SRF Shares Slide as Technical Breakdown Overshadows Strong Q3 Performance

Source: Shutterstock

SRF Limited, a multi-business chemical manufacturing entity, announced its consolidated financial results for the third quarter and nine months ended December 31, 2025. Despite a volatile market environment, the company delivered robust financial performance, supported primarily by its Chemicals business. The results were approved by the Board of Directors in a meeting held earlier today.

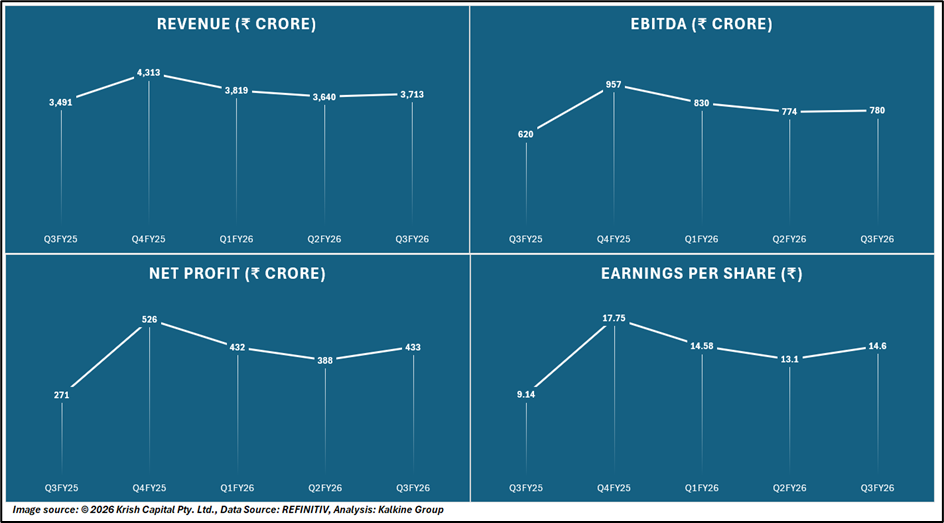

Consolidated Q3FY26 Financial Highlights

SRF Limited reported a consolidated revenue of ₹3,713 crore in Q3FY26, reflecting a 6% growth compared with ₹3,491 crore in the corresponding period last year (CPLY). Earnings before Interest and Tax (EBIT) increased significantly by 23% from ₹529 crore to ₹653 crore. Profit after Tax (PAT) surged 60%, reaching ₹433 crore compared with ₹271 crore in the previous year.

The Board has sanctioned a second interim dividend of ₹5 per share, in addition to the ₹4 per share interim dividend announced on July 23, 2025. Together, these distributions underscore the company’s ongoing focus on delivering returns to its shareholders.

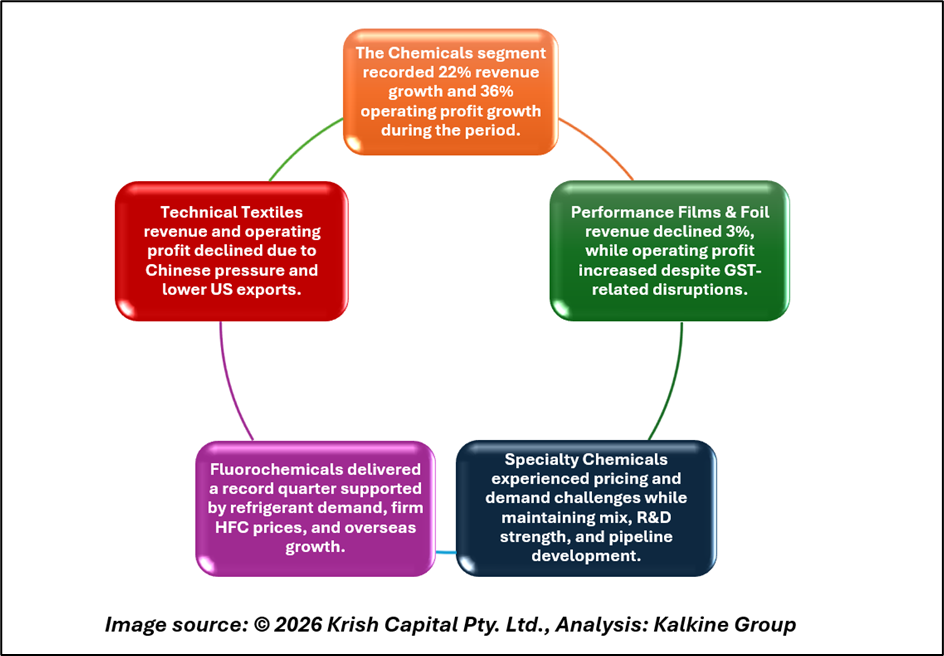

Segment-wise Performance

The Chemicals segment remained the key growth driver, with revenue rising 22% to ₹1,825 crore and operating profit increasing 36% to ₹496 crore. The Fluorochemicals business delivered a record quarter, supported by strong refrigerant gas demand, firm global HFC prices, recovery in domestic markets, and healthy overseas growth.

The Performance Films & Foil segment saw revenue decline 3% to ₹1,342 crore due to temporary GST 2.0 disruption, while operating profit improved 5% to ₹95 crore. The Technical Textiles segment reported weaker performance, with revenue down 11% and operating profit falling 24%, impacted by Chinese competition and lower US exports.

Nine-Month FY26 Performance

For the nine months ended December 31, 2025, SRF reported revenue of ₹11,171 crore, an 8% increase over ₹10,380 crore in CPLY. PAT surged 73% to ₹1,253 crore from ₹725 crore. Following the Government of India’s Labour Codes effective November 21, 2025, the company recognized an additional ₹73 crore in gratuity and leave obligations.

Strategic Initiatives and Future Outlook

The Board approved the establishment of a new Pharma Intermediates Plant at Dahej, with an investment of ₹180 crore. SRF continues to focus on innovation, with 506 patent applications filed to date and 153 patents granted globally.

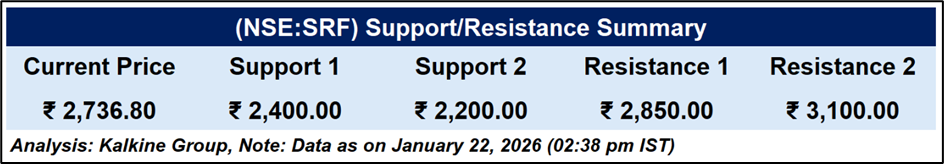

Technical Summary

SRF Limited witnessed a sharp decline, breaching the 50-day EMA near ₹2,973, indicating weakening short-term momentum. The RSI slipped below 30, entering oversold territory, which may allow for a near-term technical rebound; however, trend bias remains cautious unless prices reclaim key moving averages.

SRF Limited witnessed a sharp decline, breaching the 50-day EMA near ₹2,973, indicating weakening short-term momentum. The RSI slipped below 30, entering oversold territory, which may allow for a near-term technical rebound; however, trend bias remains cautious unless prices reclaim key moving averages.

Conclusion

SRF Limited demonstrated strong resilience and operational excellence in Q3FY26, driven by robust Chemicals business performance, strategic innovation, and effective management of segment challenges. The company’s focus on long-term growth, product diversification, and shareholder returns positions it well for continued success in FY26 and beyond.

Disclaimer:

The information available on this article is provided for education and informational purposes only. It does not constitute or provide financial, investment or trading advice and should not be construed as an endorsement of any specific stock or financial strategy in any form or manner. We do not make any representations or warranties regarding the quality, reliability, or accuracy of the information provided. This website may contain links to third-party content. We are not responsible for the content or accuracy of these external sources and do not endorse or verify the information provided by third parties. We are not liable for any decisions made or actions taken based on the information provided on this website.

Copyright 2025 Krish Capital Pty. Ltd. All rights reserved. No part of this website, or its content, may be reproduced in any form without our prior consent.