Suzlon’s Q1FY26 Order Book at Record High, Shares Trade Lower

Source: shutterstock

Suzlon Energy Limited reported a robust set of results for the first quarter of FY26, underpinned by record deliveries and improved profitability. Despite the strong financial and operational performance, the company’s stock declined nearly 5% in today’s trade, as investors booked profits after a sharp rally in recent months.

Financial Performance

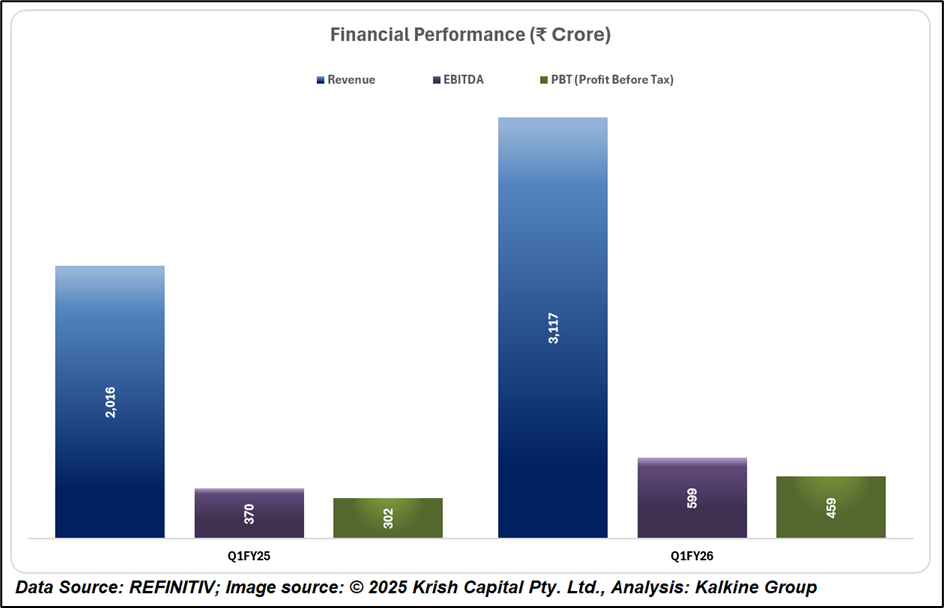

Suzlon achieved its highest-ever first-quarter deliveries of 444 MW, marking a 62% year-on-year (YoY) increase. This translated into consolidated revenue of ₹3,117 crore, up 55% YoY from ₹2,016 crore in Q1FY25. The strong momentum was supported by sustained demand from commercial and industrial (C&I) customers, hybrid renewable energy projects, and favorable policy push for domestic wind manufacturing.

EBITDA rose sharply to ₹599 crore in Q1FY26, representing a 62% YoY increase with margins expanding to 19.2%. Profit before tax stood at ₹459 crore, up from ₹302 crore a year earlier. Net profit came in at ₹324 crore, maintaining profitability despite higher depreciation and finance costs. The wind turbine generator (WTG) business contributed strongly, with a healthy margin of 26% supported by favorable customer and scope mix.

Strong Order Book and Financial Position

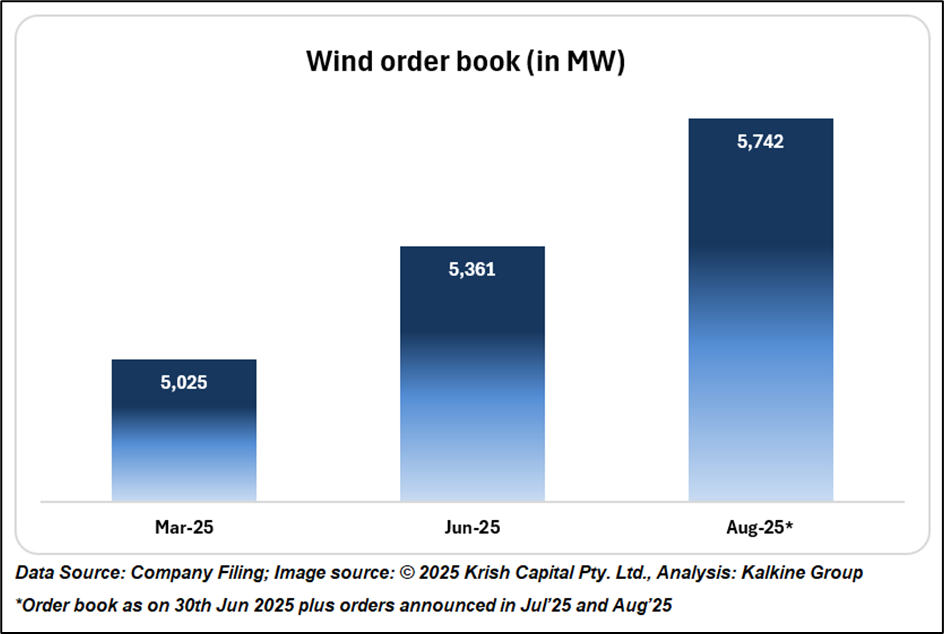

Suzlon recorded its largest firm order book to date at 5.7 GW, offering clear revenue prospects over multiple years. The flagship S144 turbine model has alone garnered more than 5 GW in orders, underscoring its leading position in the Indian wind energy sector. As of June 2025, the company held a net cash balance of ₹1,620 crore, which has bolstered its financial standing. Furthermore, credit rating agency CRISIL upgraded Suzlon’s rating to A+/Stable, indicating enhanced financial stability.

Strategic Levers: O&M and SE Forge

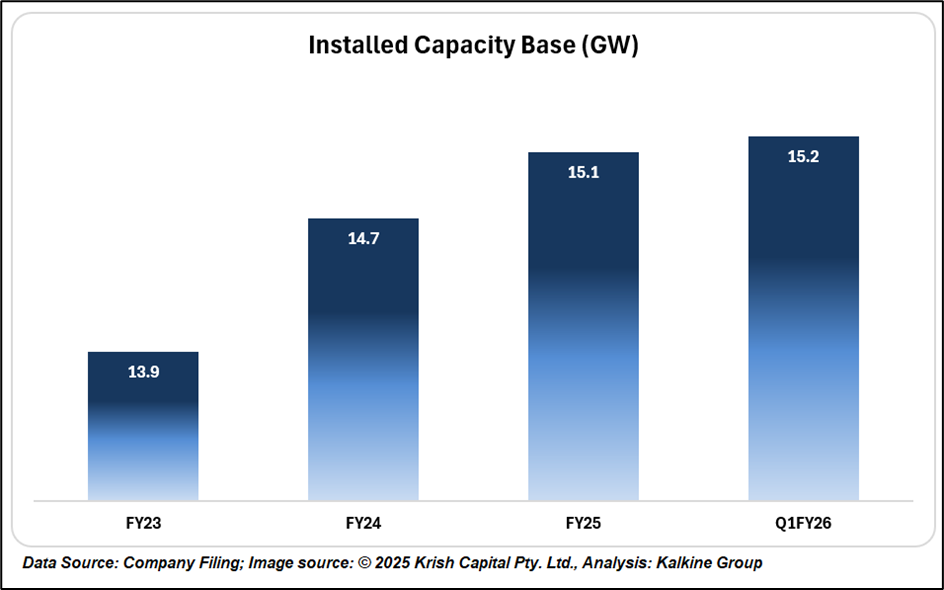

Apart from its primary wind turbine generator business, Suzlon’s Operations & Maintenance Services (OMS) division maintained steady cash flow by overseeing more than 15.2 GW of installed capacity, achieving EBITDA margins exceeding 39%. Additionally, its subsidiary SE Forge, which specializes in foundry and forging, has seen enhanced capacity utilization and is well-positioned for growth that aligns with the industry’s development trends.

Company Outlook

With India targeting 122 GW of wind capacity by 2031-32 and 500 GW of non-fossil fuel energy by 2030, Suzlon is positioned to benefit from sectoral growth. Its diversified order pipeline, domestic manufacturing base, and continued emphasis on operational efficiency provide scope for steady performance in the coming quarters.

Technical Analysis

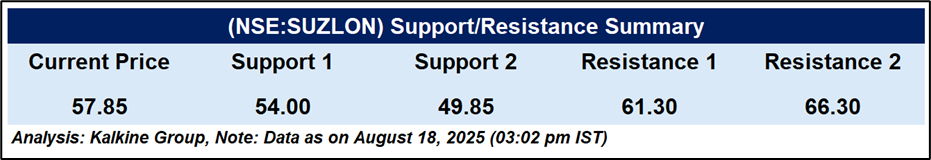

Suzlon Energy Ltd is trading at ₹57.85, down 3.68%, and currently positioned below its 51-day EMA of ₹63.53. The stock is approaching key support levels at ₹54 and ₹49.85, while resistance lies at ₹61.30 and ₹66.30. The RSI at 30.23 indicates the stock is near oversold territory, suggesting the possibility of short-term stabilization or a pullback, though broader momentum remains weak.

Conclusion

The company’s performance reflects a mix of opportunities and challenges, with growth supported by operational strengths and market positioning, while risks remain from macroeconomic factors and sectoral headwinds. Sustained focus on efficiency, innovation, and strategic expansion will be critical in driving long-term value creation and shareholder returns.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.