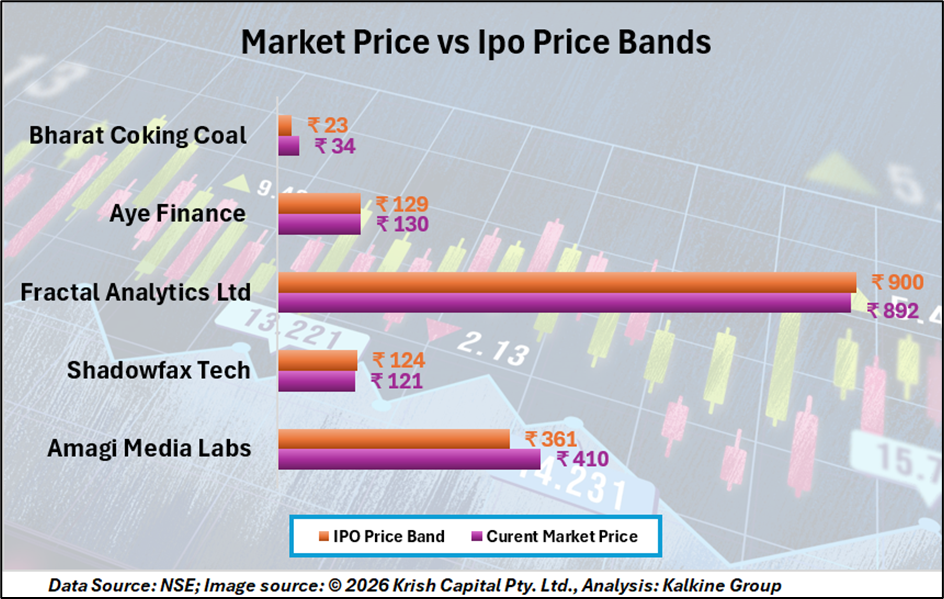

India’s primary market has started 2026 cautiously, following a year of mixed IPO performance in 2025. Only nine initial public offerings (IPOs) have hit the market so far, even as more than Rs 2 lakh crore worth of IPOs remain in the pipeline. Of the five IPOs listed this year, four — Amagi Media Labs, Shadowfax Tech, Fractal Analytics, and Aye Finance — debuted marginally below their issue price. Bharat Coking Coal was the only IPO that listed above its issue price, delivering gains of 76% on debut.

Pricing and Valuation Trends

Analysts noted that 2023 saw a post-Covid boost in IPO activity, with issues priced more reasonably. However, over the last two years, IPO pricing has become more aggressive, with promoters increasingly reducing stakes through offer-for-sale routes.

The high valuations of companies entering the market and the absence of broad positive triggers have contributed to the subdued start to 2026.

Market Performance and Investor Sentiment

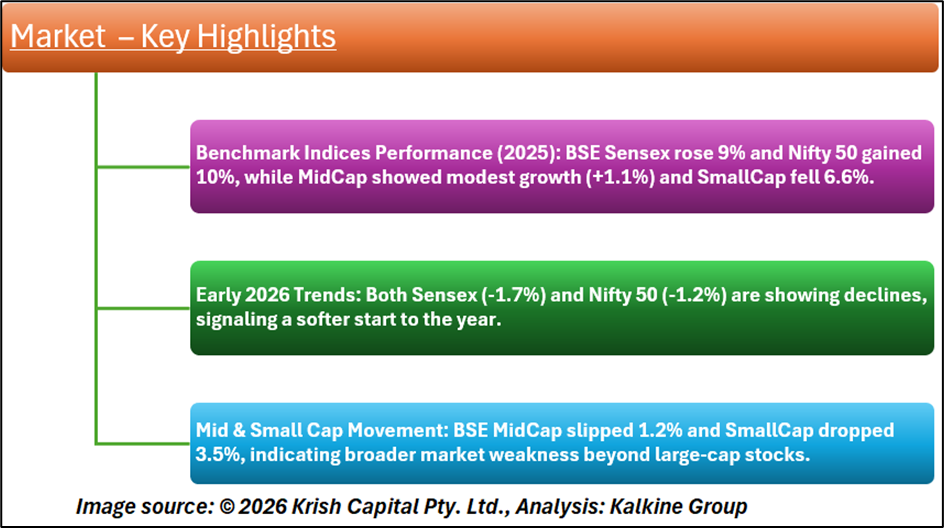

India’s benchmark indices reflected modest gains in 2025, with the BSE Sensex up 9% and Nifty 50 rising 10%. The BSE MidCap index rose 1.1%, while the BSE SmallCap declined 6.6%. In 2026, early market trends show declines, with Sensex down 1.7% and Nifty 50 down 1.2%. MidCap and SmallCap indices have also slipped 1.2% and 3.5%, respectively.

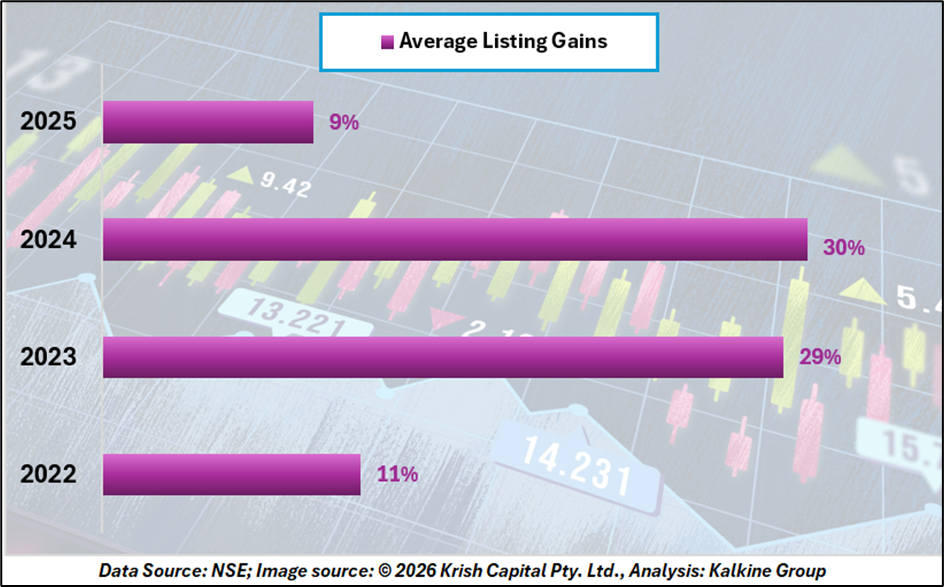

Listing Gains Show Moderate Trend

Data indicates that average listing gains rose steadily from 11% in 2022 to 29% in 2023 and 30% in 2024, before moderating to 9% in 2025. Among the 103 IPOs launched in 2025, over half traded below their issue price, with only a few delivering returns above 50%. Most IPOs slipped into negative territory within three to six months of listing.

Summary of IPO Market Performance

In 2025, a record 103 IPOs collectively raised Rs 1.76 lakh crore, compared with 91 IPOs raising Rs 1.6 lakh crore in 2024. Despite the high number of issues, the combination of flat or negative returns on many IPOs and cautious investor sentiment has slowed momentum at the beginning of 2026.