India’s labour market began 2026 on a largely steady note, with only marginal shifts in key employment indicators. According to the latest Monthly Bulletin of the Periodic Labour Force Survey (PLFS), overall participation and employment levels remained broadly stable, even as seasonal factors weighed on rural activity. The data suggests resilience in workforce engagement despite typical winter-related slowdowns.

LFPR Holds Firm with Minor Rural Dip

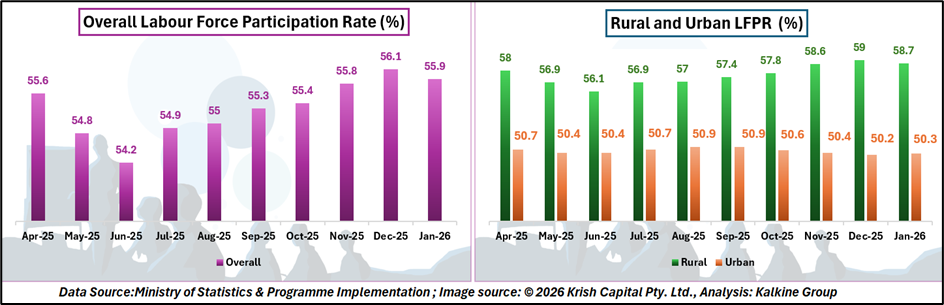

The overall Labour Force Participation Rate (LFPR) for persons aged 15 years and above stood at 55.9% in January 2026, slightly lower than 56.1% in December 2025. Rural LFPR eased from 59.0% to 58.7%, while urban LFPR edged up marginally from 50.2% to 50.3%.

This modest adjustment reflects seasonal moderation rather than structural weakness. Participation levels continue to remain within the stable range observed over recent months.

Female Participation Remains Consistent

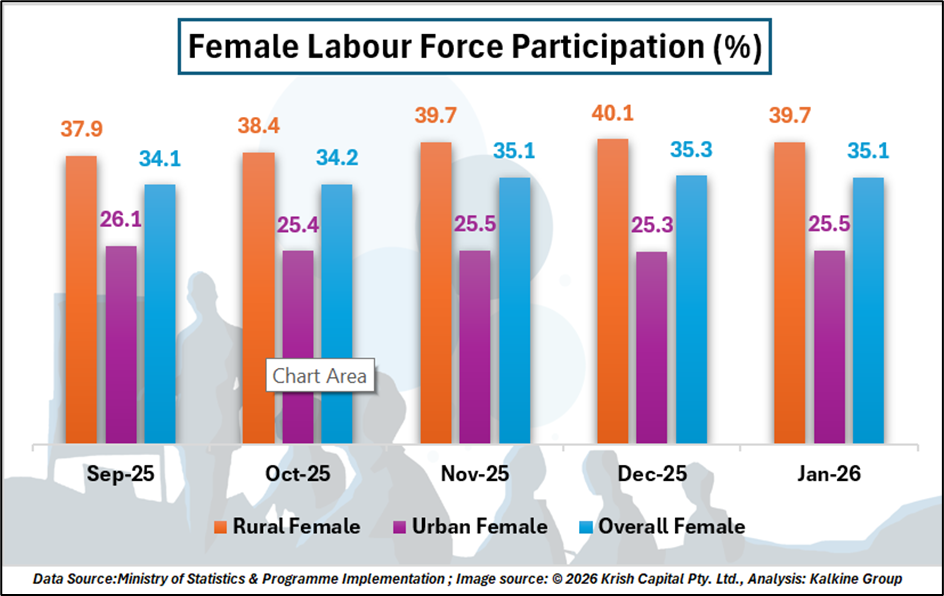

Female labour force participation continued to show stability. The overall Female LFPR was recorded at 35.1% in January 2026, unchanged from November 2025 levels. Rural female LFPR stood at 39.7%, while urban female LFPR reached 25.5%.

The steady performance indicates that women’s participation in economic activity has sustained its momentum, despite short-term seasonal pressures affecting certain sectors.

Workforce Ratio Sees Mild Cooling

The Worker Population Ratio (WPR) for persons aged 15 years and above recorded 53.1% in January 2026, marking a marginal decline after steady gains since mid-2025. Rural WPR softened slightly to 56.2% from 56.7% in December. Rural male and female WPR stood at 75.7% and 38.0%, respectively.

Urban WPR remained largely unchanged, with male WPR at 70.5%, female WPR at 23.0%, and overall urban WPR at 46.8%. The data highlights continued stability in urban employment conditions.

Seasonal Factors Drive Rural Softness

The mild decline in participation and employment, along with the uptick in unemployment, appears largely rural-driven. Post-harvest slack and winter-related slowdown in construction, agriculture-allied work, transport, and small trade have influenced activity levels.

Urban labour markets, in contrast, remained steady, reflecting resilience in services and non-agricultural sectors.

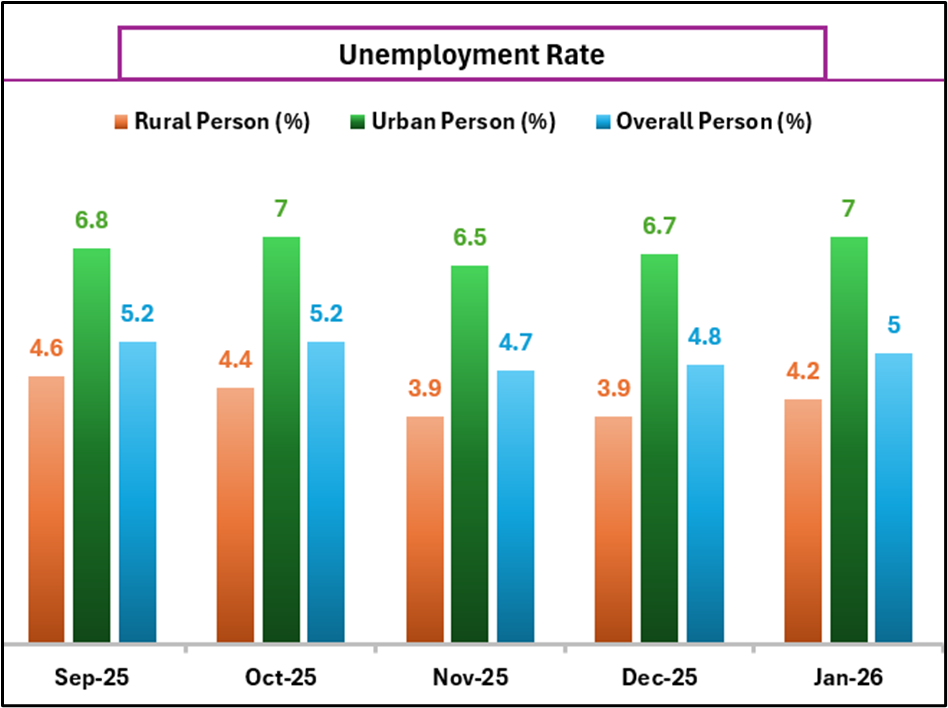

Unemployment Edges Up Slightly

The Unemployment Rate (UR) rose modestly to 5.0% in January 2026 from 4.8% in December. Rural UR increased from 3.9% to 4.2%, while urban UR moved up from 6.7% to 7.0%.

Male unemployment remained broadly stable, whereas female unemployment saw a slight uptick. However, female UR continues to remain within the range observed during April–December 2025, suggesting a temporary fluctuation rather than a structural shift.

Broad Stability Continues

The January 2026 estimates are based on a survey of 3,73,158 persons, including 2,13,226 in rural areas and 1,60,932 in urban areas.

Overall, India’s labour market performance in January reflects seasonal adjustment rather than deterioration, with participation and employment indicators maintaining a broadly stable trend as the year begins.

Steady Start with Seasonal Adjustments

Overall, the January 2026 PLFS data suggests that India’s labour market remains on a stable footing despite minor seasonal fluctuations. The slight moderation in rural participation and employment appears largely cyclical, linked to post-harvest and winter-related slowdowns, rather than indicating structural weakness.

Urban labour conditions continue to demonstrate resilience, supported by steady performance in services and non-agricultural sectors. While unemployment ticked up marginally, it remains within recent ranges. Taken together, the data reflects a labour market that is adjusting to seasonal dynamics while maintaining underlying strength and continuity in workforce engagement at the start of 2026.