India's Cement Price Surge - How Infrastructure Demand Boosts Profit Margins

Source: Shutterstock

Key Highlights

In December 2024, cement dealers across India have introduced a notable price increase, sparking discussions about the future of the cement industry and its impact on the stock market. This price hike is primarily driven by factors such as escalating input costs, supply chain disruptions, and strong demand from infrastructure projects. As production costs rise, cement manufacturers are transferring these expenses to consumers, affecting the construction and real estate sectors. Here's an overview of how this price increase might influence the cement market and which stocks could benefit from potential margin growth.

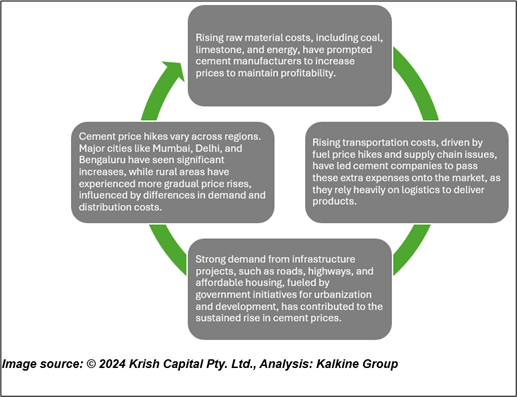

Reasons Behind the Cement Price Hike

The cement price hike presents both opportunities and challenges for the industry. On the positive side, higher prices could enhance margins for cement companies, particularly those that successfully pass on the cost increases without hurting demand. However, rapid price hikes might slow down demand for smaller, individual construction projects. Large-scale infrastructure projects, however, are less likely to be affected, given their long-term nature and substantial material requirements.

Cement Prices See a Significant Rise Across India

Cement prices have seen an increase in December 2024, particularly in western and southern India. In western India, the price of a 50-kilogram bag has reached between 350 and 400 rupees, reflecting a rise of 5-10 rupees. In Delhi, prices have also increased by 20 rupees, with rates now ranging from 340 to 395 rupees per bag, depending on the brand and quality. In southern India, where cement prices are the lowest, dealers have raised prices by up to 40 rupees per bag, bringing the cost to around 320 rupees. In eastern India, prices have surged by up to 30 rupees after several months, driven by recent construction activity. In December, further price hikes of approximately 10-15 rupees per bag are expected across all regions, as reported, particularly due to improvements in government spending.

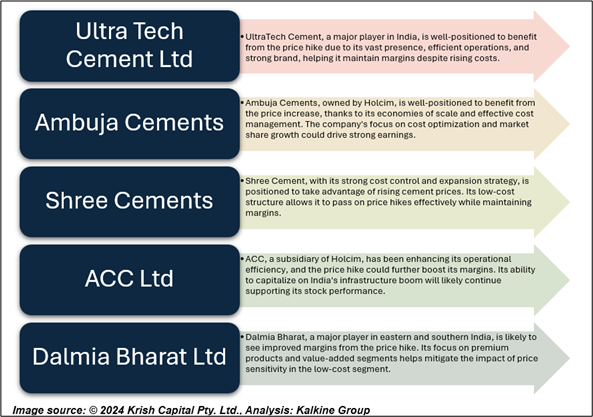

Top Cement stocks

Impact on Margins

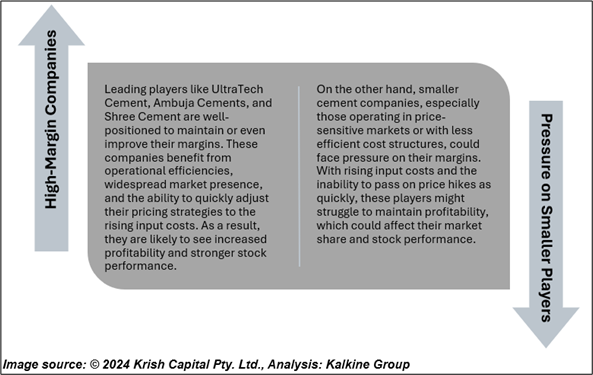

With the recent cement price hike, the immediate effect on cement companies is expected to be an increase in their profit margins. Companies that can effectively pass on the price increase to customers, without significant loss of market share, are likely to see a rise in profitability. Stronger margins will translate to higher earnings, which should be reflected in the stock prices of these companies.

Stocks Technical Analysis

Ultratech Cement Ltd. (NSE: ULTRACEMCO) The chart shows resistance around ₹12,100–12,150, where price struggles to break above, as seen in July, October, and December. Support lies at ₹10,800–11,000, tested in September and November, indicating strong buying interest. From July to November, prices moved sideways, with a sharp uptrend beginning in late November, pushing the price higher to ₹12,150. The RSI is at 61.21, indicating upward momentum without being overbought. Key levels to watch include ₹12,100–12,150 (resistance), ₹11,000 (support), and ₹11,500–11,600 (intermediate support). The stock was trading at ₹11,942.50 as at the closing of 16 Dec'2024.

Ambuja Cements Ltd. (NSE: AMBUJACEM) The chart shows a downtrend from mid-July to late November, followed by a reversal in late November, marked by strong bullish candles as prices rebounded from ₹460 to near 577. Support is found at ₹460, while resistance lies around ₹580–600, a zone where selling pressure was previously seen. A breakout above ₹600 could signal further upside. Candlestick patterns indicate strong upward momentum, with small-bodied candles near ₹580 suggesting consolidation before the next move. The RSI at 58.36 shows bullish momentum with room for more upside, but traders should watch for a potential pullback if RSI approaches 70. Key levels to watch are resistance at ₹580–600, support at ₹540, and crucial support at ₹460. The stock was trading at ₹576.95 as at the closing of 16 Dec'2024.

Shree Cement Ltd. (NSE: SHREECEM) shows strong bullish momentum, with the price recently reaching ₹28,091.25. The stock has been trending upwards since late November, marked by higher highs and lows. Immediate resistance is at ₹28,115.00, and support is at ₹27,500 and ₹27,000. The RSI is at 70.66, indicating overbought conditions, which could lead to a short-term pullback. Traders should watch for a breakout above ₹28,100 for buying opportunities or a reversal near support levels for caution. The medium-term outlook remains positive as long as the price stays above ₹27,000. The stock was trading at ₹28,091.25 as at the closing of 16 Dec'2024.

Conclusion

The cement price surge in December 2024, driven by rising costs and strong infrastructure demand, offers both challenges and opportunities. While smaller projects may face slower demand, cement companies that effectively pass on price increases are poised to see higher profit margins. This should positively impact stock prices, especially for companies involved in large-scale infrastructure projects. Overall, the outlook for the cement industry remains positive, with margin growth expected to benefit key players.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.