndiGo) reported its Q3 FY26 results, following which the stock declined by approximately 3% in today’s trading session, reflecting investor caution around weaker headline profitability. The market reaction appears to factor in the impact of one-off charges and adverse foreign exchange movements, even as the airline’s underlying operating performance remained resilient.

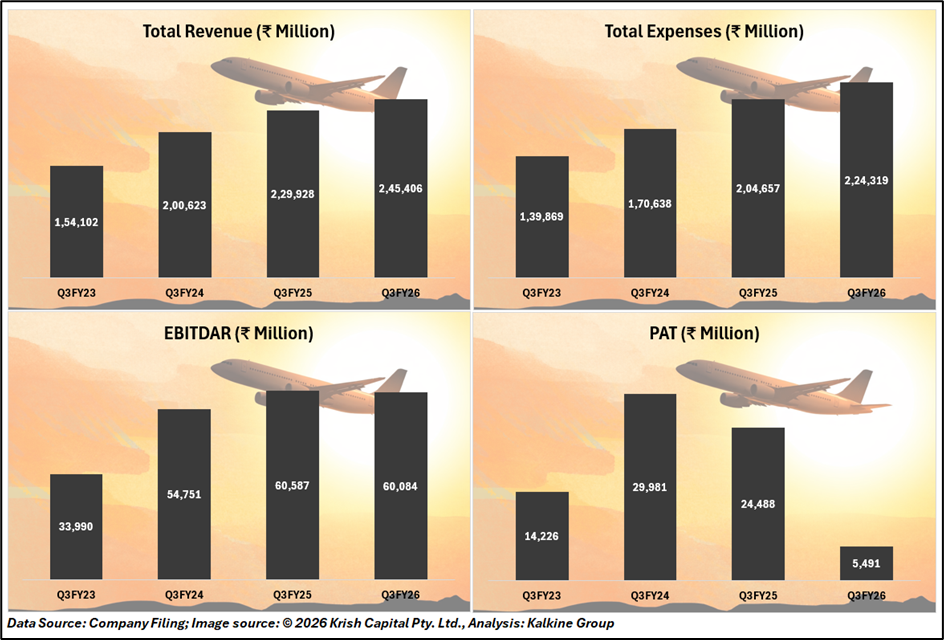

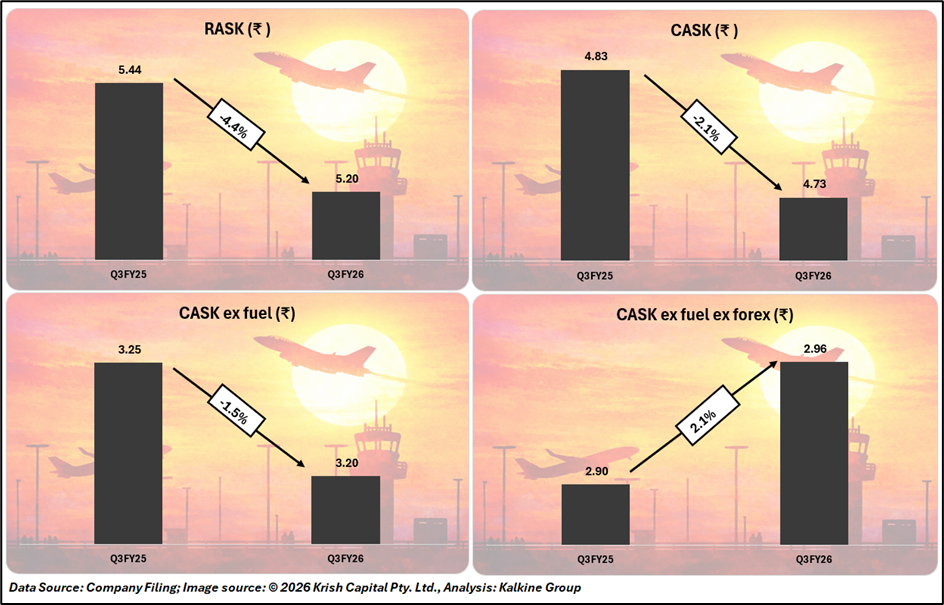

IndiGo delivered a mixed performance in Q3 FY26, with reported profitability materially affected by exceptional items and currency headwinds. Total income for the quarter increased 6.7% year-on-year to ₹245.4 billion, supported by an 11.2% expansion in capacity and robust passenger demand during the festive and wedding season. Passenger volumes rose to 31.9 million, although revenue quality moderated, with RASK declining 4.4% YoY and yields easing 1.8% YoY, reflecting competitive intensity and capacity optimisation following early-December operational disruptions.

Reported profit after tax declined sharply to ₹5.5 billion, compared with ₹24.5 billion in the corresponding period last year. The contraction was driven by ₹15.5 billion of exceptional charges and ₹10.4 billion in net foreign exchange losses arising from rupee depreciation against dollar-denominated liabilities. Exceptional items included a ₹9.7 billion provision related to the implementation of New Labour Codes and ₹5.8 billion linked to operational disruptions, covering customer compensation, goodwill gestures, and regulatory penalties. On an adjusted basis, core profitability remained resilient, with PAT of ₹31.3 billion, albeit lower than last year’s elevated base.

Cost discipline continued to underpin operating performance. CASK declined 2.1% YoY to ₹4.73, aided by favourable fuel economics and fleet mix optimisation, although CASK ex-fuel ex-forex increased 2.1% YoY due to contractual escalations, currency depreciation, and modest dilution in operating leverage. EBITDAR stood at ₹60.1 billion, with margins of 30.0% excluding forex, reinforcing the strength of IndiGo’s operating model.

Strategically, IndiGo continued to scale its network and fleet, closing the quarter with 440 aircraft, including the induction of India’s first A321 XLR, supporting longer-haul international expansion. A strong liquidity buffer of ₹369.4 billion in free cash provides balance-sheet resilience and strategic flexibility.

Overall, while Q3 FY26 headline numbers prompted a near-term stock correction, the results reaffirm IndiGo’s structural advantages, balance-sheet strength, and durable earnings profile, supporting confidence in its medium-term outlook.

Consensus Recommendations and Target Price

The stock currently carries a consensus recommendation of 1.74, reflecting an overall BUY stance among covering analysts. Based on prevailing estimates, the consensus target price is ₹5,878.4 per share, implying an upside potential of approximately 22.5% from current levels. Analysts continue to factor in a long-term growth assumption of 23.1%, supported by scale benefits, network expansion, and operating leverage over the medium term.

Conclusion

Despite near-term pressure on reported earnings and a modest stock correction, IndiGo’s Q3 FY26 performance underscores the resilience of its core business. Strong operating fundamentals, disciplined cost management, robust liquidity, and favourable analyst consensus continue to support confidence in the airline’s medium-term growth and earnings visibility.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.