Zydus Lifesciences Limited began FY26 on a steady note, reporting moderate growth in revenues and profits in the first quarter, supported by strong momentum in international markets, a resilient domestic formulations business, and an expanding innovation pipeline.

Financial Performance

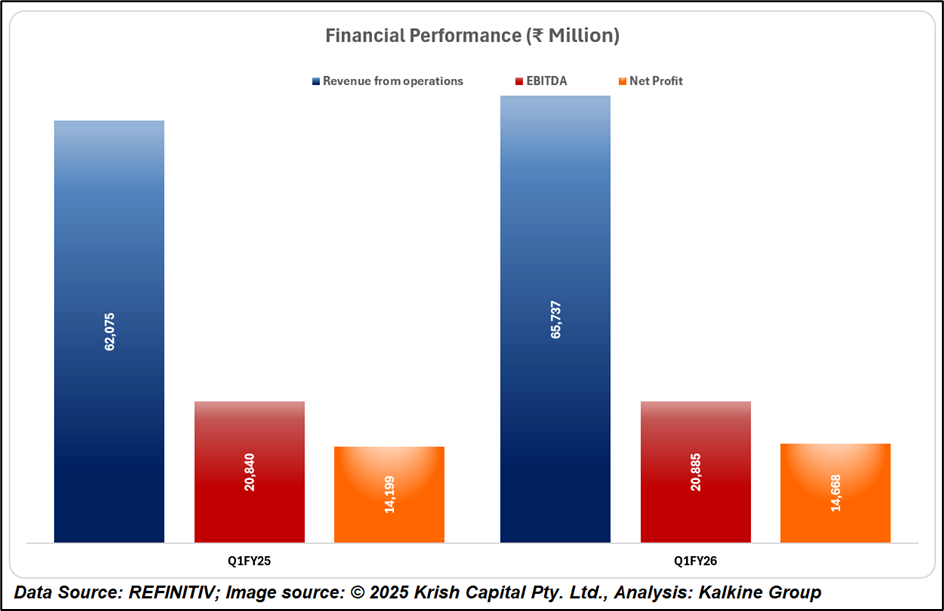

For the quarter ended June 30, 2025, the company posted revenue from operations of ₹65,737 million, marking a 5.9% increase YoY. Net profit stood at ₹14,668 million, up 3.3% from the same period last year and surging 25.3% sequentially on the back of improved operational performance. EBITDA remained broadly stable at ₹20,885 million, with margins at 31.8%.

The company maintained a strong commitment to research and development, investing ₹4,856 million – 7.4% of quarterly revenues – to advance its innovation-led growth strategy. Capital expenditure for the period stood at ₹4,020 million, reflecting ongoing investments in capacity and capability building.

Balanced Growth Across Markets

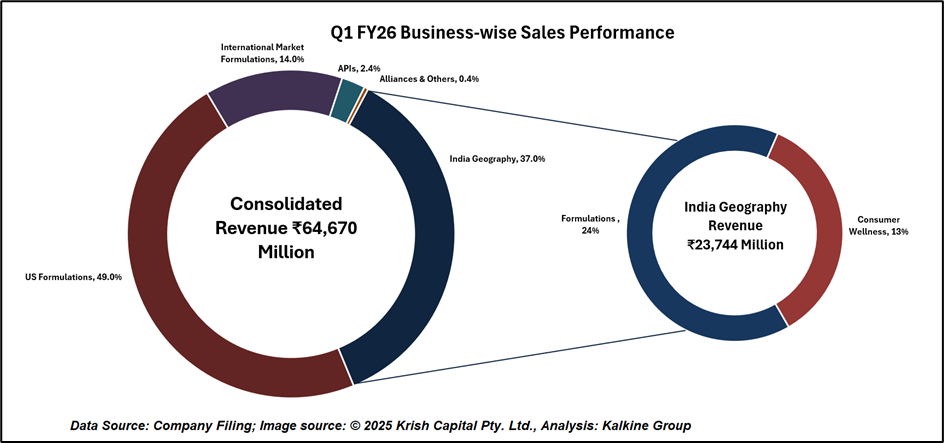

The domestic formulations business, which contributes 24% of consolidated revenues, grew 8% YoY, outpacing market growth in key therapy areas including cardiology, respiratory, oncology, pain management, and anti-infectives. The chronic portfolio continued to expand its share, now accounting for 43.7% of the segment, up 420 basis points over three years.

The Consumer Wellness division posted a 2% YoY increase, with non-seasonal brands delivering double-digit growth. Organised trade’s share of sales rose to 30.9%, driven by increased contributions from e-commerce and modern retail channels.

The US formulations business, accounting for nearly half of consolidated revenues, grew 3% YoY to ₹31,817 million. The quarter saw three new product launches and six ANDA approvals, as the company deepened its focus on specialty products and rare pediatric diseases.

International formulations revenue recorded a robust 36.8% YoY growth, reflecting strong demand across geographies, while the APIs segment rose 11.3% YoY.

Strategic Acquisitions to Drive Future Growth

In line with its global expansion plans, Zydus entered the biologics contract development and manufacturing (CDMO) space through the acquisition of Agenus Inc.’s US-based biologics facilities. It also completed the purchase of Amplitude Surgical SA, a French MedTech firm specialising in advanced orthopedic technologies and robotic surgery systems, expanding its portfolio in high-growth healthcare segments.

Technical Analysis

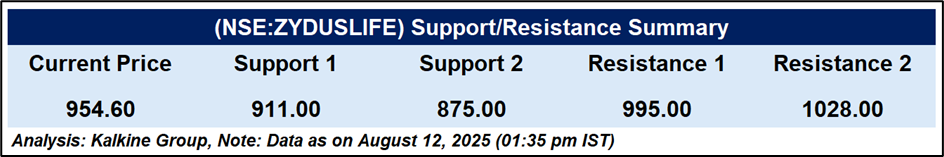

Zydus Lifesciences is currently trading at ₹954.60, marginally below its 51-day EMA of ₹958.31, indicating mild intraday weakness. The RSI stands at 46.89, suggesting neutral momentum. Immediate support is seen at ₹911 and ₹875, while resistance lies at ₹995–₹1,028. A sustained move above the 51-day EMA may improve sentiment, whereas a fall below ₹940 could invite further selling pressure.

Conclusion

Zydus Lifesciences delivered a stable Q1 FY26 performance, supported by diversified growth across markets, strategic acquisitions, and robust R&D investments. While the stock shows mild technical weakness, holding key support levels and breaking above resistance could trigger renewed momentum, aligning with the company’s long-term growth and innovation ambitions.