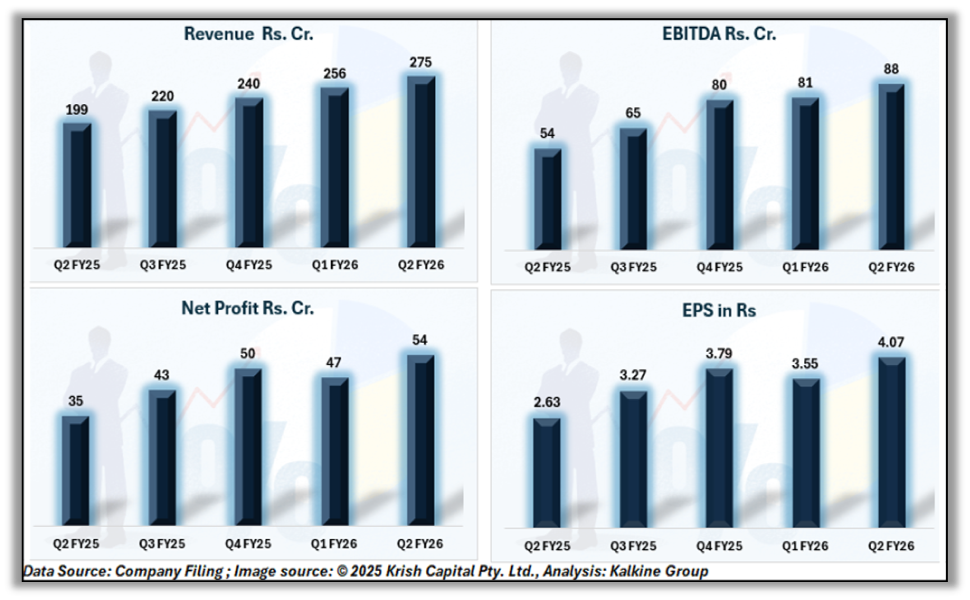

Aether Industries Ltd. (BSE:AETHER) has reported financial results for Q2 FY26, with revenue reaching Rs 275 Cr, up 38.4% YoY from Rs 199 Cr in Q2 FY25.

EBITDA rose to Rs 88 Cr, maintaining a margin of 32%. Profit before tax stood at Rs 74 Cr, supported by disciplined cost management and strategic expansion in high-growth sectors.

The company’s net profit rose to Rs 54 Cr, reflecting a 55% YoY jump and translating into an EPS of Rs 4.07. The company’s second-quarter performance reflected steady operational efficiency and continued growth across key business segments.

Regional Performance and Market Focus

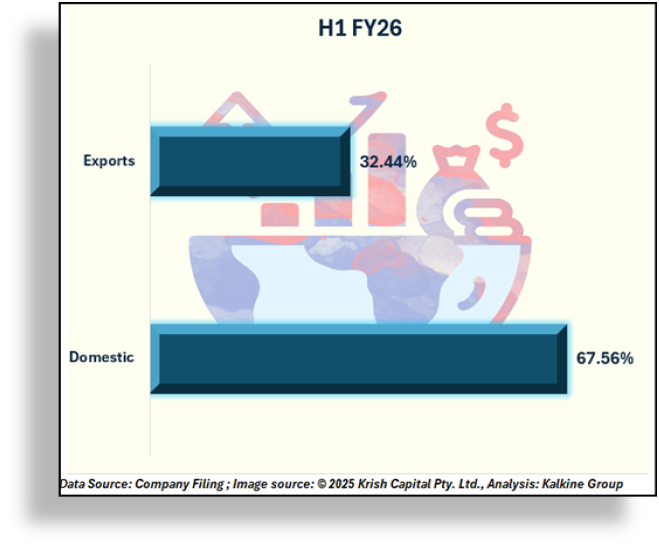

Domestic operations remained the primary revenue driver, contributing 67.56% of H1 FY26 revenue, while exports accounted for 32.44%. Within business lines, CEM contributed 42.56%, CRAMS 9.46%, and other services 1.60%, reflecting a focused strategy to leverage both domestic and international demand.

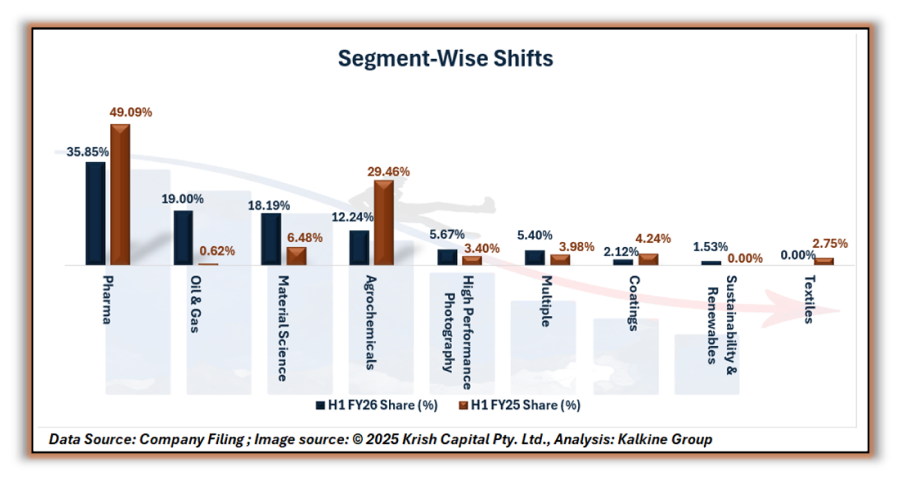

Segment-Wise Shifts and Emerging Areas

Pharma, historically the largest segment, contributed 35.85% of revenue in H1 FY26, down from 49.09% in H1 FY25. Notably, Oil & Gas and Material Science showed significant growth, contributing 19% and 18.19% respectively. Agrochemicals’ share reduced to 12.24%, while Sustainability & Renewables emerged as a new segment with 1.53% contribution. High Performance Photography, Coatings, and Multiple segments further underscore the company’s expanding product portfolio and strategic diversification.

Conclusion

Aether Industries’ Q2 FY26 results highlight sustained momentum, driven by diversified business segments and operational efficiency. Growth in emerging areas such as Oil & Gas, Material Science, and Sustainability underscores the company’s strategic positioning for long-term opportunities in both domestic and international markets. Continued focus on execution, transparent reporting, and prudent capital allocation will remain key to driving future growth.