Jio Financial Services Q3 FY26: Profit at ₹269 Cr as Lending, Payments and AUM Drive Income Surge

Source: shutterstock

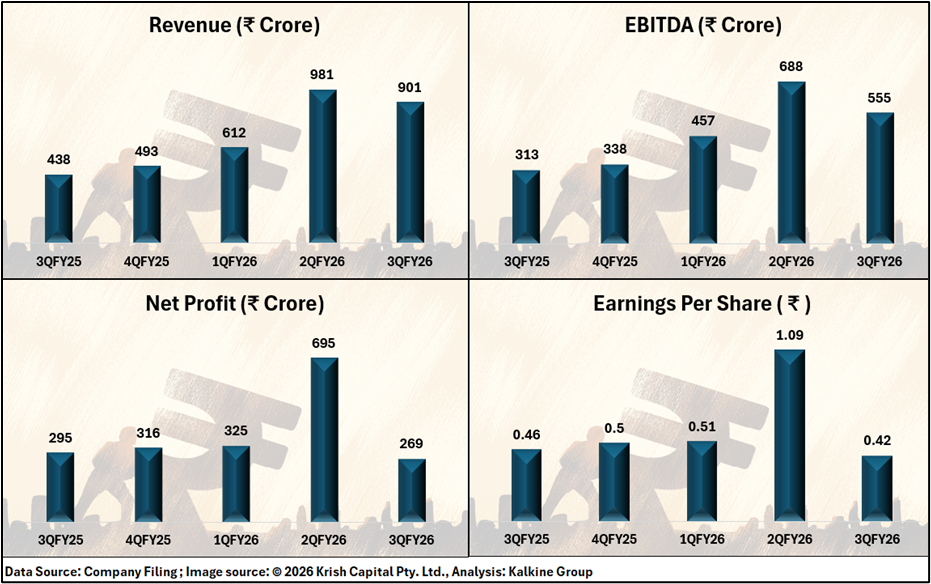

Jio Financial Services Ltd reported a consolidated profit of ₹269 crore for the third quarter ended December 31, 2025 (Q3 FY26). During the same period, the company’s total income rose to ₹901 crore, more than double compared to the corresponding quarter of the previous financial year. The growth in income was mainly supported by higher contributions from its operating businesses.

Income and Operating Profit Details

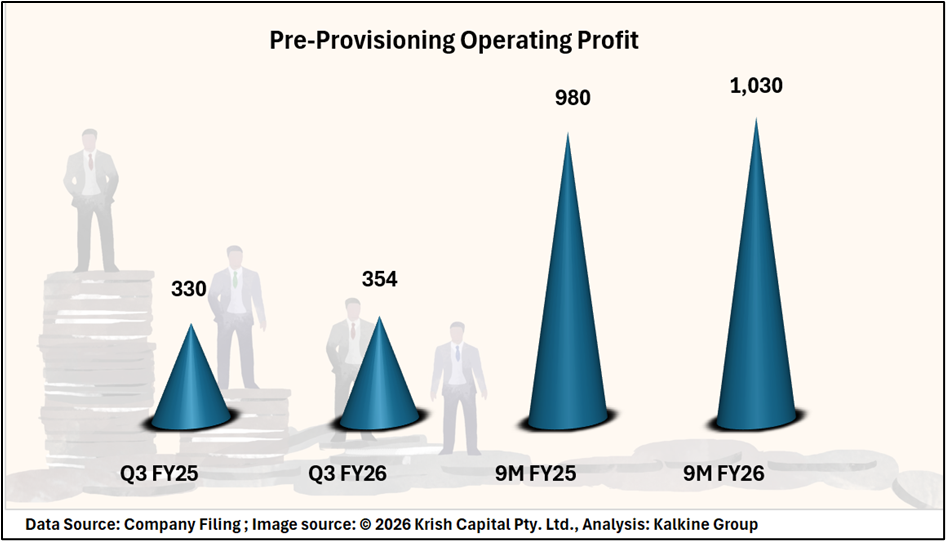

For Q3 FY26, JFSL recorded a pre-provisioning operating profit (PPOP) of ₹354 crore, showing a moderate increase compared to the year-ago period. While income increased sharply, expenses also rose as the company continued to scale its lending, payments, and asset management operations. As a result, operating profit growth remained measured.

Payments and Transaction Processing

JFSL’s payments ecosystem also showed higher activity levels. Transaction processing volume at Jio Payment Solutions rose to ₹16,315 crore, increasing about 2.6 times year-on-year.

The gross fee and commission income from this business grew to ₹96 crore, supported by increased merchant onboarding and higher transaction volumes. The company maintained a stable unit-level processing margin of around 10 basis points during the quarter.

Jio Payments Bank Performance

Jio Payments Bank reported total income of ₹61 crore in Q3 FY26, reflecting a significant increase compared to the previous year. Customer deposits stood at ₹507 crore, showing 94 percent year-on-year growth.

The bank’s customer base expanded to 3.2 million CASA accounts, supported by growth in transaction throughput and expansion of its business correspondent network.

Asset Management Business Update

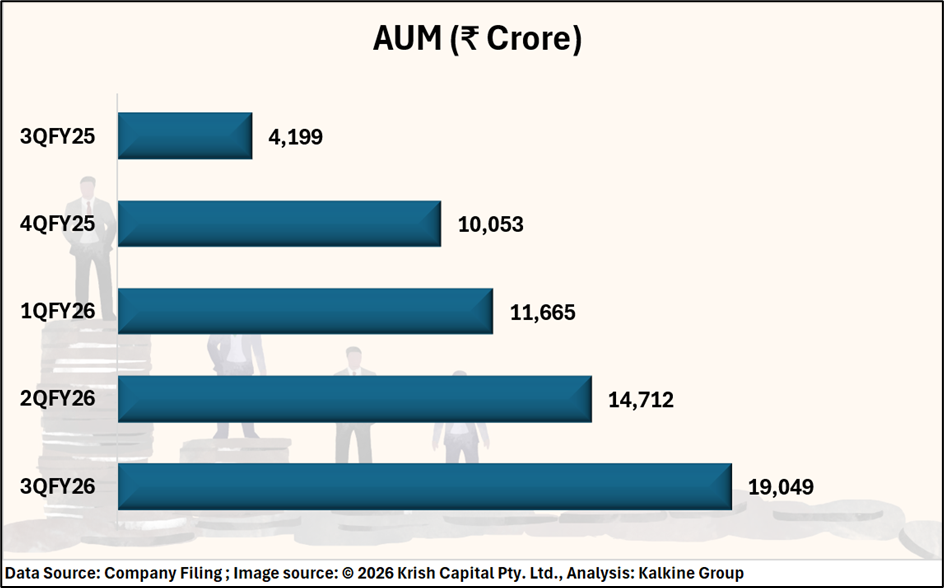

The lending business, operated through Jio Credit Limited, continued to expand during the quarter. The assets under management (AUM) increased to ₹19,049 crore, representing a growth of about 4.5 times year-on-year and 29 %sequentially.

Gross disbursements during Q3 FY26 stood at ₹8,615 crore, nearly double compared to the same quarter last year. The lending segment reported net interest income of ₹165 crore, while pre-provisioning operating profit reached ₹99 crore for the quarter.

The asset management business, operated through the Jio-BlackRock joint venture, reported assets under management of ₹14,972 crore across 10 mutual fund schemes. The retail investor base crossed one million investors during the quarter.

According to the company, a meaningful portion of inflows came from locations beyond the top 30 cities, with a growing number of first-time mutual fund investors.

Technical Summary

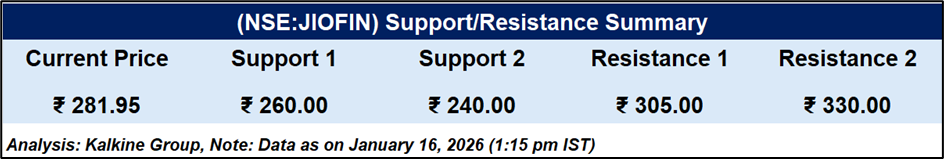

Jio Financial was trading at ₹281.95, positioned between important support and resistance levels. The stock finds initial support at ₹260.00, with a stronger level at ₹240.00, which may attract buying interest if prices decline further. On the upside, resistance is observed at ₹305.00 and ₹330.00, which could limit gains and prompt profit-taking. These support and resistance levels provide a clear framework for traders to manage risk and make informed entry or exit decisions.

Conclusion

Jio Financial Services’ Q3 FY26 results reflect steady progress in building its core financial businesses. Higher income contribution from lending, payments, banking, and asset management indicates a gradual shift toward operating-led earnings. While costs increased in line with expansion, growth in AUM, transaction volumes, and customer accounts supported overall performance.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.