Kalyan Jewellers Slides 12% as Sentiment Weakens Despite Robust Q3 Update

Source: shutterstock

Kalyan Jewellers India Limited experienced a sharp decline of around 12% on 21 January 2026, marking its 8th straight session of losses and extending the recent corrective trend in the stock. The decline comes despite the company reporting a robust operational update for Q3 FY26 on 7 January 2026, indicating that the recent weakness is driven less by fundamentals and more by an expectation reset and near-term uncertainty.

Investor sentiment appears to have turned cautious as the company released only a business update for the quarter, with detailed financial results for Q3 FY26 still awaited. This, coupled with profit-taking following a strong pre-run-up in the stock, has weighed on near-term performance.

Institutional Shareholding Dynamics Signal Mixed Sentiment

Over the last year, select institutional investors have trimmed their exposure to the stock. Sundaram Midcap Fund, which held a 1.02% stake as of December 2024, no longer appears in the list of public shareholders as of December 2025. This suggests either a complete exit or a reduction in its holding below the 1% disclosure threshold.

Similarly, the Government of Singapore has marginally reduced its stake to 1.75% from 2.01% over the same period. These reductions have contributed to concerns around near-term institutional sentiment.

On the other hand, Motilal Oswal Midcap Fund has significantly increased its stake, raising its shareholding to 9.05% in December 2025 from 6.3% in December 2024, highlighting continued conviction among select long-term investors.

Promoter Actions and Pledge Levels

Promoters acquired a 2.36% stake from Warburg Pincus in August 2024 at ₹535 per share, signalling confidence at higher levels. However, the increase in pledged promoter shares to 24.89% as of December 2025 from 19.32% a year ago remains a key overhang and warrants monitoring.

Rising Retail Participation

Amid recent stock weakness, retail participation has increased, with the number of shareholders rising to 6.62 lakh in December 2025 from 5.59 lakh a year earlier. Retail ownership also edged up to 5.88% from 5.17%, indicating higher participation at lower price levels.

Q3 FY26 Operational Performance Remains Strong

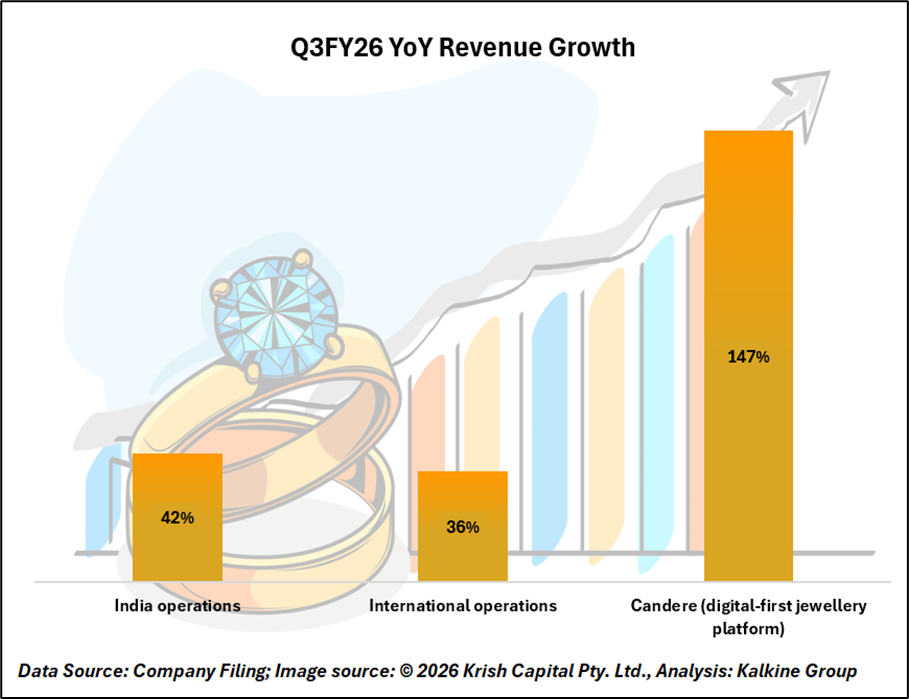

Operationally, Kalyan Jewellers delivered a strong performance in Q3 FY26, reporting approximately 42% year-on-year growth in consolidated revenue, supported by robust festive demand. The India business recorded similar growth, with healthy same-store sales growth of around 27%, reflecting broad-based traction across both plain gold and studded jewellery segments.

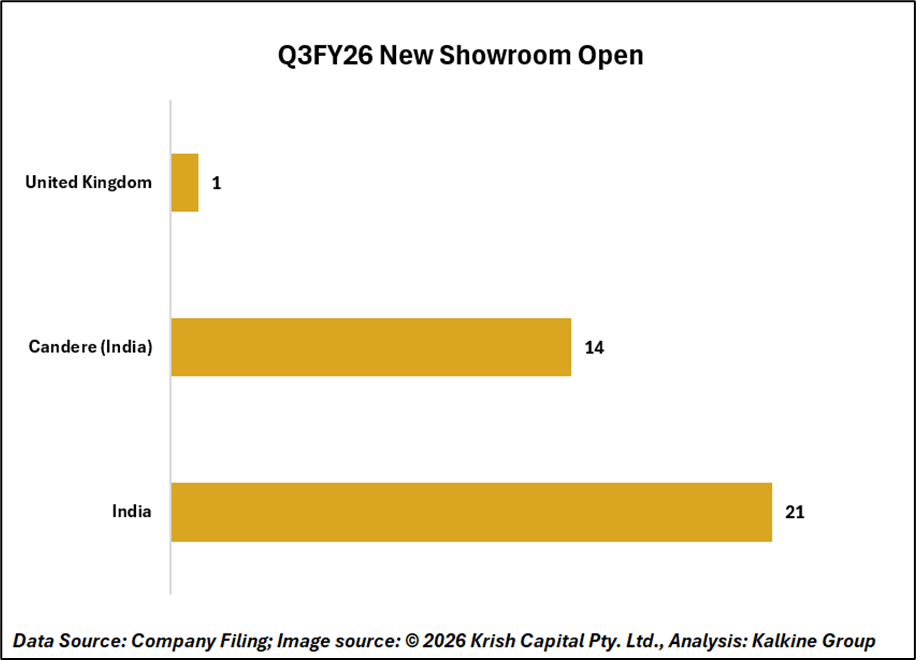

International operations reported revenue growth of around 36% YoY, driven by steady performance in the Middle East. The company’s digital-first platform, Candere, continued to scale rapidly, registering exceptional revenue growth of nearly 147% YoY. Ongoing store additions during the quarter further strengthened Kalyan Jewellers’ domestic and international retail footprint.

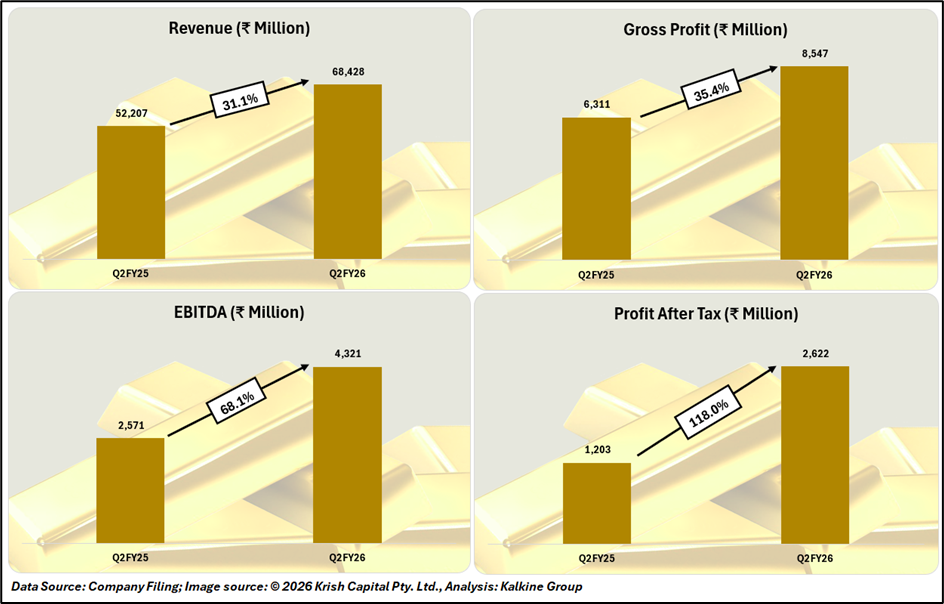

Q2FY26 Financial Performance

Technical Analysis

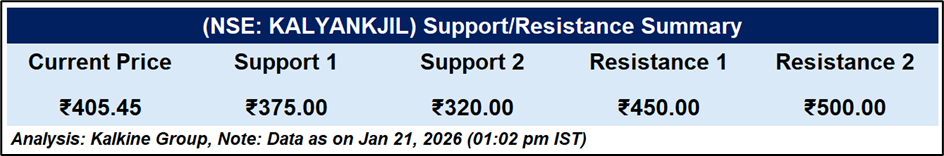

The stock saw a sharp ~10% decline, breaking decisively below the ₹450–460 support zone and the 50-day EMA (~₹486), indicating a bearish trend shift. RSI has slipped into deep oversold territory (~22), suggesting potential for a short-term technical bounce, though no reversal signal is evident yet. Elevated volumes confirm strong selling pressure. Immediate support lies at ₹375–3200, while resistance is placed at ₹450–500. Overall bias remains bearish, with caution advised until the stock reclaims key resistance levels.

Conclusion

The recent correction in Kalyan Jewellers appears driven by sentiment and technical factors rather than operational weakness. While near-term volatility may persist amid pending Q3 financials and elevated promoter pledges, strong growth momentum, selective institutional confidence, and long-term structural tailwinds continue to underpin the company’s fundamental outlook.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.