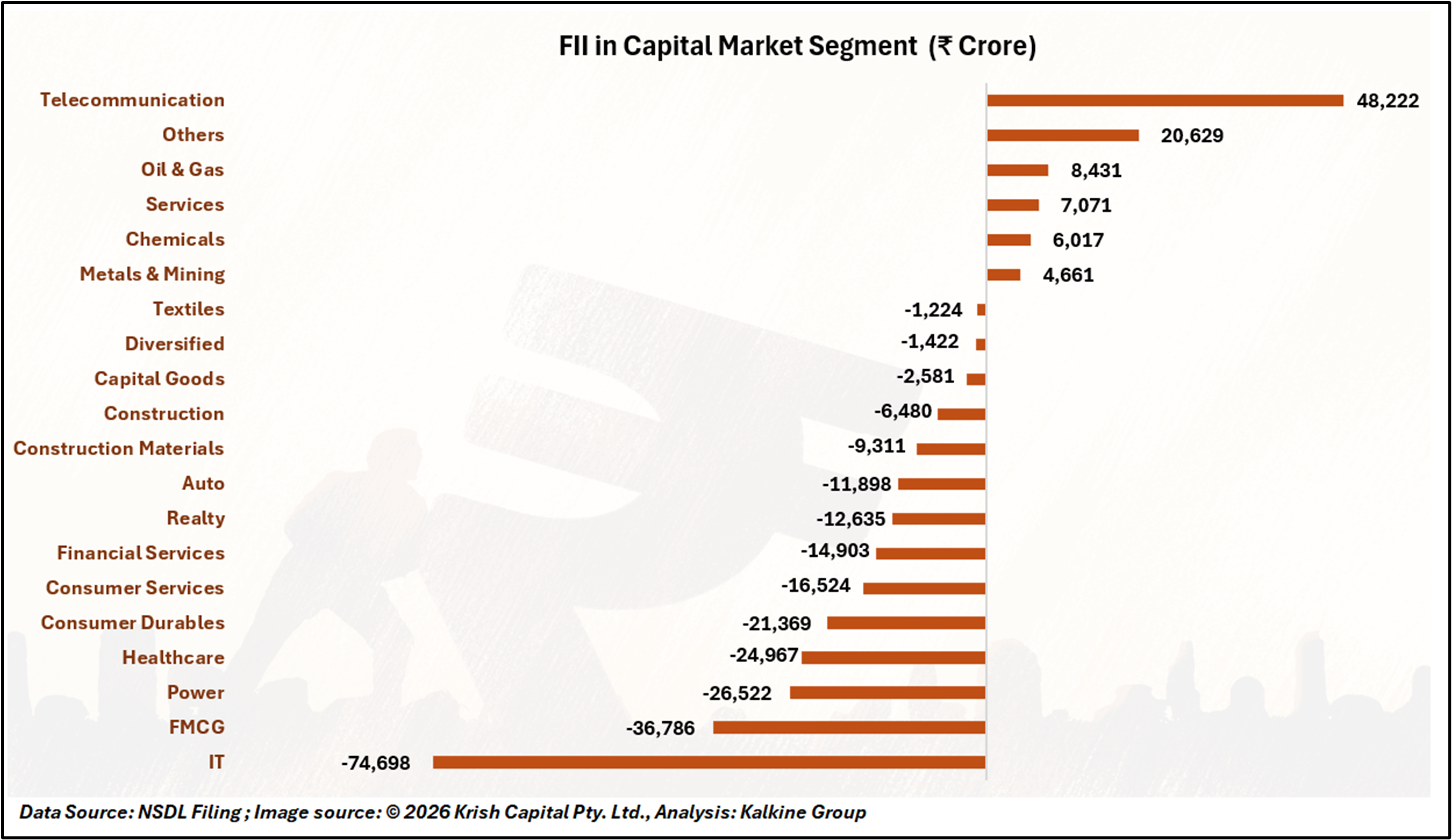

Foreign institutional investors (FIIs) were net sellers in Indian equities in 2025, offloading ₹1.66 lakh crore. The IT sector accounted for the largest outflows, with ₹74,700 crore sold, representing over 45% of total FII selling. Analysts cited stretched valuations, subdued earnings, and global uncertainty as key drivers. The FMCG sector followed, with ₹36,800 crore of foreign funds withdrawn, while the power sector saw ₹26,500 crore in outflows. Additional selling occurred in healthcare (₹25,000 crore), consumer durables (₹21,370 crore), consumer services (₹16,500 crore), financials (₹14,900 crore), realty (₹12,645 crore), and automobiles (₹11,900 crore). Both healthcare and consumer durables experienced moderate selling as earnings failed to meet expectations, while financials and realty outflows reflected investor caution amid economic uncertainty and interest rate concerns.

Despite broad selling, FIIs increased positions in sectors expected to show stable growth or recovery. Telecom emerged as the top beneficiary, receiving ₹48,222 crore amid earnings optimism. The oil & gas sector also attracted ₹8,431 crore. Other sectors gaining foreign attention included services (₹7,071 crore), chemicals (₹6,017 crore), and metals & mining (₹4,661 crore). Analysts noted that this selective allocation highlights a rotation strategy, focusing on sectors with favorable earnings outlooks or defensive characteristics.

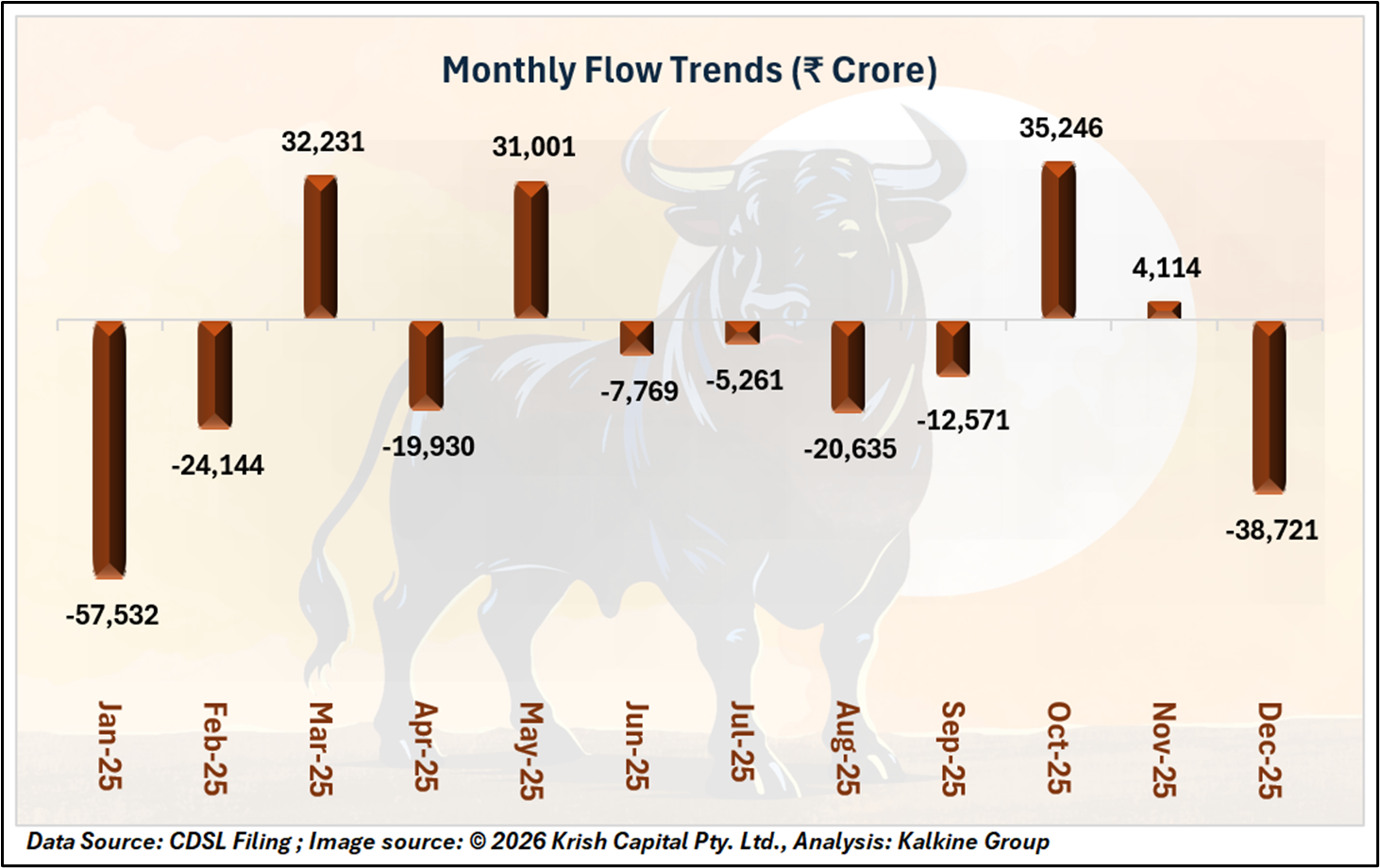

Monthly Flow Trends

Equity flows were volatile through 2025, with selling concentrated at the beginning and end of the year. January and February recorded heavy outflows of ₹57,532 crore and ₹24,144 crore, respectively. Outflows resurfaced in April, June, July, August, September, and peaked in December at ₹38,721 crore. Intermittent inflows provided some balance, with March, May, October, and November recording net buying. October stood out with ₹35,246 crore of inflows, reflecting cautious optimism among FIIs.

Conclusion

Overall, FII activity in 2025 reflected a cautious and selective approach rather than a complete withdrawal from Indian equities. Heavy selling in sectors such as IT, FMCG, and power was largely driven by valuation concerns, uneven earnings performance, and global economic uncertainty. At the same time, steady inflows into telecom, oil & gas, and select cyclical sectors indicated a strategic rotation toward areas with relatively stable cash flows or recovery potential. The marginal rise in total FII assets under custody suggests that foreign investors continued to maintain exposure to India while actively reallocating capital across sectors. The uneven monthly flow pattern further highlights a wait-and-watch stance, with periods of risk aversion interspersed with selective buying.