MTAR Technologies Strengthens Global Footprint with Robust Orders and Innovation-Led Growth

Source: shutterstock

MTAR Technologies Limited, a leading precision engineering and manufacturing company, continues to reinforce its position as a trusted partner across clean energy, aerospace, and defence sectors.

The company recently secured a significant international order worth USD 29.95 million (approximately ₹263.54 crore) from an existing overseas customer, to be executed over the next twelve months. This order follows another USD 7.6 million (₹67.16 crore) contract received earlier in October 2025, reflecting MTAR’s strong momentum in global markets and deepening customer relationships.

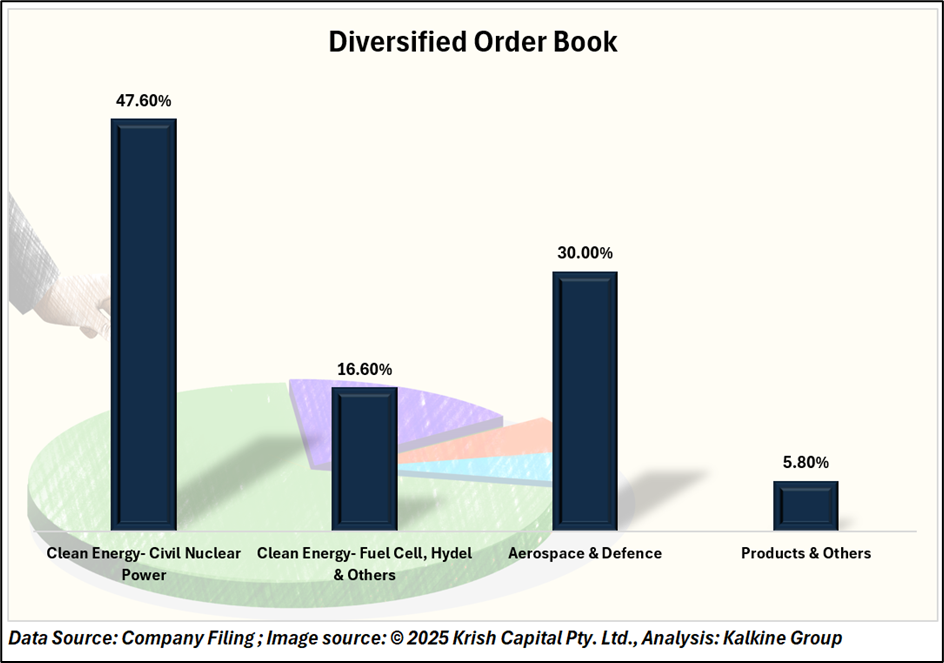

Diversified Order Book and Expanding Customer Base

MTAR reported a diversified order book of ₹930.21 crore, underpinned by multiple high-growth verticals. Clean Energy – Civil Nuclear Power remains the largest contributor at 47.6%, followed by Aerospace & Defence (30%), Fuel Cell and Hydel Projects (16.6%), and Products & Others (5.8%). The company secured ₹105.3 crore in fresh orders during Q1 FY26, indicating steady demand across its business segments.

Over the past few years, MTAR has added several prestigious international clients such as Fluence (a Siemens and AES company), Andritz Hydro, GE Power, GKN Aerospace, Thales, IAI, and Weatherford. Execution of first-article units for Weatherford and IAI is currently underway, while batch production for GKN Aerospace, Rafael, Elbit, and Thales has commenced. These developments are expected to significantly enhance revenue visibility from FY26 onwards.

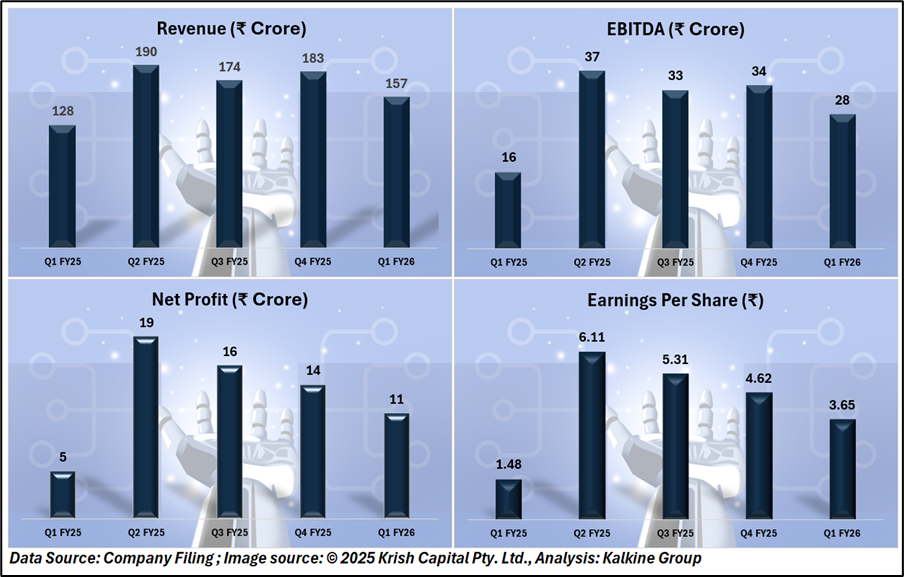

Financial Performance: Stable Revenues and Operational Resilience

MTAR’s financial trajectory reflects a consistent revenue base and gradual margin recovery post-FY23. Between June 2022 and June 2025, quarterly revenues ranged from ₹91 crore to ₹196 crore, with EBITDA margins stabilizing around 18–20% in FY25 after a dip in FY24 due to higher input costs and lower operating leverage.

For the quarter ended June 2025, revenue stood at ₹157 crore, with EBITDA of ₹28 crore and an EBITDA margin of 18%. Net profit came in at ₹11 crore, translating to an EPS of ₹3.65. Despite industry-wide cost pressures, MTAR has maintained disciplined expense management total costs at ₹128 crore in Q1 FY26 versus ₹149 crore in March 2025 signaling improved operational efficiency.

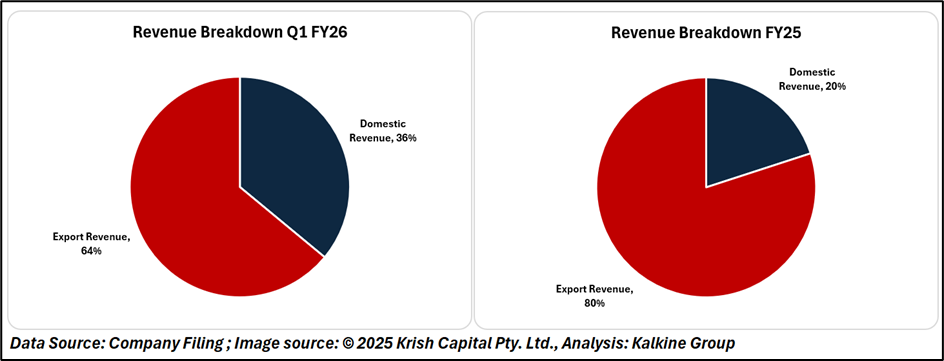

On an annual trend basis, the company’s profitability has remained resilient, supported by strong order inflows, an expanding export mix, and improved capacity utilization. Export revenues have grown sharply, constituting 80% of total revenue in Q1 FY26, compared to 64% in FY25, underscoring MTAR’s increasing global relevance.

Innovation and Outlook

The company continues to focus on innovation-led growth, with new product developments across clean energy, defence, and oil & gas applications. It recently completed prototype units for Fluence’s battery storage systems, dispatched proto valves for naval defence programs, and qualified for large-scale production orders.

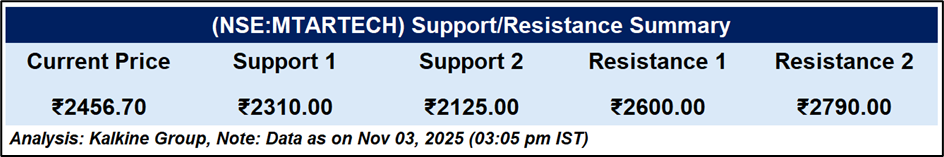

Technical Analysis

MTAR Technologies maintains bullish momentum, trading well above its 51-day EMA (₹1,961). Rising volumes confirm trend continuation. RSI at 69.57 indicates overbought territory, hinting at a possible short-term pause or mild correction. Key support is seen near ₹2,300–₹2,350, with resistance around ₹2,600.

Conclusion

MTAR Technologies remains well-positioned for sustained growth, supported by a robust and diversified order book, expanding global clientele, and improving export contribution. Operational efficiency and steady margins reinforce financial stability, while new product developments and strategic orders in clean energy and defence enhance long-term visibility and shareholder value creation.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.