Adani Group has announced a transformative USD 100 billion investment to build renewable-energy-powered, AI-ready data centres across India by 2035. The initiative is positioned as one of the world’s largest integrated energy-compute commitments and aims to establish India’s sovereign AI backbone for the next decade.

$100 Billion AI Infrastructure Push

The Group’s direct investment will fund hyperscale data centres designed specifically for high-density AI workloads. By integrating renewable energy generation, transmission networks and compute infrastructure into a single architecture, the project moves beyond traditional data centre expansion. The initiative is expected to catalyse an additional USD 150 billion across server manufacturing, electrical systems, sovereign cloud services and supporting industries—potentially creating a USD 250 billion AI ecosystem in India by 2035.

Chairman Gautam Adani emphasised that nations mastering the balance between energy and compute will define the next industrial era. The strategy aims to ensure India becomes a producer and exporter of intelligence infrastructure rather than merely a consumer.

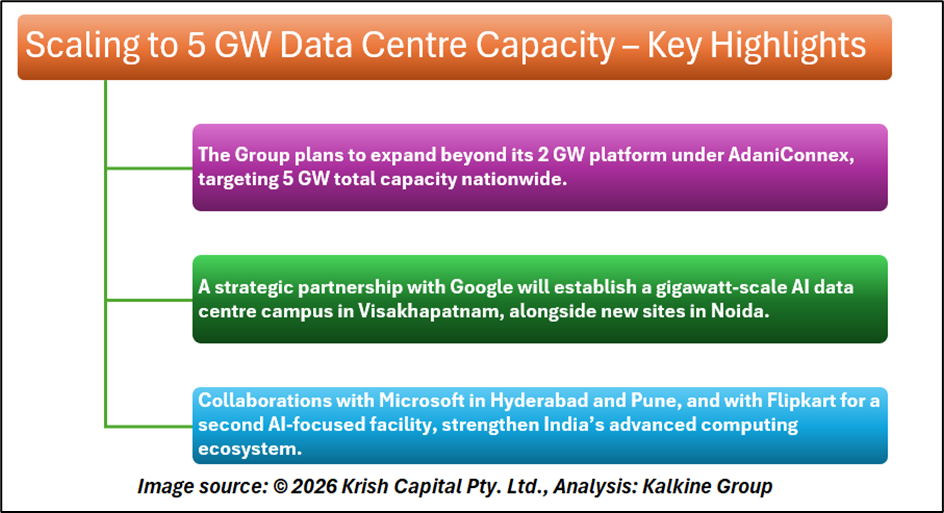

Scaling to 5 GW Data Centre Capacity

Building on the 2 GW national platform of AdaniConnex, the Group plans to expand capacity to 5 GW. A key highlight is its partnership with Google to establish a gigawatt-scale AI data centre campus in Visakhapatnam, along with additional sites in Noida. Collaboration with Microsoft covers campuses in Hyderabad and Pune. The Group is also deepening its engagement with Flipkart to build a second AI-focused facility supporting digital commerce and advanced computing needs.

Powering AI with Green Energy

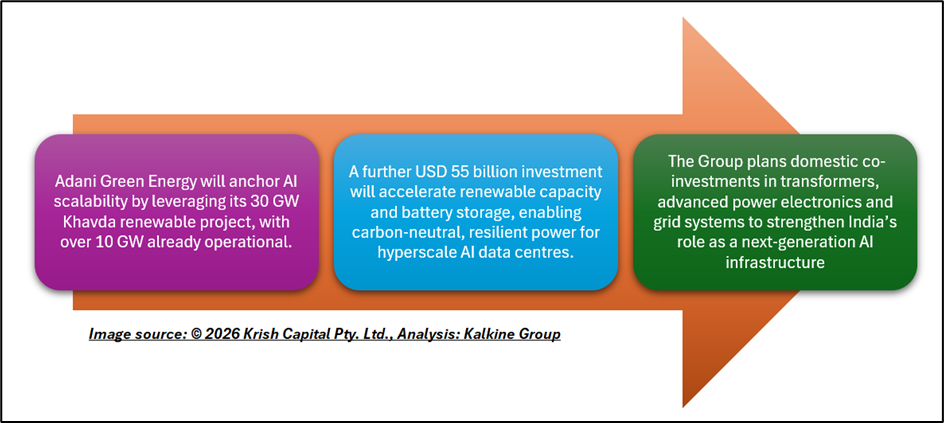

Energy remains central to AI scalability. Through Adani Green Energy, the Group will leverage its 30 GW Khavda renewable project, with over 10 GW already operational. An additional USD 55 billion commitment will expand renewable capacity and battery energy storage systems, ensuring carbon-neutral and resilient power for hyperscale operations.

To reduce global supply risks, the Group will co-invest in domestic manufacturing of transformers, advanced power electronics, grid systems and thermal management solutions. This strategy supports India’s ambition to become a manufacturing hub for next-generation AI infrastructure.

Financial Momentum

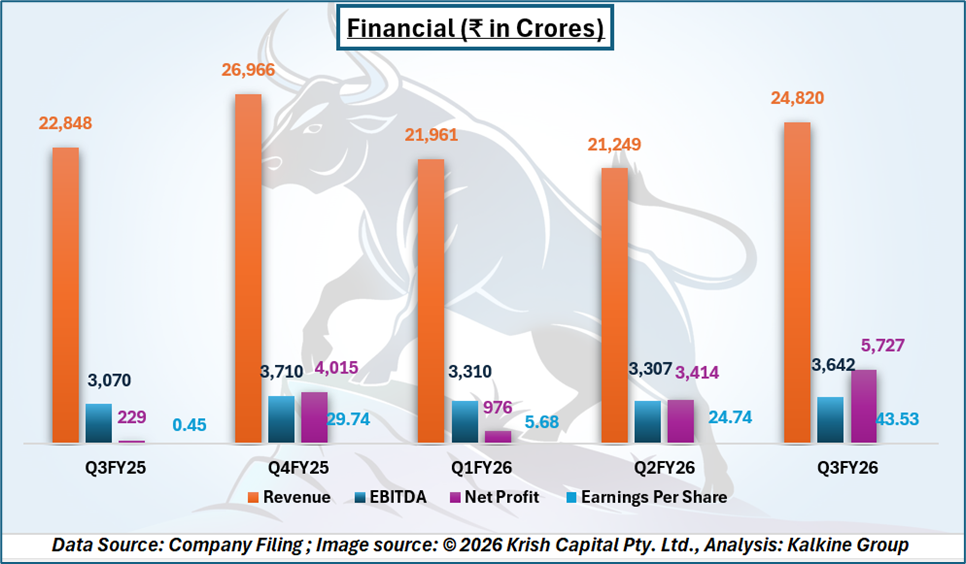

Operational performance remains strong. Revenue reached 24,820 in Q3FY26, up from 21,249 in Q2FY26. EBITDA improved to 3,642, while net profit surged to 5,727. Earnings per share climbed to 43.53, reflecting solid profitability trends alongside long-term strategic expansion.

With integrated energy, compute and infrastructure capabilities, Adani Group is positioning India as a global AI powerhouse by 2035.

Technical Summary

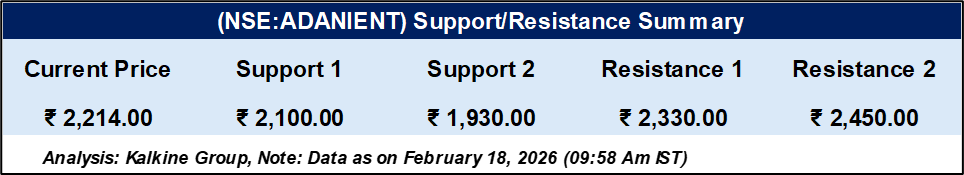

Adani Enterprises is traded at ₹2,214.00, positioned between key technical levels. Immediate support stands at ₹2,100.00, with stronger support placed at ₹1,930.00. On the higher side, resistance is marked at ₹2,330.00 and ₹2,450.00. The stock remains range-bound within these levels, and price movement near support or resistance zones may determine the next directional trend in the short term.

Conclusion: Building India’s AI Sovereignty

The $100 billion commitment by Adani Group represents more than a large-scale infrastructure investment—it signals a long-term strategic shift toward energy-backed digital sovereignty. By integrating renewable power, grid resilience and hyperscale AI compute into one coordinated ecosystem, the Group is laying the groundwork for India’s leadership in the global AI economy.

With strong industry partnerships, expanding domestic manufacturing and dedicated compute access for startups and researchers, the initiative could redefine India’s technological independence and position the country as a major exporter of next-generation intelligence infrastructure.