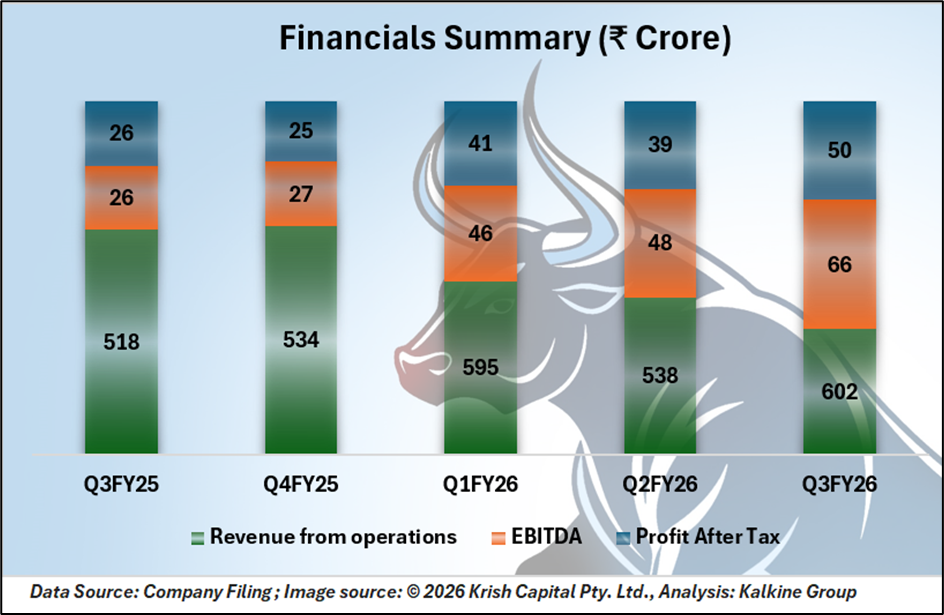

Honasa Consumer Ltd., India’s leading beauty and personal care “House of Brands”, delivered its highest-ever quarterly revenue in Q3 FY26. The company reported a revenue of ₹630 crore for the quarter ended December 31, 2025, representing a 21.7% year-on-year increase, while profits nearly doubled to ₹55 crore before exceptional items.

This strong performance underscores Honasa’s ability to combine strategic execution with robust demand across its brand portfolio.

Flagship Brand Mamaearth Leads Growth Charge

Chairman, CEO, and Co-founder Varun Alagh described the quarter as a “step-up” for Honasa, noting that focus categories anchored the company’s performance. The flagship brand, Mamaearth, returned to double-digit growth, driven by product superiority and targeted investments.

Strategic Gen Z-led marketing and innovative formulations have strengthened market share, demonstrating that consumer trust and product efficacy remain central to the company’s growth strategy.

The Derma Co. and Emerging Brands Shine

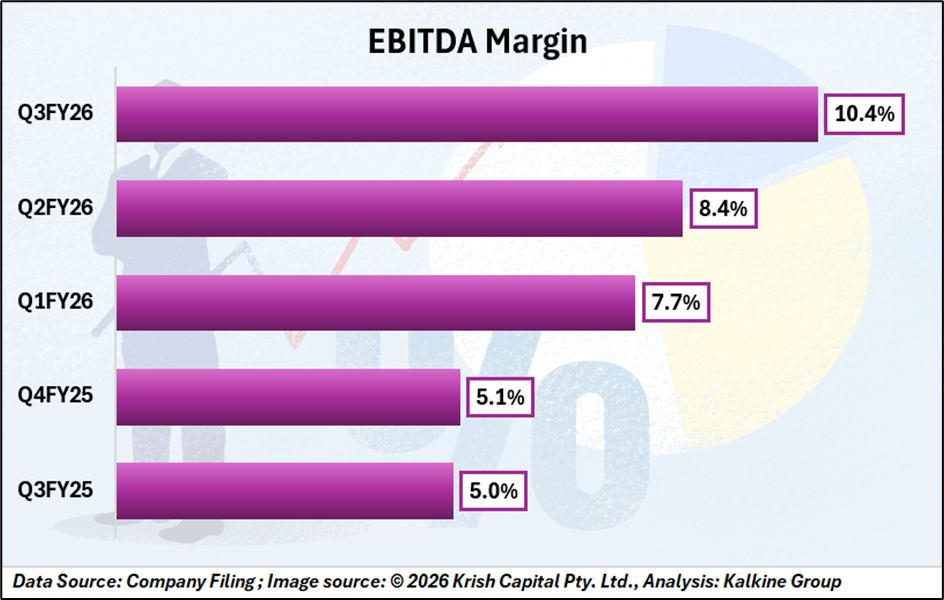

Science-backed skincare brand The Derma Co. continued its upward trajectory, maintaining a double-digit EBITDA profile while expanding its consumer base efficiently. Meanwhile, Honasa’s younger brands achieved over 25% growth, reflecting rising adoption in focus segments. The combined momentum of established and emerging brands highlights Honasa’s successful portfolio-driven growth approach, ensuring long-term scalability and profitability.

Offline Expansion Fuels Wider Reach

Honasa’s growth was bolstered by enhanced offline execution. Direct outlet coverage surpassed 1 lakh outlets, and total distribution expanded by over 25% YoY to 2.7 lakh outlets, strengthening the company’s omnichannel presence. With UVG at 30.2%, the performance reflects sustained consumer demand across its core categories, validating the company’s focus on both reach and execution excellence.

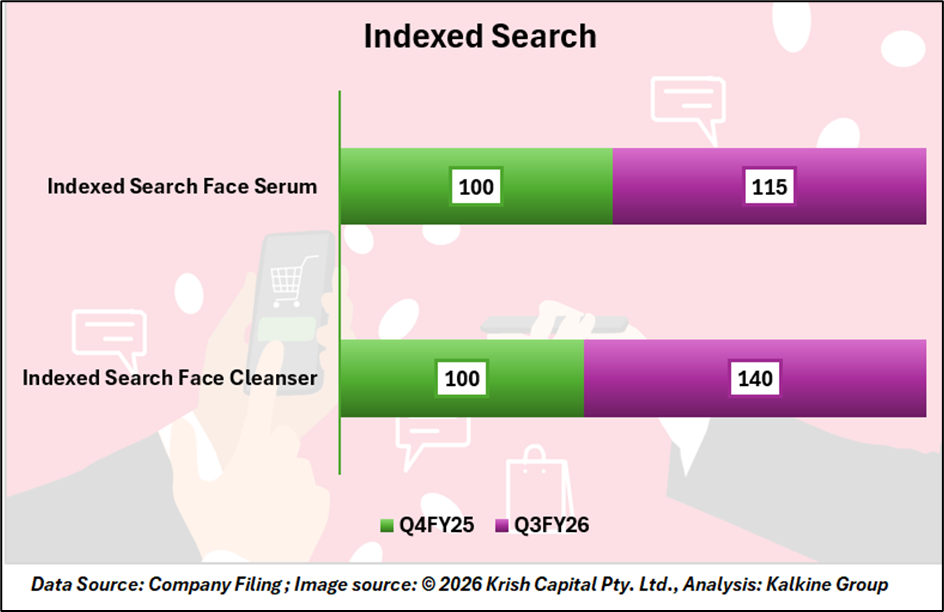

Innovation and Re-Innovation Drive Market Leadership

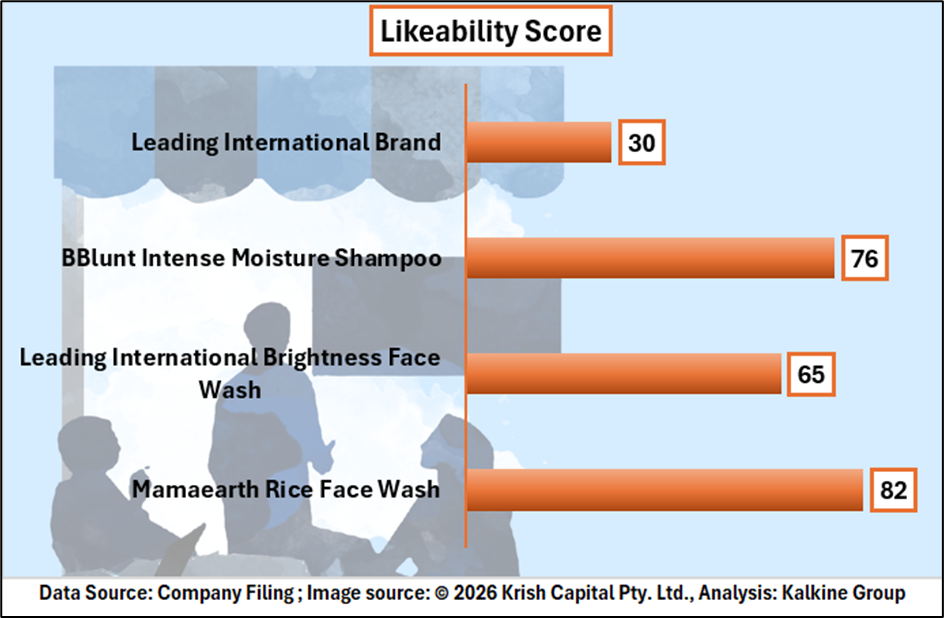

Co-founder and CIO Ghazal Alagh emphasized that innovation remains at the heart of Honasa’s growth. Products like Mamaearth Rice Face Wash and BBlunt Intense Moisture Shampoo performed strongly against leading national and international benchmarks, showcasing the company’s commitment to genuine product superiority. Honasa continues to invest in better science and sharper execution to build a House of Purposeful Brands grounded in sustainable growth.

Digital-First Strategy and Future Outlook

As India’s largest digital-first beauty and personal care company, Honasa operates a portfolio of eight diverse brands. Leveraging data-driven innovation and market-first execution, the company is well-positioned to capture trends shaping the BPC sector. With clear priorities on profitability, capital efficiency, and operational scale, Honasa is consolidating its leadership while setting benchmarks for innovation-driven, consumer-centric growth in the industry.

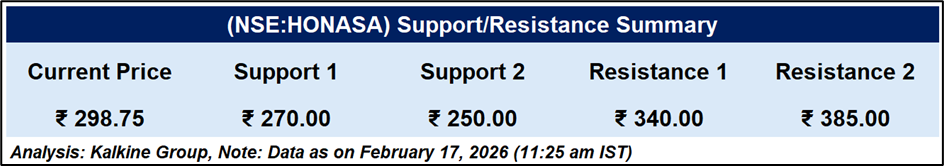

Technical Summary

The stock is currently trading at ₹298.75. Key support levels are ₹270 and ₹250, which could limit further decline if tested. On the upside, resistance levels are at ₹340 and ₹385, which may act as barriers to upward movement. A drop below support could indicate weakness, while a sustained rise above resistance could signal strength.

Strong Performance, Market Leadership Secured

Honasa Consumer Ltd. delivered a landmark Q3 FY26 performance, with revenue reaching ₹630 crore, up 21.7% YoY, and profits nearly doubling to ₹55 crore. Growth was led by flagship brand Mamaearth, while The Derma Co. and emerging brands also showed strong momentum.

Expanded offline reach, innovative product offerings, and a digital-first strategy underpinned the company’s success. With robust execution across channels and continued focus on consumer trust, innovation, and portfolio diversification, Honasa is well-positioned to sustain profitable growth, strengthen market leadership, and capture evolving trends in India’s beauty and personal care sector.