Godfrey Phillips India Ltd. (GPIL), a leading FMCG player and flagship of the KK Modi Group, announced its Q1FY26 results on August 4, 2025, delivering a strong performance supported by its core tobacco segment, growing export operations, and early progress in its non-tobacco portfolio. Following the results, the stock surged 9.92% on August 5, making a high of ₹9,981.50. Momentum continued August 6, with the stock hitting a fresh all-time high of ₹10,861.50. On August 7, however, the stock saw sharp intraday volatility rising to a new peak of ₹11,444 before declining approximately 8.5%, reflecting near-term profit booking after a steep two-day rally.

Financial Performance

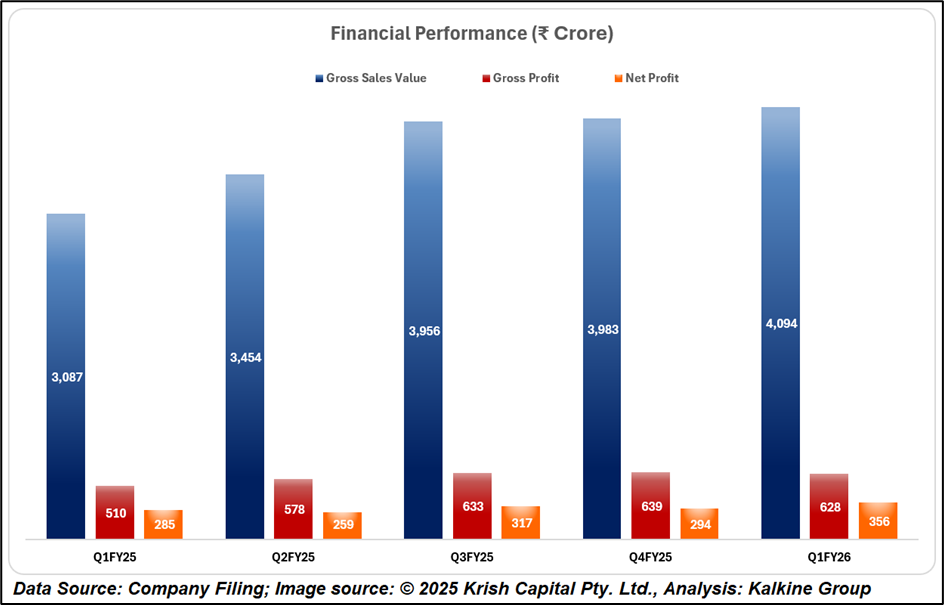

Godfrey Phillips India Ltd. (GPIL) reported its financial results for the first quarter of FY26, reflecting continued revenue growth and stable profitability across key segments. The company recorded a consolidated gross sales value of ₹4,094 crore in Q1FY26, marking a 32.6% increase compared to ₹3,087 crore in Q1FY25. Net profit from continuing operations stood at ₹356 crore, up 25.1% year-on-year, supported by higher cigarette volumes and consistent export activity.

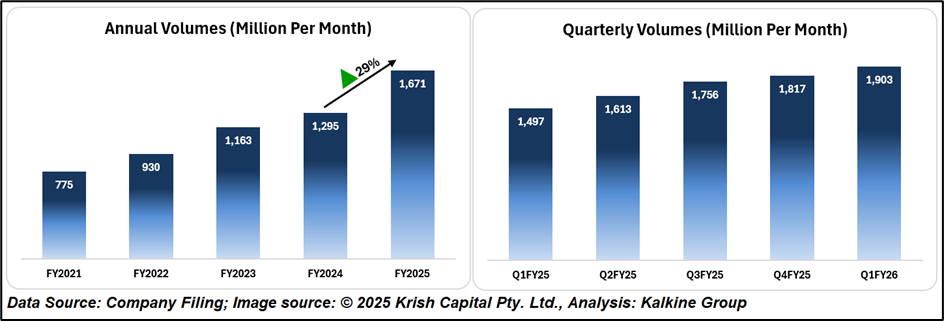

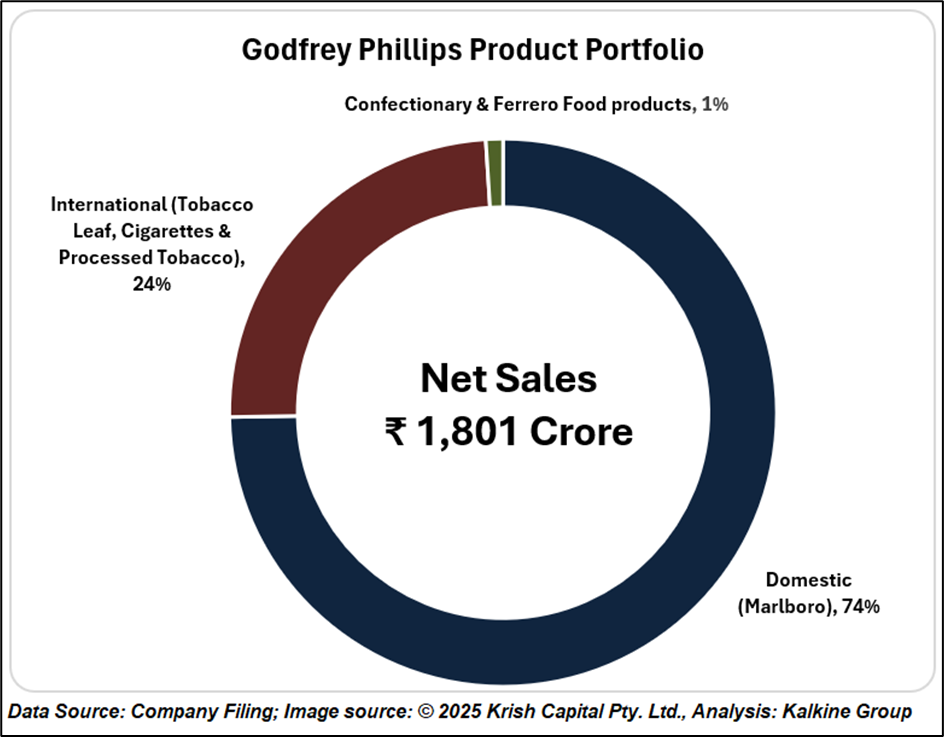

Operating EBITDA rose to ₹338 crore in Q1FY26, compared to ₹270 crore in the same period last year, representing a 25.2% increase. The EBITDA margin remained broadly steady, with a slight moderation in gross profit margin to 15.3% from 16.5% in Q1FY25, largely due to higher input costs. Domestic cigarette volumes reached 1,903 million sticks per month during the quarter, up from 1,497 million a year earlier, indicating healthy demand trends. Unmanufactured tobacco exports also contributed meaningfully to revenue, while international business accounted for 25% of net sales, with presence in over 35 countries. The cigarette and tobacco products manufacturer also announced a 2:1 bonus share issuance, further boosting investor sentiment.

The company’s performance in FY25 sets a base for comparison. GPIL reported gross sales of ₹14,480 crore in FY25, up 34.2% over FY24. Net profit from continuing operations for the full year was ₹1,153 crore, up 24.4% year-on-year, while operating EBITDA rose 30.3% to ₹1,177 crore. The growth during the year was supported by both domestic and international segments, with improvements in distribution reach and product availability.

GPIL has also continued its diversification efforts beyond tobacco. The confectionery portfolio, along with distribution of Ferrero products, generated ₹42 crore in gross sales in Q1FY26. While the contribution remains limited, the company maintains its focus on broadening its FMCG offerings gradually.

Technical Analysis

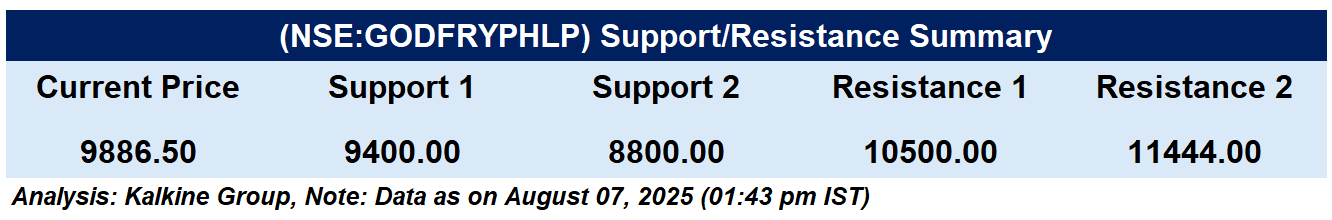

Godfrey Phillips India Ltd. is currently trading at ₹9,886.50, down 8.92% intraday after hitting a high of ₹11,444. The sharp pullback suggests profit booking following a recent rally. Immediate support lies at ₹9,400–₹9,500, with further support at the 51-day EMA near ₹8,800. On the upside, resistance is seen at ₹10,400–₹10,500, with ₹11,444 acting as the short-term top. RSI has eased to 58, indicating cooling momentum. Price action near the ₹9,400 level will be key for the short-term trend.

Conclusion

Godfrey Phillips India’s Q1FY26 performance reflects steady growth in core and emerging segments. While recent price action suggests near-term volatility, the company’s strong fundamentals, expanding export base, and diversification efforts position it well for sustained performance. Technical levels near ₹9,400 will be crucial in determining short-term direction.