Bank Nifty Hits Fresh All-Time High at 58,560.60 Ahead of Q2FY26 Results

Source: shutterstock

The Bank Nifty index extended its winning streak to a fresh all-time high of 58,560.60 on October 23, 2025, before settling marginally lower in late trade. The benchmark, which has been on a steady upward trajectory since March 2025, reflects growing investor optimism ahead of Q2FY26 earnings from key lenders such as HDFC Bank, ICICI Bank, and Axis Bank.

The sustained rally underscores confidence in the sector’s fundamentals—driven by robust credit growth, healthy asset quality, and expectations of resilient profitability despite margin pressures from deposit repricing.

Index Momentum and Sectoral Strength

The Bank Nifty has climbed over 10,000 points from its March 2025 lows, highlighting strong buying momentum across both private and public sector banks. After breaching the 58,000 marks earlier this week, the index surged further to touch a record high of 58,560.60 on October 23.

The gains follow sustained institutional inflows and positive sentiment around the banking sector’s quarterly performance. Expectations of steady loan growth, contained slippages, and improving operational efficiencies have supported the index’s outperformance relative to other sectors.

Banking Stock Performance: Broad-Based Rally

The uptrend has been broad-based, with both large-cap and mid-tier banks contributing meaningfully:

- HDFC Bank has advanced 18% from its 2025 lows, in line with ICICI Bank (+18%) and Axis Bank (+17%).

- Kotak Mahindra Bank gained 15%, while IDFC First Bank surged 28%, buoyed by retail loan expansion and improving margins.

- Among public sector lenders, State Bank of India climbed 22%, while Canara Bank and Punjab National Bank rose 52% and 30%, respectively.

- AU Small Finance Bank (+46%) and Federal Bank (+19%) also added to the momentum, underscoring investor confidence across the financial spectrum.

This rally reflects a strong revival in credit growth, improving balance sheet health, and renewed optimism around the sector’s structural earnings trajectory.

Broader Market Resilience

The banking sector’s performance has been pivotal in lifting the broader indices.

Market activity remains centered around heavyweight earnings from HDFC Bank, ICICI Bank, and Reliance Industries, which are expected to set the tone for near-term market direction. The strength in financials continues to anchor benchmark stability amid global volatility.

Technical Analysis

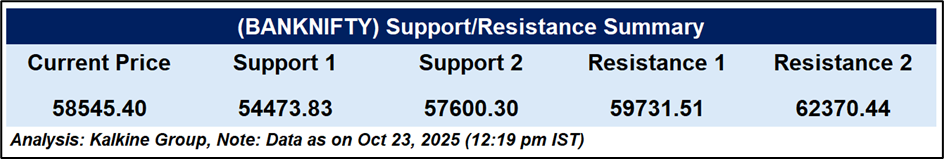

Bank Nifty hit a fresh all-time high of 58,560.60, closing at 58,545.40 (+0.93%). The index remains well above the 51-day EMA (55,925.40), confirming strong bullish momentum. The RSI at 79.38 signals overbought conditions, suggesting potential short-term consolidation after a sharp rally from early October. Trend remains firmly positive.

Conclusion

The Bank Nifty’s record high reflects sustained investor optimism ahead of Q2FY26 results, supported by broad-based gains across lenders. Despite near-term overbought signals, the sector’s strong credit growth, stable asset quality, and solid fundamentals suggest continued strength, with upcoming earnings likely to shape the next leg of the rally.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.