Wipro Shares Fall 7% as Q3 Outlook Signals Weak Deal Momentum

Source: shutterstock

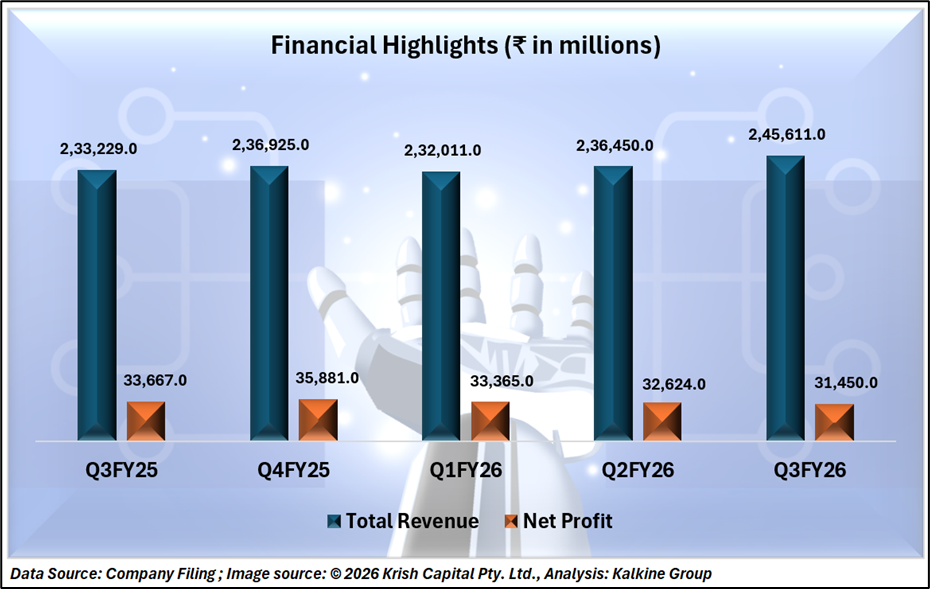

Wipro Limited (NSE: WIPRO), a global technology services and consulting company, released its financial results for the quarter ended 31 December 2025. The company reported gross revenue of ₹235.6 Bn, representing a 5.5% increase year-on-year and a 3.8% sequential rise. This reflects continued execution of technology-led solutions across multiple industries, supporting stable top-line growth amid varying market conditions.

Financial Performance

Net income for Q3 FY26 was reported at ₹31.2 Bn, representing a sequential decline of 3.9% and a 7% decrease YoY. Adjusting for labor code changes, net income increased to ₹33.6 Bn, with earnings per share (EPS) at 3.21. Operating cash flows for the quarter stood at ₹42.6 Bn, equivalent to 135% of net income, underlining effective liquidity management and cash generation from ongoing operations.

Client Wins and Strategic Deals

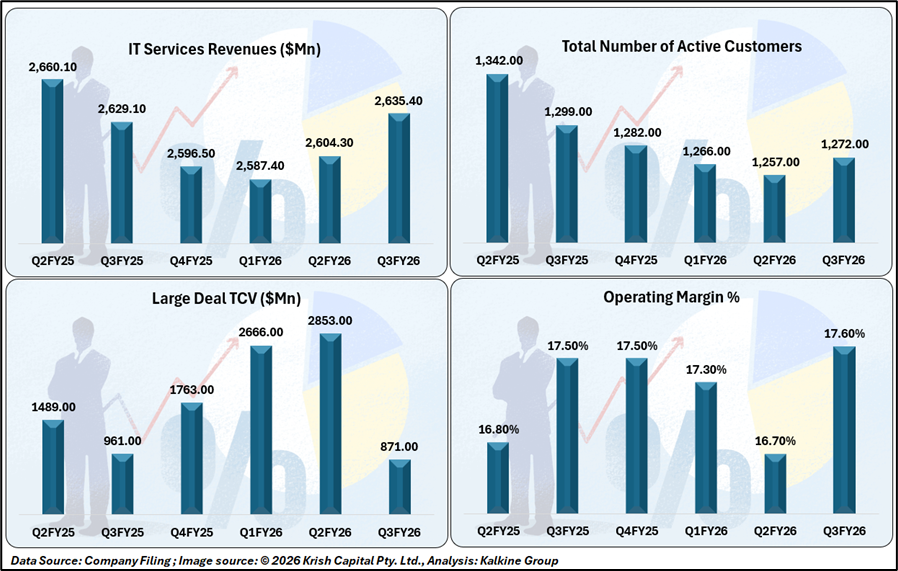

During the quarter, Wipro secured total bookings of USD 3.3 Bn, with large deals contributing USD 871 Mn. These bookings span multiple geographies and sectors, including technology, healthcare, retail, manufacturing, and financial services

IT Services Segment Momentum

The company’s IT services segment recorded revenue of USD 2,635.4 Mn, up 1.2% quarter-on-quarter (QoQ) and 0.2% year-on-year (YoY). On a constant currency basis, revenue rose 1.4% sequentially, indicating stability in client engagements despite currency fluctuations. Operating margins improved to 17.6%, an increase of 0.9% sequentially and 0.1% YoY. This margin performance highlights disciplined operational execution and cost management across service lines.

Employee Metrics and Operational Overview

The company expects its IT Services business to earn revenue between USD 2,635 million and USD 2,688 million in the coming period. This means revenue is expected to remain almost stable or grow slightly, with growth ranging from 0% to 2% compared to the previous period, after adjusting for currency changes. Overall, the outlook shows steady performance with limited growth under current market conditions.

Decline in Deal Wins

Total Bookings TCV showed a declining trend in recent quarters. In Q1 FY26, bookings were highest at USD 4,971 million, followed by USD 4,688 million in Q2 FY26. However, bookings declined sharply to USD 3,335 million in Q3 FY26. Compared to last year, bookings in Q3 FY26 are lower than Q3 FY25 (USD 3,514 million), reflecting weaker deal inflows and cautious client spending during the quarter.

Outlook for Q4 FY26

The company expects revenue from its IT Services business segment to be in the range of USD 2,635 million to USD 2,688 million for the upcoming period. This outlook reflects a sequential growth guidance of 0% to 2.0% in constant currency terms, indicating stable to modest improvement in performance. The guidance underscores cautious optimism amid prevailing market conditions while maintaining a focus on operational stability and disciplined execution across key service offerings.

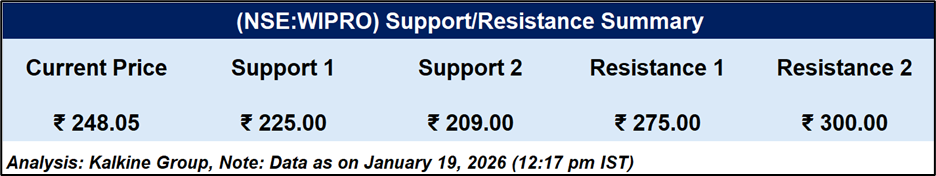

Technical Summary

Wipro was trading at ₹248.05 and is moving between important price levels. The key support is at ₹225; if the stock falls below this, it may drop further to ₹209, where buyers are likely to step in. On the higher side, ₹275 is the first resistance. If the price moves above this level, it could rise toward ₹300. Overall, the stock is trading in a range, and stronger movement is expected only after a clear breakout

Conclusion

Overall, Wipro’s Q3 FY26 performance demonstrates stable revenue growth, consistent operating margins, and continued client adoption of AI-enabled solutions. The company’s strategic deals, combined with operational efficiencies and cash flow generation, underscore its ongoing ability to maintain performance in a dynamic technology services environment.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.