Can Orient Electric Sustain Double-Digit Growth Despite Seasonal Headwinds?

Source: shutterstock

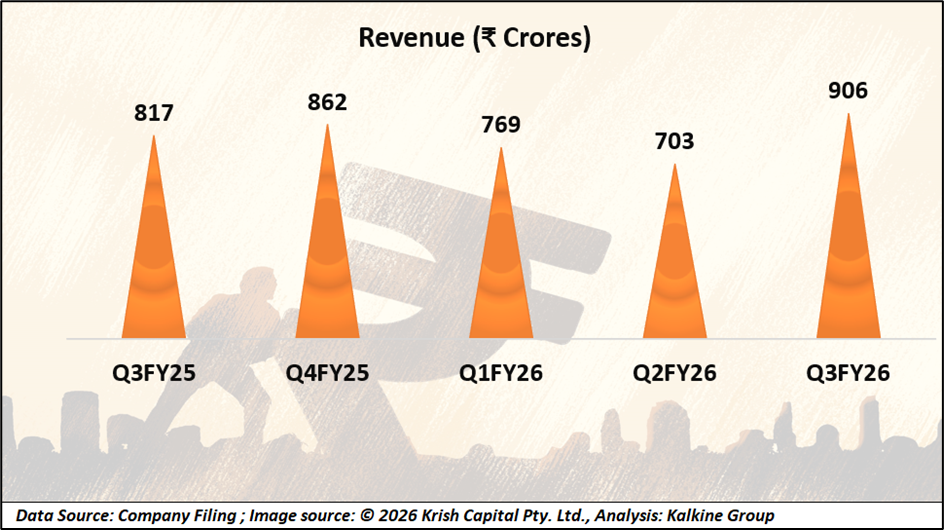

Orient Electric Limited (OEL), part of the USD 3 billion CKA Birla Group, delivered a resilient performance in Q3 FY26, underlining the strength of its diversified business model. The company reported revenue of ₹906.5 crore, marking an 11.0% year-on-year growth despite seasonal softness in its cooling portfolio, particularly fans. This growth highlights Orient Electric’s ability to counter cyclical demand challenges through portfolio diversification and focused expansion across consumer and professional electrical segments.

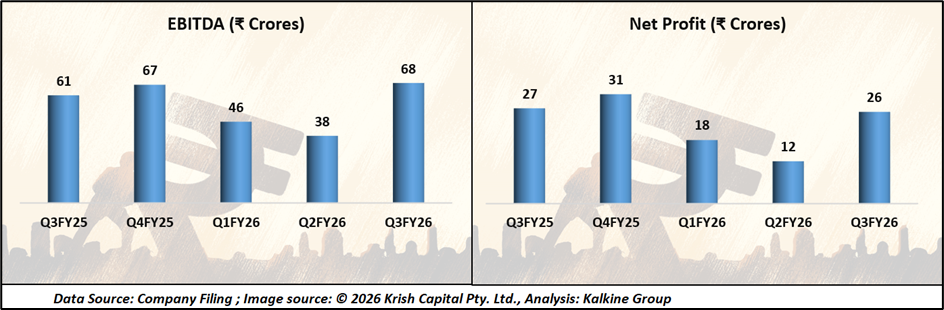

Profitability Improves on Cost Discipline

Profitability strengthened meaningfully during the quarter, supported by operating leverage and disciplined cost management. Profit Before Tax, excluding a one-time exceptional impact of ₹8.7 crore related to new labour codes, rose 19.0% YoY to ₹43.6 crore. EBITDA increased 10.6% YoY to ₹67.7 crore, with EBITDA margins holding steady at 7.5%, even as commodity inflation continued to pressure input costs. Gross profit grew 4.3% YoY, although gross margins moderated slightly.

Balanced Segment Performance Drives Stability

Segment-wise performance remained balanced. The Electrical Consumer Durables (ECD) business grew 12.6% YoY, driven by strong double-digit growth in the Heating category, which helped offset weakness in seasonal cooling products. Meanwhile, the Lighting, Switchgear and Wires segment sustained strong momentum, reinforcing Orient Electric’s transition toward a multi-engine growth model and reducing reliance on weather-driven demand cycles.

Broker Optimism Signals Strong Upside Potential

Brokerage analysts remain constructive on Orient Electric’s outlook. The stock carries a consensus recommendation of 2.0, reflecting a BUY stance, with a consensus target price of ₹250.4 per share implying a potential upside of approximately 44.0% from current levels. Analysts expect steady long-term growth driven by premiumisation, expansion of B2B businesses and operating leverage, while assuming a modest long-term growth rate of 0.7%, indicating a focus on sustainable value creation.

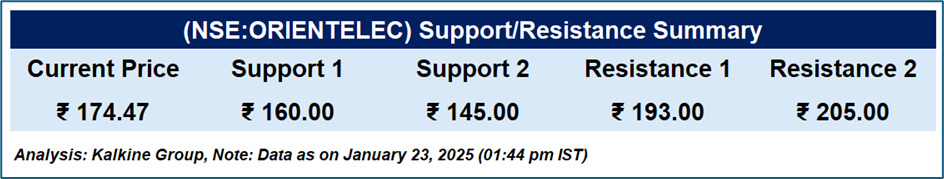

Technical Summary

Orient Electric is trading at ₹174.47, up 2.33% on the day. The stock shows support in the ₹160–₹145 range, which has historically acted as a demand zone. Resistance is seen between ₹193–₹205, where selling pressure may emerge. A sustained move below ₹145 could indicate further downside, while a break above ₹205 may lead to additional upward movement.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.