What Does Kotak Mahindra Bank’s 5-for-1 Stock Split Mean for Investors?

Source: shutterstock

Kotak Mahindra Bank Limited (NSE: KOTAKBANK) announced that its Board of Directors approved a stock split to mark the bank’s 40th Foundation Day. Each existing equity share with a face value of ₹5 will be subdivided into five shares of ₹1 each.

The stock split is subject to regulatory and statutory approvals, including the Reserve Bank of India and shareholder clearances, and is expected to be completed within two months after receiving all necessary approvals. The decision aims to improve liquidity and make the shares more accessible to a wider range of investors, particularly retail participants.

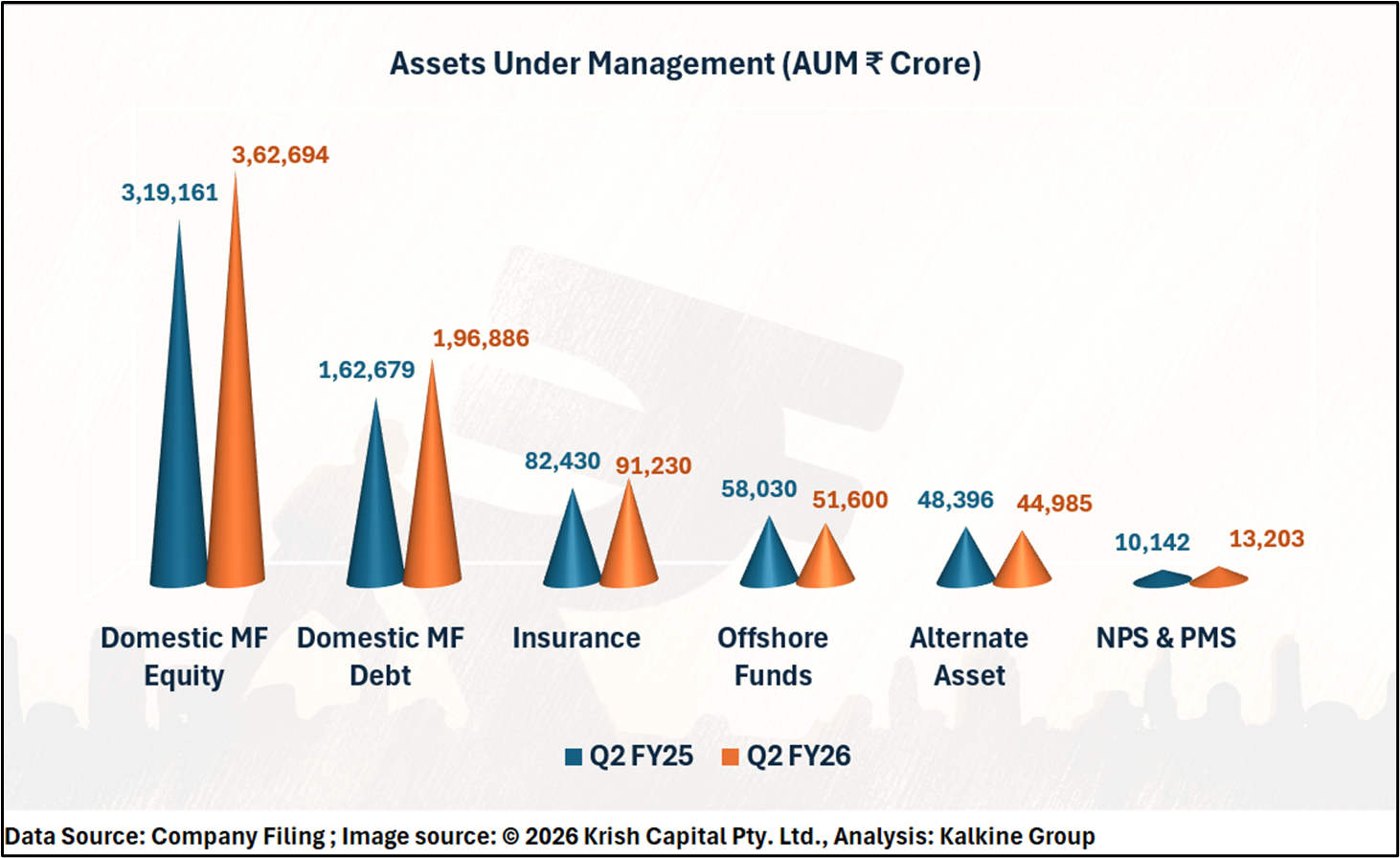

Asset Growth Across Categories

In Q2 FY26, Kotak Mahindra Bank’s total assets under management (AUM) increased to ₹7,60,598 Cr from ₹6,80,838 Cr in Q2 FY25. Domestic mutual fund equity grew from ₹3,19,161 Cr to ₹3,62,694 Cr, while domestic MF debt increased from ₹1,62,679 Cr to ₹1,96,886 Cr. Insurance AUM also rose to ₹91,230 Cr from ₹82,430 Cr, reflecting steady growth in most domestic segments. Conversely, offshore funds declined from ₹58,030 Cr to ₹51,600 Cr, and alternate assets dropped from ₹48,396 Cr to ₹44,985 Cr. NPS and PMS AUM saw an increase from ₹10,142 Cr to ₹13,203 Cr, highlighting consistent expansion in retirement and discretionary investment products.

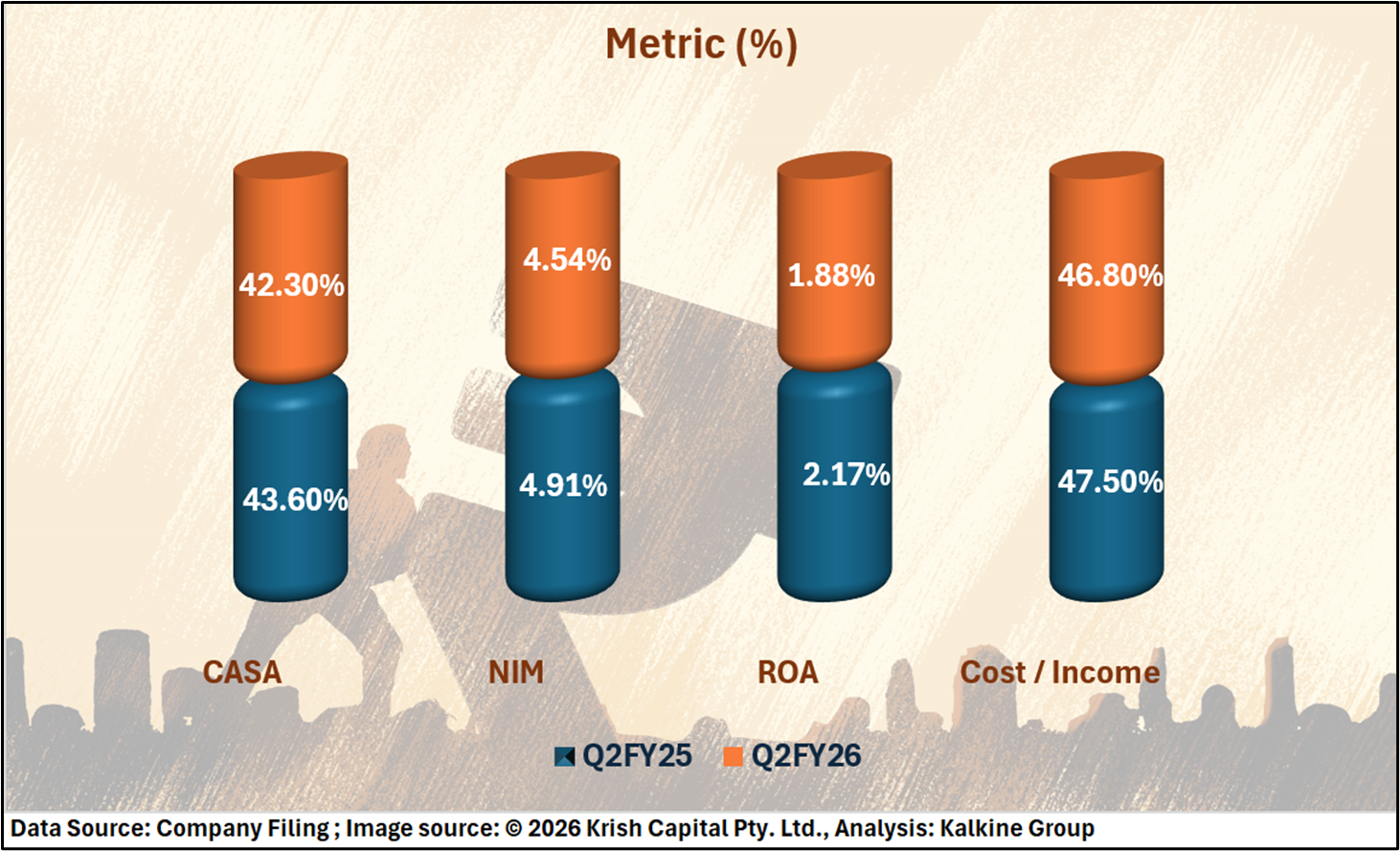

Financial Performance

Kotak Mahindra Bank posted a PAT of ₹3,253 Cr in Q2 FY26, slightly down from ₹3,344 Cr in Q2 FY25. Net interest margin (NIM) decreased to 4.54% from 4.91%, while return on assets (ROA) declined to 1.88% from 2.17%. On a positive note, the cost-to-income ratio improved marginally to 46.8% from 47.5%, reflecting better operational efficiency despite the modest dip in profitability. The results indicate a balance between controlled costs and slight pressure on earnings.

Market Implications

The stock split is expected to make Kotak Mahindra Bank’s shares more affordable, potentially attracting a wider range of retail investors. By lowering the price per share, individual investors who may have found the stock expensive could now participate more actively, which could increase trading volumes and market activity. Additionally, the split may improve the stock’s liquidity, making it easier for investors to buy and sell shares without significant price fluctuations.

Analysts and market watchers may also interpret this move as a signal of the bank’s intent to maintain investor interest and engagement over the long term.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.